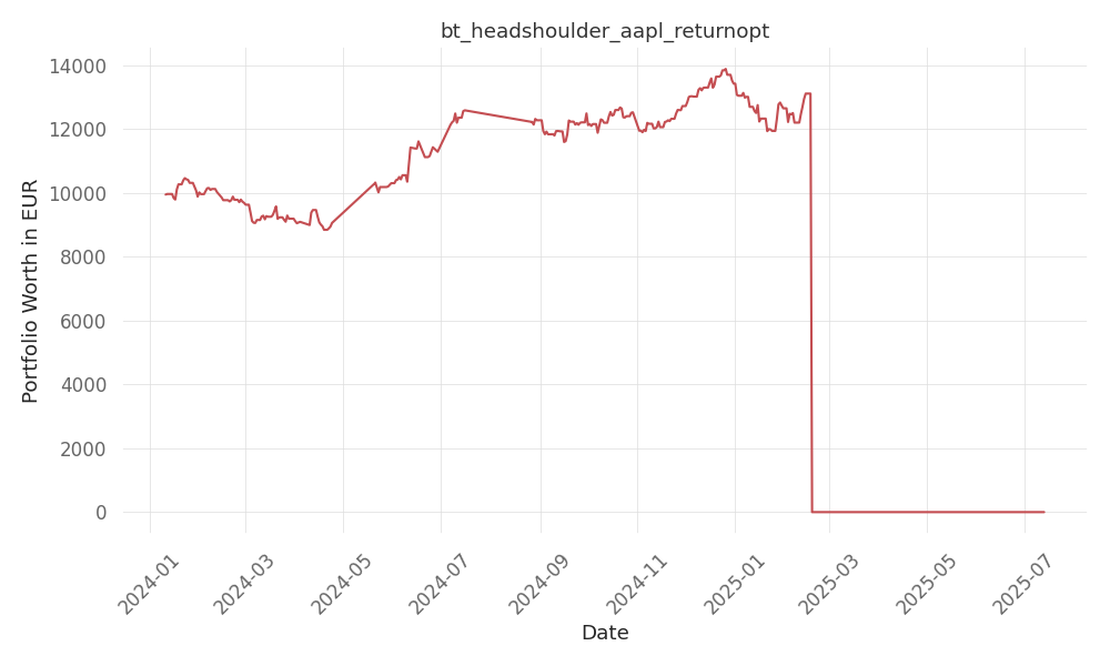

bt_headshoulder_aapl_returnopt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -66 Days active 549 …

source: Decrypt.co

| ticker | polarity | why? |

|---|---|---|

| BLK | positively | BlackRock’s (BLK) record-high assets under management and strong net flows in Q2, driven by the success of its iShares Bitcoin Trust (IBIT), highlight the company’s positive trajectory and potential for continued growth, benefiting its stock performance. |

| BTC-USD | positively | BlackRock’s success with its iShares Bitcoin Trust (IBIT) ETF, which holds a substantial amount of Bitcoin, suggests strong investor interest in Bitcoin and crypto exposure. As BlackRock continues to attract investors and grow its assets under management, particularly with its Bitcoin spot ETF, it could drive increased demand for Bitcoin, potentially having a positive impact on the BTC-USD ticker. |

BlackRock reached a record high of $10.65 trillion in assets under management (AUM) as of June 30, largely due to the success of its iShares Bitcoin Trust (IBIT), the world’s largest Bitcoin spot ETF. This represents a 13% increase year-over-year and surpasses the company’s Q2 estimate of $10.2 trillion.

BlackRock’s Q2 net flows totaled $82 billion, with $51 billion in new client cash flowing into its long-term investment funds. The company’s total net flows for the first half of the year reached $139 billion.

The strong performance marks a rebound for BlackRock and other money managers who faced value declines as the Federal Reserve hiked interest rates in 2022 and 2023. With markets now predicting a drop in interest rates come September, investors are moving capital back into fixed-income assets.

