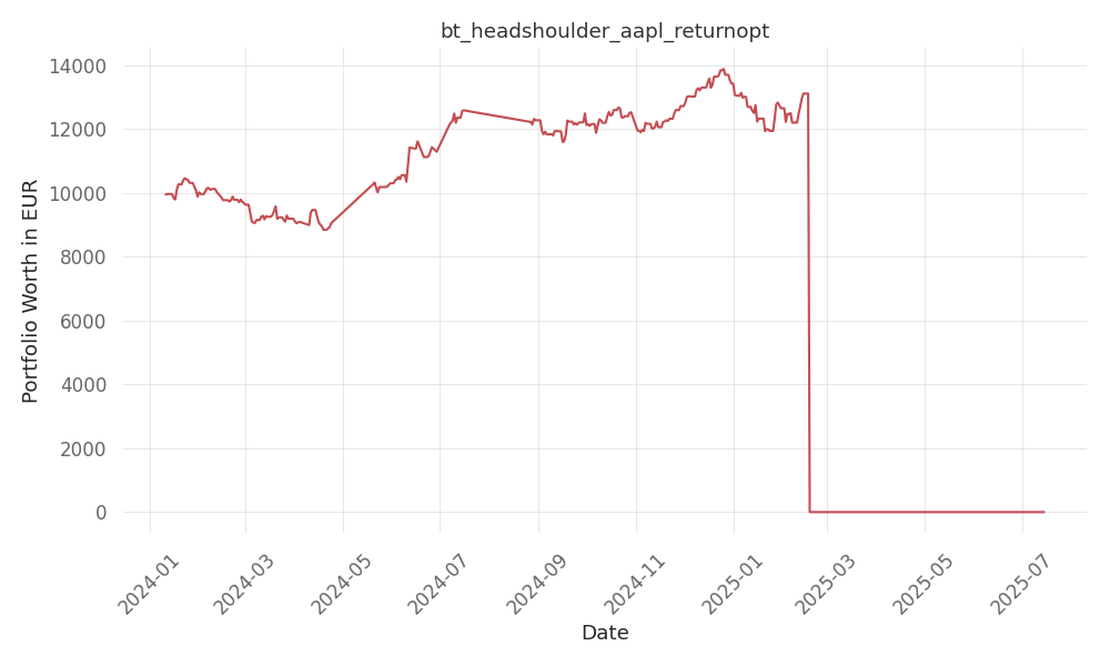

bt_headshoulder_aapl_returnopt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -66 Days active 551 …

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| BIDU | positively | Baidu’s Robotaxi initiative is expected to drive significant revenue growth and improve unit economics, with policy support and increasing fleet coverage laying the foundation for its success. The potential for a turnaround in ad revenue and accelerated growth in Baidu’s cloud business also contributes to the positive outlook for the company’s stock, BIDU. |

| GS | positively | Baidu’s Robotaxi initiative is expected to drive significant revenue growth and improve unit economics, which will positively impact Goldman Sachs’ investment in the company and its overall financial performance, leading to potential gains for the GS stock. |

None so far…

At this early stage, policy support from city governments and increasing Robotaxi fleet coverage are crucial. These factors are not only driving user adoption but also laying the foundation for Baidu’s future revenue growth. While near-term revenue contributions are anticipated, the scalability of the car fleet and improvements in unit economics are key for long-term success.

Over the past few weeks, Baidu has made significant progress in its Robotaxi policy rollout, gaining support from major cities like Shanghai and Beijing. This support is essential as the company prepares to launch its next-generation RT6 Robotaxi by the end of 2024.

The global Robotaxi market could reach $25 billion in the long term. In China alone, with its 4-5 million ride-hailing cars, even a modest 5% Robotaxi penetration could result in a RMB 35 billion (US$5 billion) market, according to Kong.

Despite the promising prospects of Robotaxi, Baidu faces near-term softness in advertising due to macroeconomic challenges and its AI-driven revamp of the search experience. Kong anticipates a turnaround in ad revenue by year-end and accelerated growth in Baidu’s cloud business in the second half of 2024. Goldman Sachs maintains a “Buy” rating for Baidu, with a revised 12-month price target of $144, implying a significant upside of 54.6% from the current share price of $93.15.

