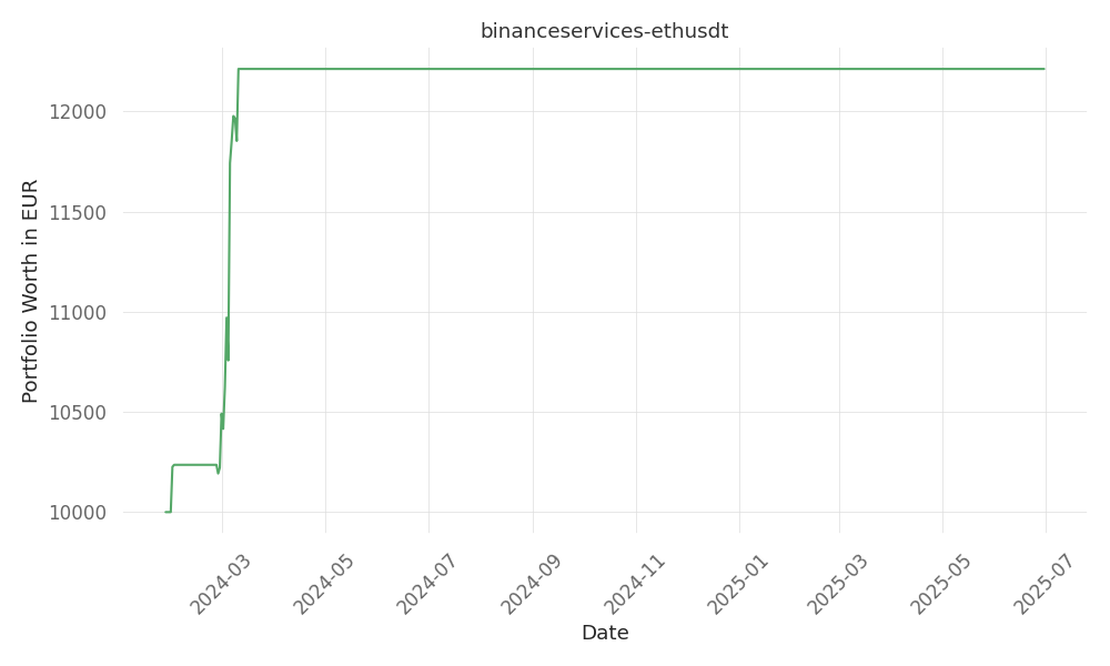

binanceservices-ethusdt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 519 …

tickers: AAPL

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| AAPL | positively | The ticker AAPL, representing Apple Inc., is likely to be positively impacted by the company’s continuous innovation and release of cutting-edge technology. Their commitment to sustainability and customer privacy can also boost investor confidence, potentially leading to an increase in stock value. Moreover, Apple’s strong financial performance and robust ecosystem of products and services provide a solid foundation for future growth. |