BlackRock’s IBIT, launched in January, has been a significant driver of the company’s success. As of Friday, IBIT held $18.3 billion worth of Bitcoin, with net flows to the fund climbing $4.4 billion since the end of Q1.

BlackRock’s largest competitor, Vanguard Group, held $8.6 trillion in assets under management as of December 31, 2023, but has chosen not to offer any Bitcoin spot ETFs. This philosophical difference has provided BlackRock with a unique opportunity to attract investors interested in Bitcoin exposure.

BlackRock’s record-high AUM and strong net flows in Q2 highlight the company’s successful rebound and the potential of its Bitcoin spot ETF, IBIT. With markets anticipating a shift in monetary policy, BlackRock is well-positioned to continue its growth trajectory and benefit from investors’ shifting preferences.

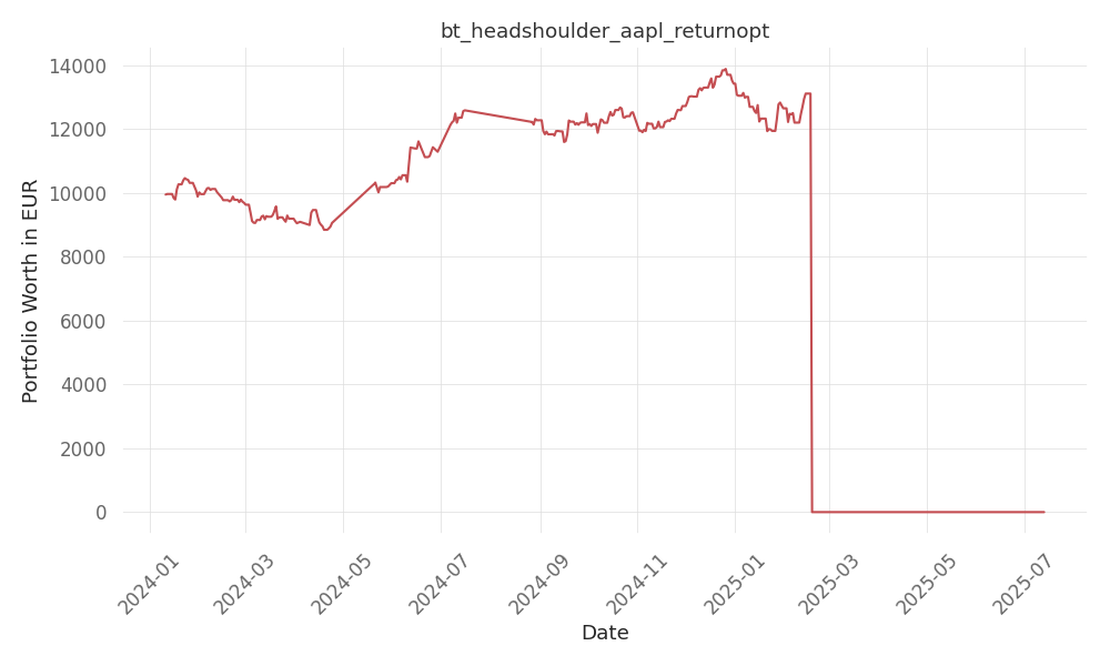

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -66 Days active 549 …

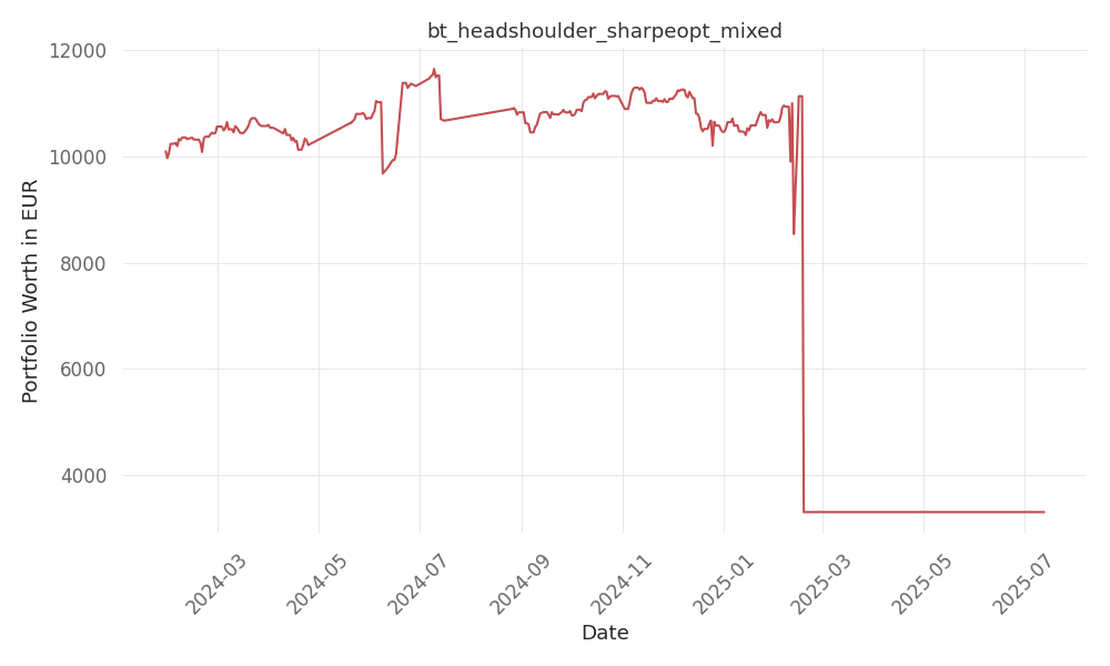

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -46 Days active 530 …

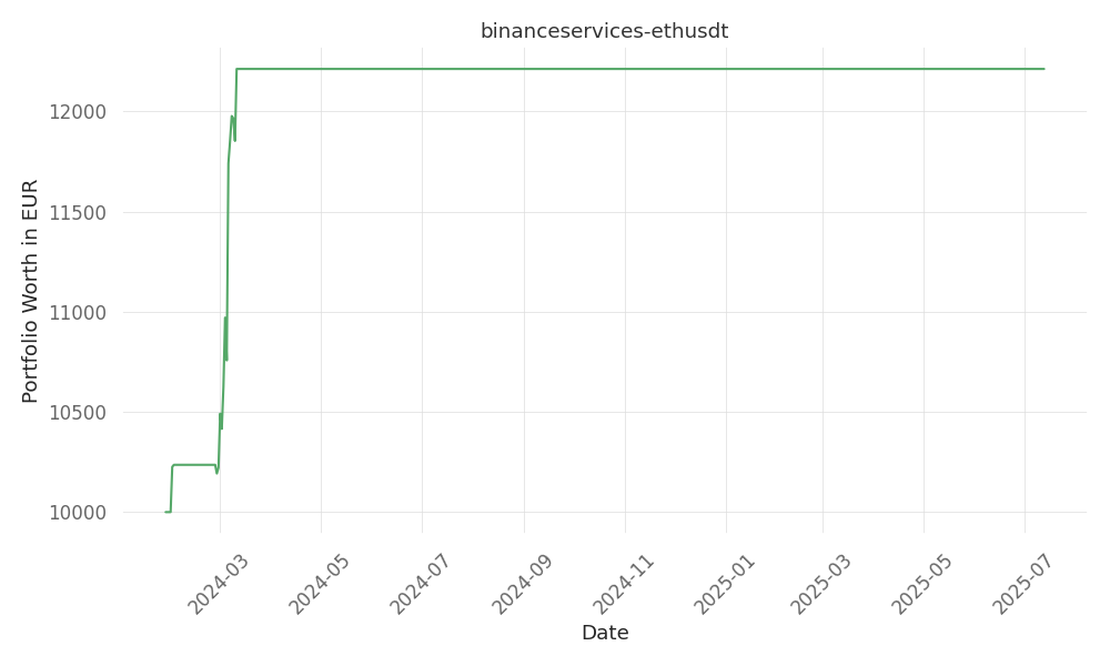

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 532 …