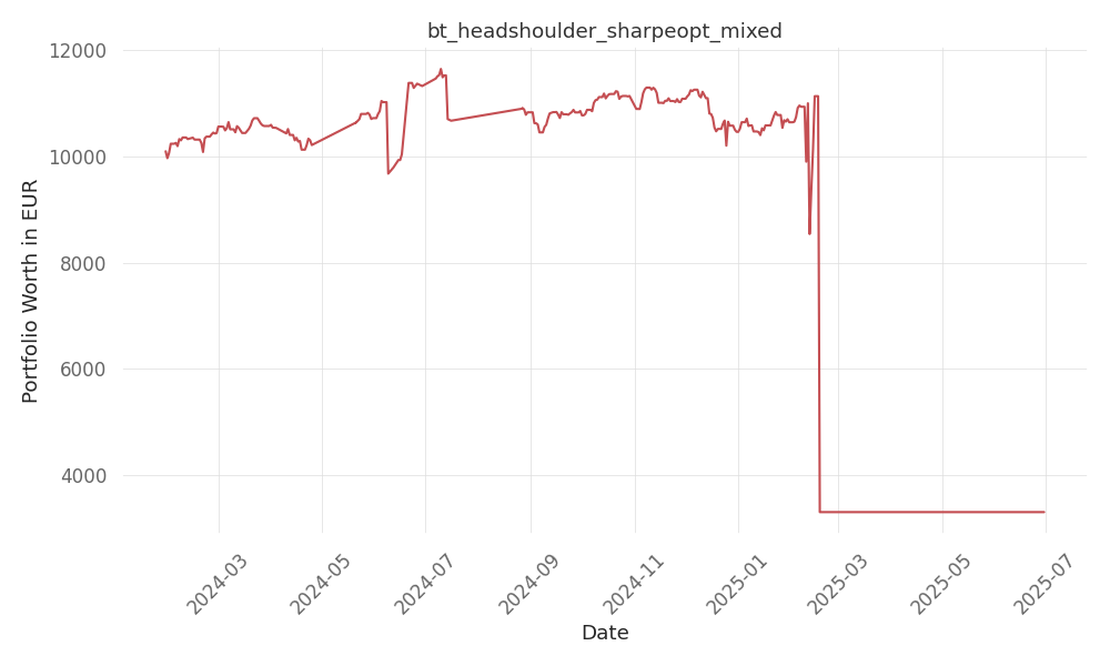

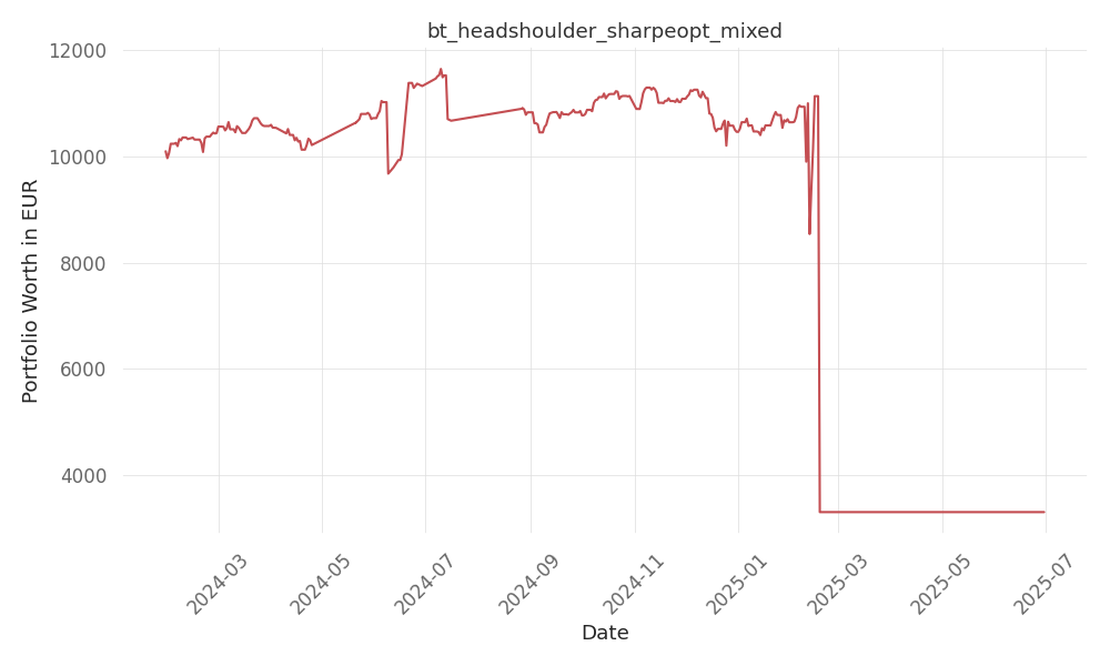

-47% p.a.

bt_headshoulder_sharpeopt_mixed

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -47 Days active 517 …

source: Motley Fool

| ticker | polarity | why? |

|---|---|---|

| S | positively | SentinelOne’s strategic focus on AI-driven cybersecurity, improving margins, and potential acquisition appeal make it a promising investment prospect, likely boosting investor confidence and positively impacting its stock performance. |

| VORBQ | negatively | BigBear.ai and SentinelOne’s struggles in the AI market, with their speculative nature, SPAC merger, and competition from established players, may impact VORBQ negatively, as investors could view these developments as a cautionary tale for speculative AI investments, potentially leading to decreased interest and confidence in VORBQ. |

None so far…

# Speculative Stocks Faceoff: BigBear.ai vs. SentinelOne

In the dynamic world of artificial intelligence (AI) investments, two companies stand out for their speculative nature: BigBear.ai and SentinelOne. Both firms have carved niches in the AI market, with BigBear.ai focusing on modular data mining and analytics tools, and SentinelOne specializing in AI-powered cybersecurity solutions.

## BigBear.ai's Struggle and Turnaround Efforts

BigBear.ai's journey began with a SPAC merger, opening at $9.84 per share, only to plummet to around $1.50. The company's failure to meet its ambitious growth estimates has been a significant setback. With a revenue shortfall and gross margins falling short of projections, BigBear.ai has faced macroeconomic headwinds and stiff competition from established tech giants and startups alike.

The company's reliance on a few key customers and fixed-price contracts has exacerbated its financial woes. However, under the leadership of CEO Mandy Long, BigBear.ai is attempting a turnaround by acquiring AI firm Pangiam, securing new government contracts, and implementing cost-cutting measures.

## SentinelOne's Growth and Market Position

SentinelOne, on the other hand, entered the market through a traditional IPO at $35 a share, now trading below $20. Despite impressive initial growth, the company's revenue increase has slowed, raising concerns among investors accustomed to its rapid expansion.

Competition from larger players like Palo Alto Networks and CrowdStrike looms large, but SentinelOne has managed to improve its gross and operating margins consistently. The company's focus on automating threat detection with AI algorithms positions it as a potential acquisition target, offering a glimmer of hope for investors.

## Investment Outlook

Between the two, SentinelOne appears to be the more promising investment. Its larger scale, improving margins, and strategic focus on AI-driven cybersecurity make it a more attractive proposition in the current market.

Investors are advised to exercise caution and consider the broader landscape of AI and cybersecurity stocks, which may offer more stable and reasonable valuations.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -47 Days active 517 …

