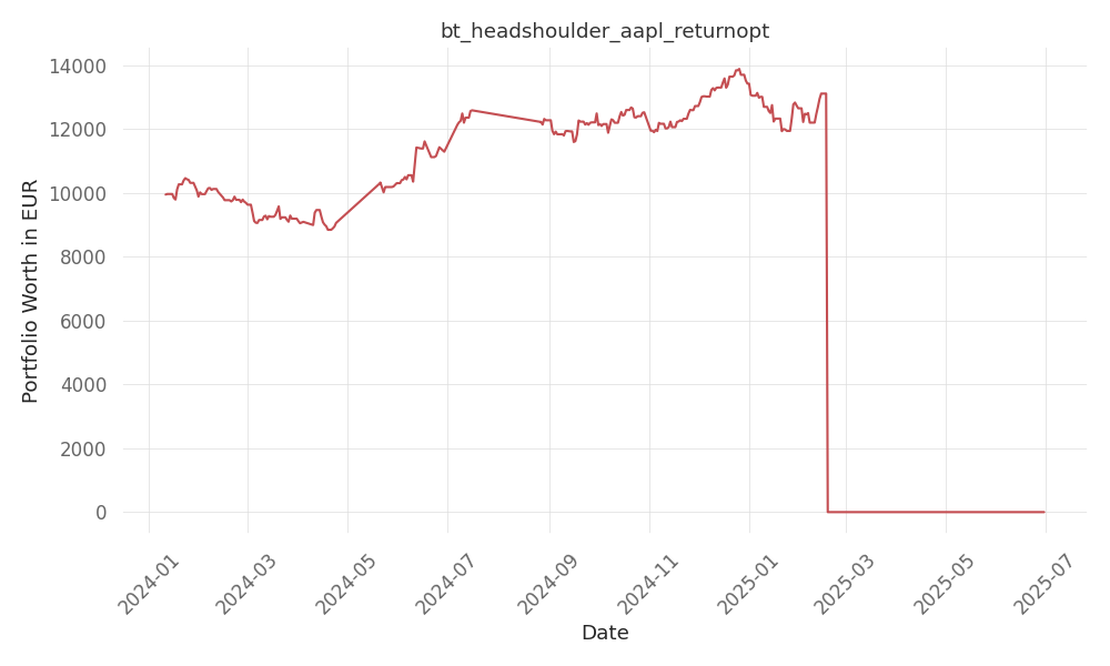

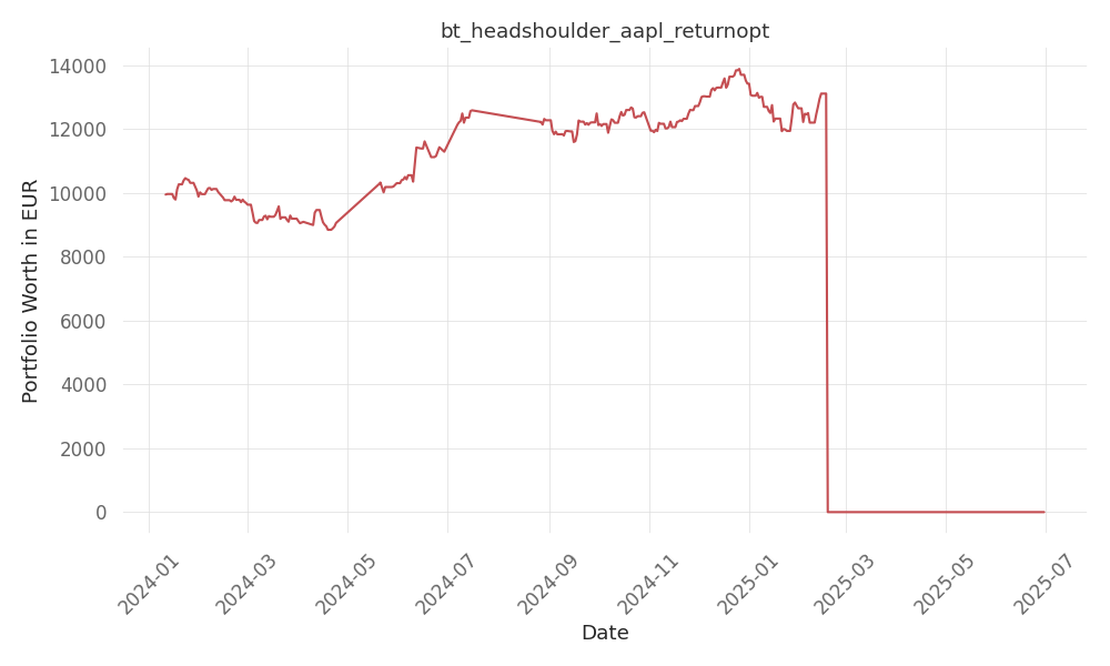

bt_headshoulder_aapl_returnopt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -68 Days active 536 …

tickers: APD

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| APD | positively | Aramco’s acquisition of a 50% stake in Air Products and Chemicals’ Blue Hydrogen Industrial Gases Company is a positive development for APD as it validates the company’s hydrogen business and technology. This partnership with Saudi Arabia’s largest oil company will expand APD’s lower-carbon hydrogen business, serving both domestic and regional consumers in the Middle East. The deal also provides financial benefits, with APD shares trading 3.49% higher during Tuesday’s trading session. |

None so far…

Aramco, Saudi Arabia’s largest oil company, has signed definitive agreements to acquire a 50% stake in the Blue Hydrogen Industrial Gases Company (BHIG), a subsidiary of Air Products Qudra (APQ) based in Jubail. Post-transaction, Aramco and APQ, a joint venture between Air Products and Qudra Energy, will each own equal stakes in BHIG. The deal includes provisions for Aramco to secure hydrogen and nitrogen offtake options and is contingent on standard closing conditions. Through this investment, Aramco is expanding its lower-carbon hydrogen business and alternative energy portfolio. Dr. Samir J. Serhan, Air Products Qudra Chairman, commented on the partnership, highlighting the acceleration of the hydrogen economy and the creation of the largest hydrogen network in the Middle East, serving key industries. Ashraf Al Ghazzawi, Aramco Executive Vice President of Strategy & Corporate Development, emphasized their ambition to support the establishment of a vibrant marketplace for lower-carbon hydrogen, leveraging their capabilities in carbon capture and storage (CCS) and technical expertise in hydrogen. Investors seeking exposure to APD can consider exchange-traded funds (ETFs) such as the iShares U.S. Basic Materials ETF (IYM) and the Materials Select Sector SPDR (XLB). At the time of writing, APD shares were up approximately 3.49% during Tuesday’s trading session, with a share price of $268.91.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -68 Days active 536 …