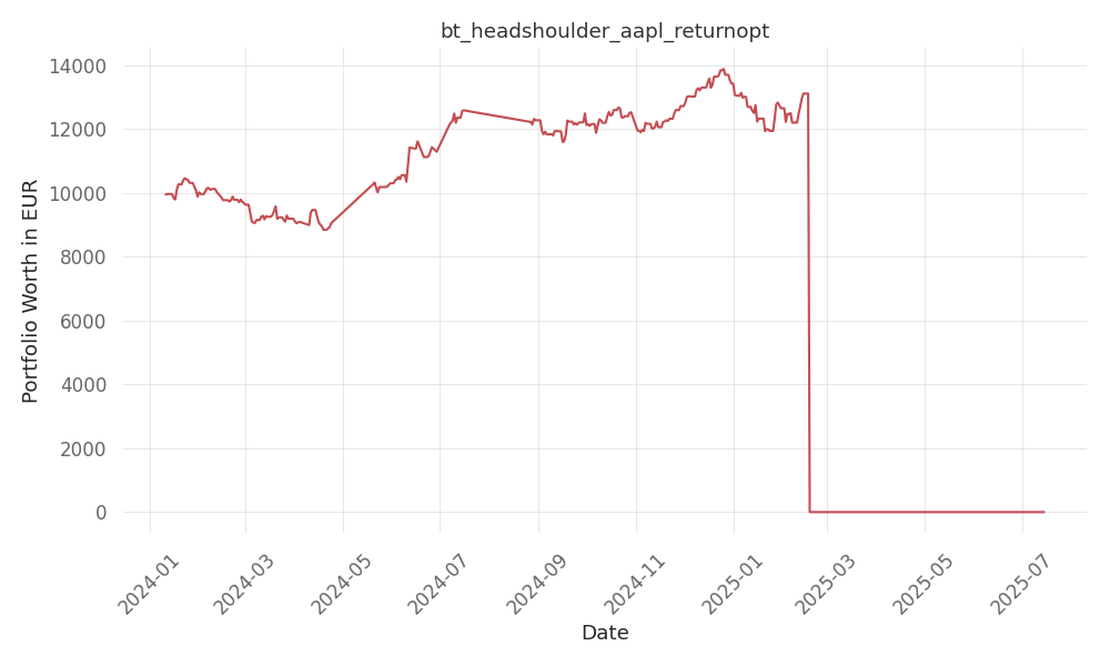

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -66 Days active 551 …

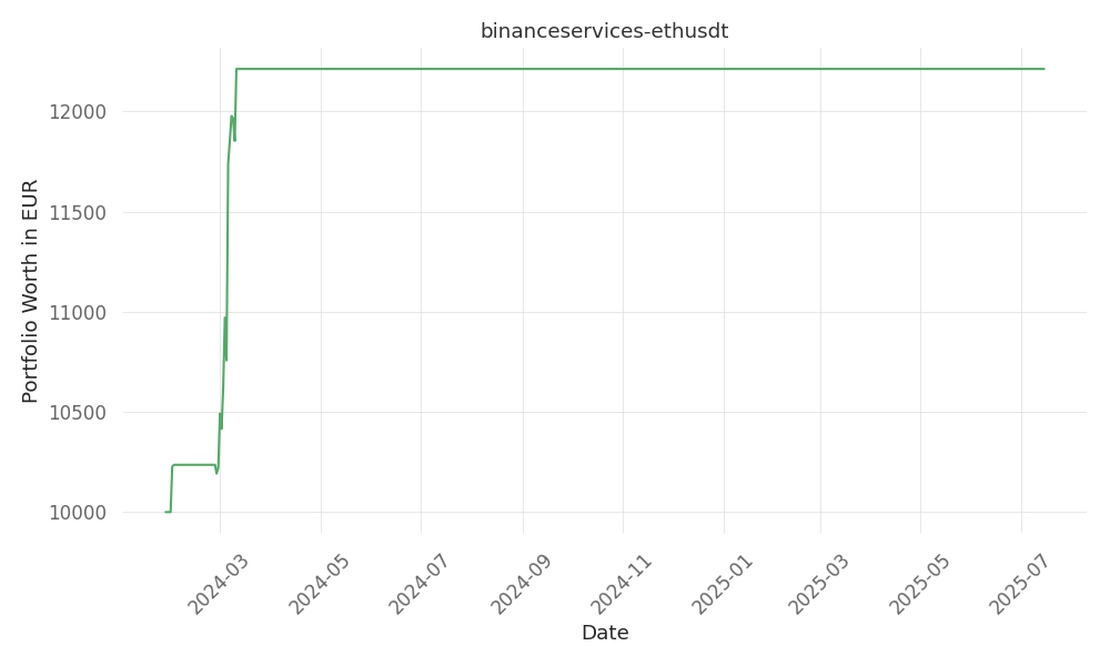

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 534 …

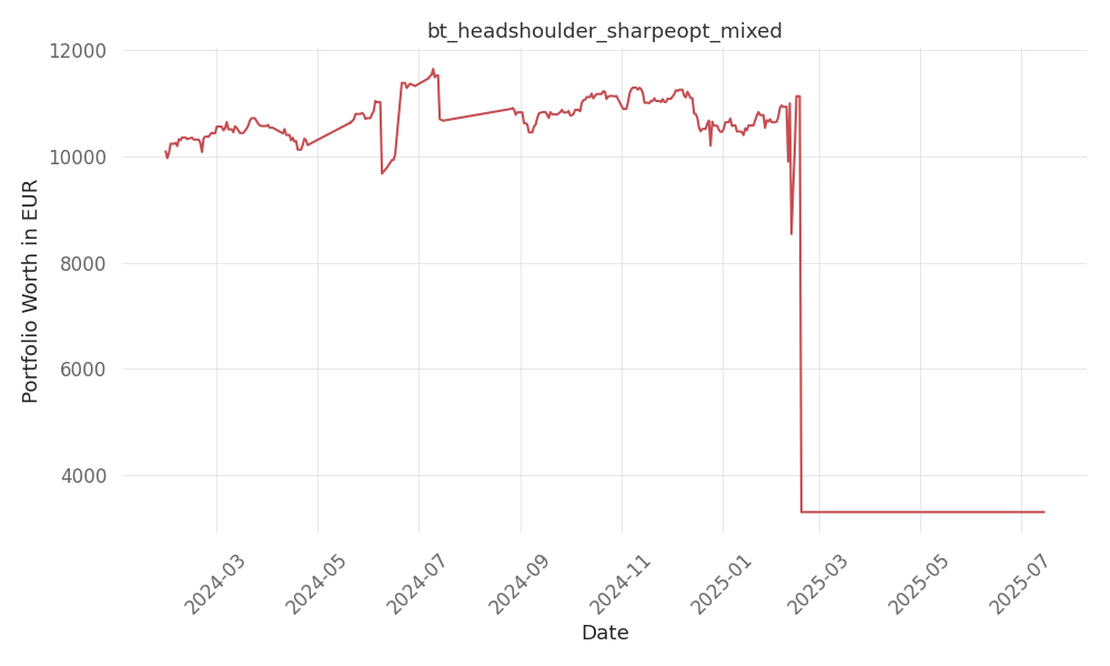

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -46 Days active 532 …