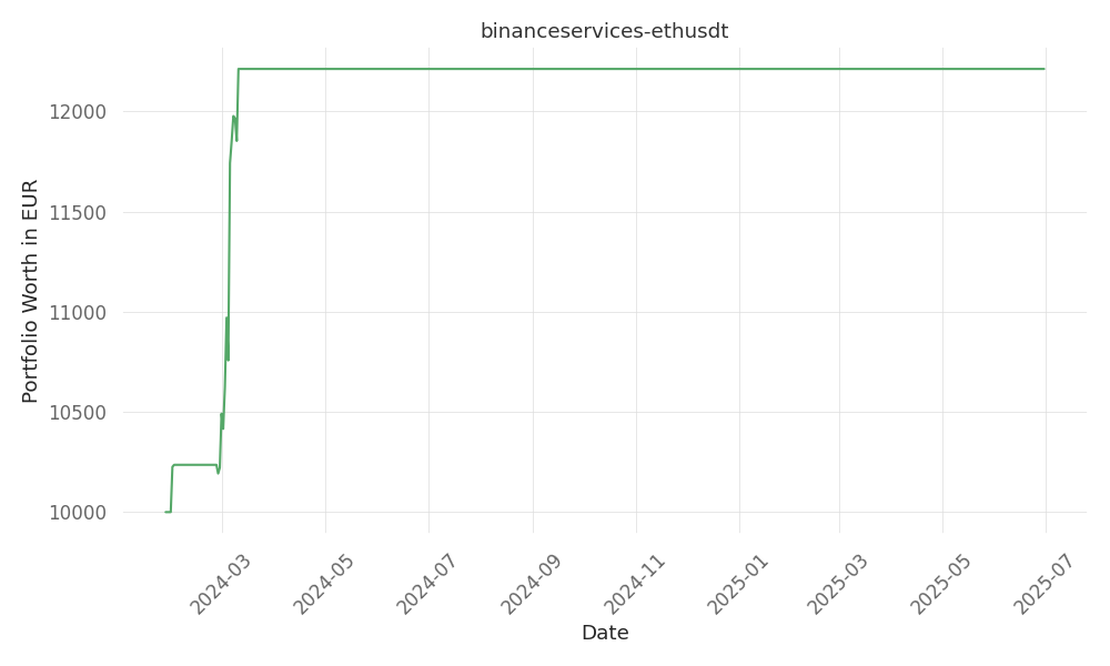

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 519 …

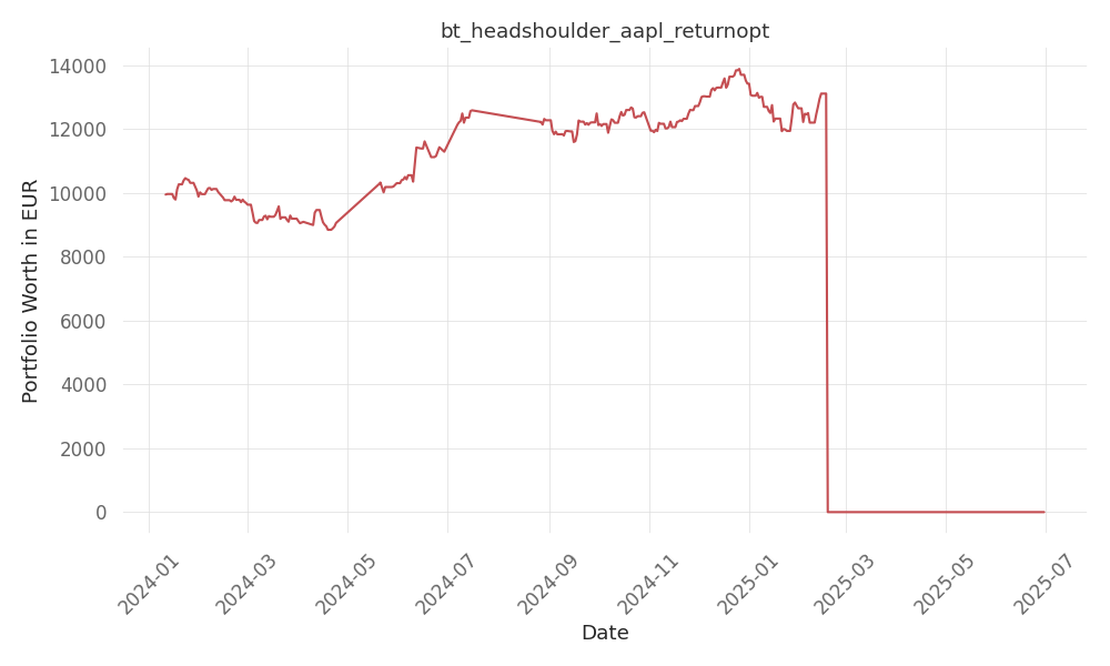

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -68 Days active 536 …