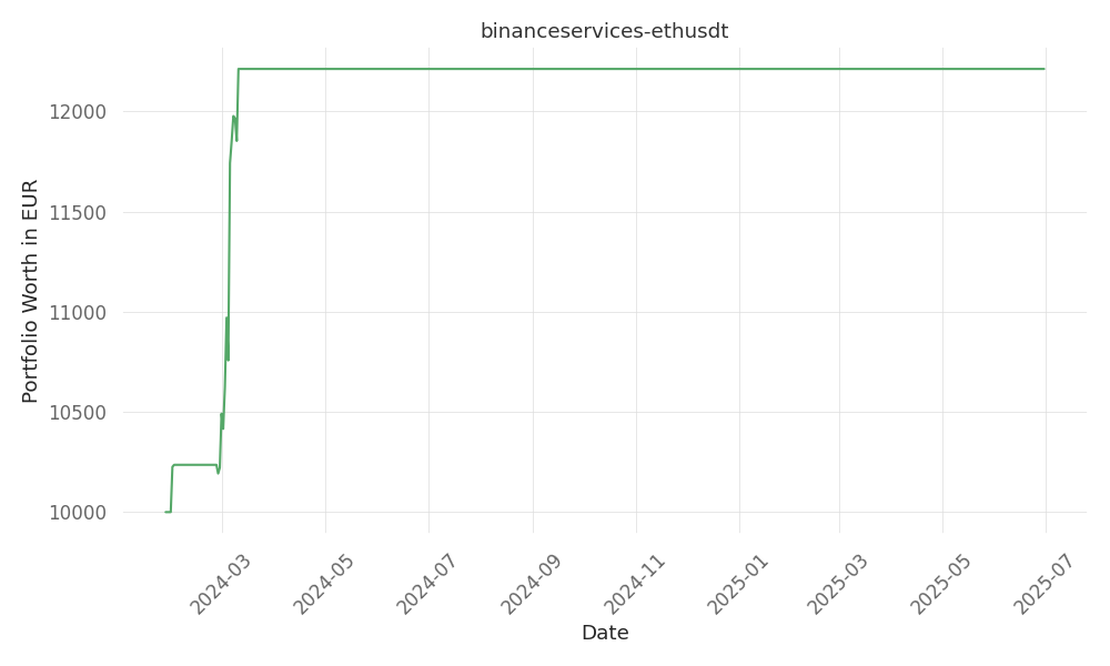

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 519 …

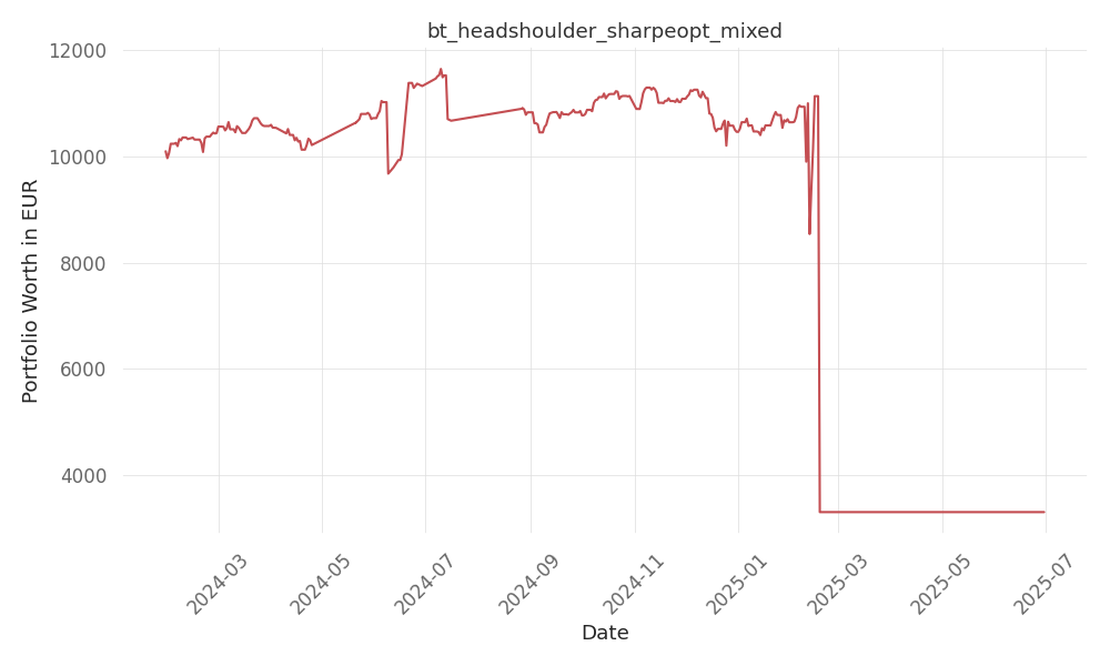

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -47 Days active 517 …