bt_headshoulder_aapl_returnopt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -85 Days active 427 …

tickers: BKR

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| BKR | positively | The strategic partnership between Baker Hughes and Frontier Infrastructure to accelerate carbon capture and storage (CCS) and power solutions will likely drive up demand for the company’s advanced technology and solutions, boosting its revenue and growth prospects, impacting ticker BKR positively. Expansion into large-scale, scalable carbon storage like the Sweetwater Carbon Storage Hub adds to positive growth expectations and enhancing portfolio with sustainable and innovative projects might strengthen investor confidence in the company. The support for energy infrastructure development, will generate substantial projects for the company, underpinning its growth and profitability. Also the collaboration for power generation capabilities can further drive revenue. |

None so far…

Baker Hughes Company (BKR) has announced a strategic partnership with Frontier Infrastructure to accelerate large-scale carbon capture and storage (CCS) and power solutions in the United States. This collaboration aims to enhance the development of sustainable energy infrastructure across the country. Under the agreement, Baker Hughes will provide advanced technology solutions and resources to support CCS, power generation, and data center projects. Frontier Infrastructure is currently developing the Sweetwater Carbon Storage Hub, a 100,000-acre open-access sequestration site in Wyoming. This hub is designed to serve industrial emitters and Midwest ethanol facilities, utilizing a CO₂-by-rail strategy to set a new standard for scalable carbon storage. With three Class VI permits secured, drilling is underway, and the first injection is planned for late 2025. Frontier Infrastructure is also expanding its power generation capabilities with 256 megawatts (MW) of gas-fired generation to meet the growing power demands in Wyoming, the Mountain West, and Texas. This expansion is driven by the increasing need for energy from data centers and industrial growth. Baker Hughes’ NovaLT gas turbines will be integral to enhancing power generation, ensuring efficient and flexible energy delivery. Baker Hughes anticipates receiving orders as Frontier’s projects advance under this agreement. Frontier Infrastructure is a portfolio company of Tailwater Capital, a private equity firm specializing in integrated energy and environmental infrastructure investments. In other news, Baker Hughes recently appointed Ahmed Moghal as its new chief financial officer. The company also reiterated its first-quarter and full-year 2025 guidance, projecting another strong year of EBITDA growth. Baker Hughes targets a 20% EBITDA margin for its Oilfield Services and Equipment segment (OFSE) in 2025 and for the Industrial and Energy Technology segment (IET) in 2026. Investors interested in gaining exposure to Baker Hughes can consider the iShares U.S. Oil Equipment & Services ETF (IEZ) and the VanEck Oil Services ETF (OIH). As of the latest check on Monday, BKR shares were up 0.65% at $44.88.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -85 Days active 427 …

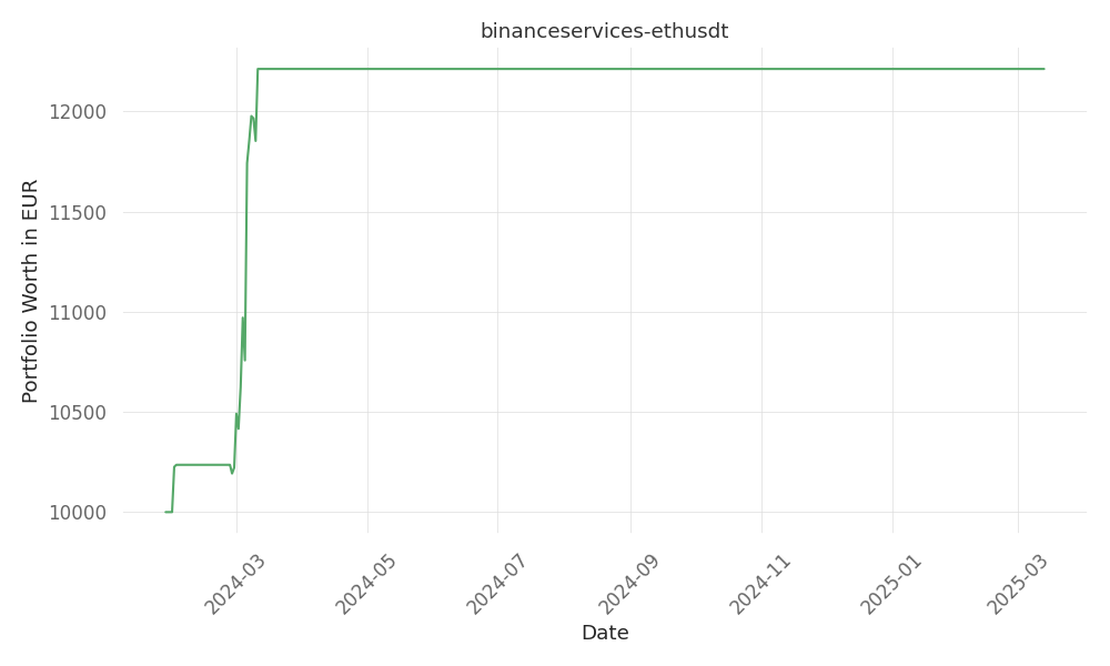

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 19 Days active 410 …

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -60 Days active 408 …