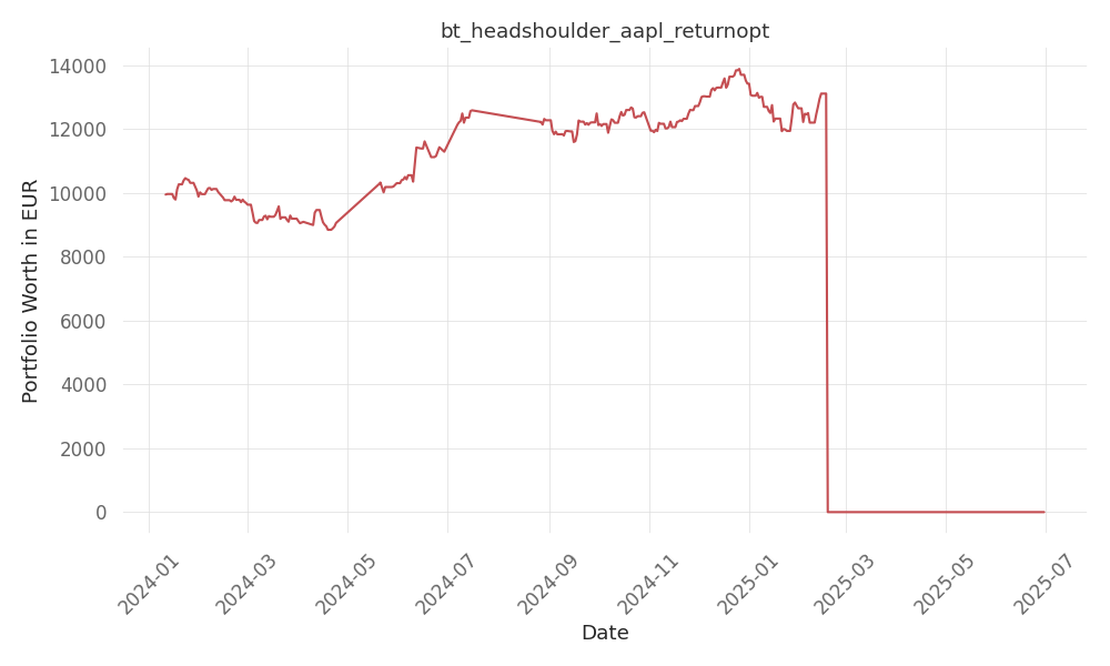

static-skfolio-nested-cluster-optimization , head-and-shoulders-AAPL , newstrader , bt_headshoulder_aapl_returnopt , c-bigtech-momentum , finnhub-recommendations

Apple’s iOS 18 public beta is now available, offering a host of improvements and new features powered by advanced AI technologies. The update showcases Apple’s ongoing commitment to enhancing the user experience on iPhones, and the company’s financial health remains robust, as reflected by a recent surge in its stock price. iOS 18 offers a revamped user interface, providing users with deeper customization options to tailor their devices to their personal preferences and usage patterns. This update reflects Apple’s user-centric design philosophy, accommodating the diverse ways people use their iPhones. The update also improves app functionality, streamlining user interactions and boosting efficiency. Users can expect a smoother experience thanks to refined app interfaces and transitions, making common tasks more intuitive and less time-consuming. One of the most exciting aspects of iOS 18 is its advanced AI capabilities. While not yet included in the current beta, the anticipated inclusion of ChatGPT technologies and enhanced Siri features are expected later this year, representing a significant evolution in mobile AI. Siri’s enhancements, in particular, are designed to offer more accurate responses and a broader contextual understanding, redefining voice-assisted interactions. Apple’s financial performance remains impressive, with its stock hitting a new record high at the beginning of the week, opening 2.5% higher. Despite a slight dip, Apple’s stock still closed with a notable 1.65% increase, continuing an upward trend. Year-to-date growth stands at an impressive 21%, with July seeing a bullish move of 11% so far. Investors are optimistic about Apple’s future, with the stock poised to target the $250 mark as the next key resistance level. This optimism is fueled by Apple’s history of surpassing market expectations and its relentless pursuit of technological innovation, as exemplified by the updates in iOS 18.

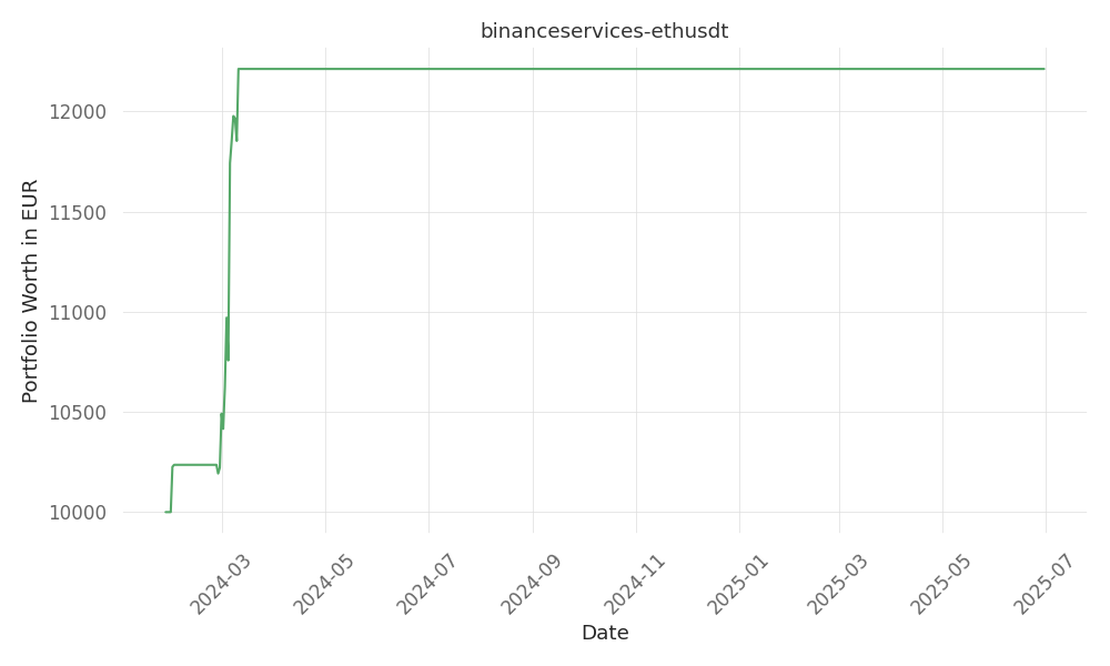

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 519 …

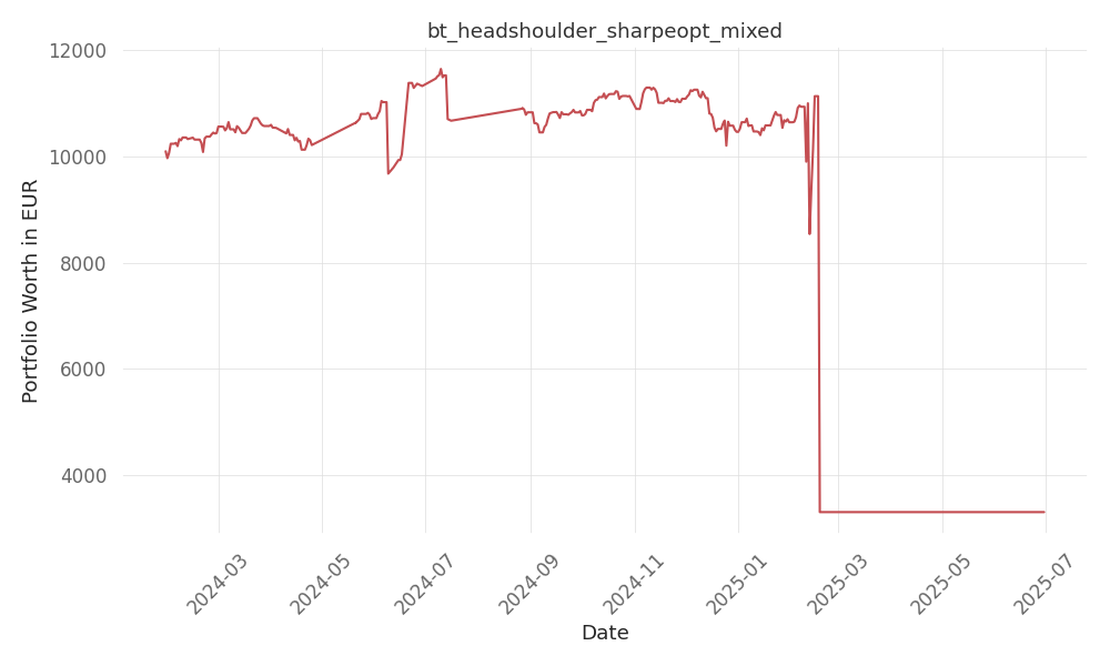

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -47 Days active 517 …

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -68 Days active 536 …