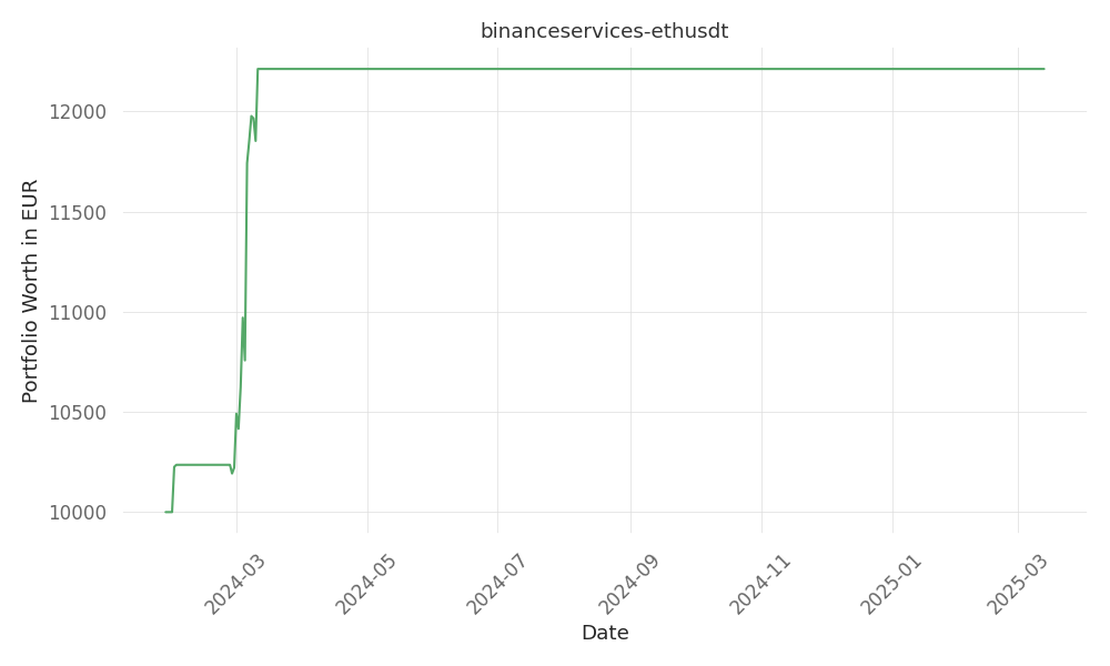

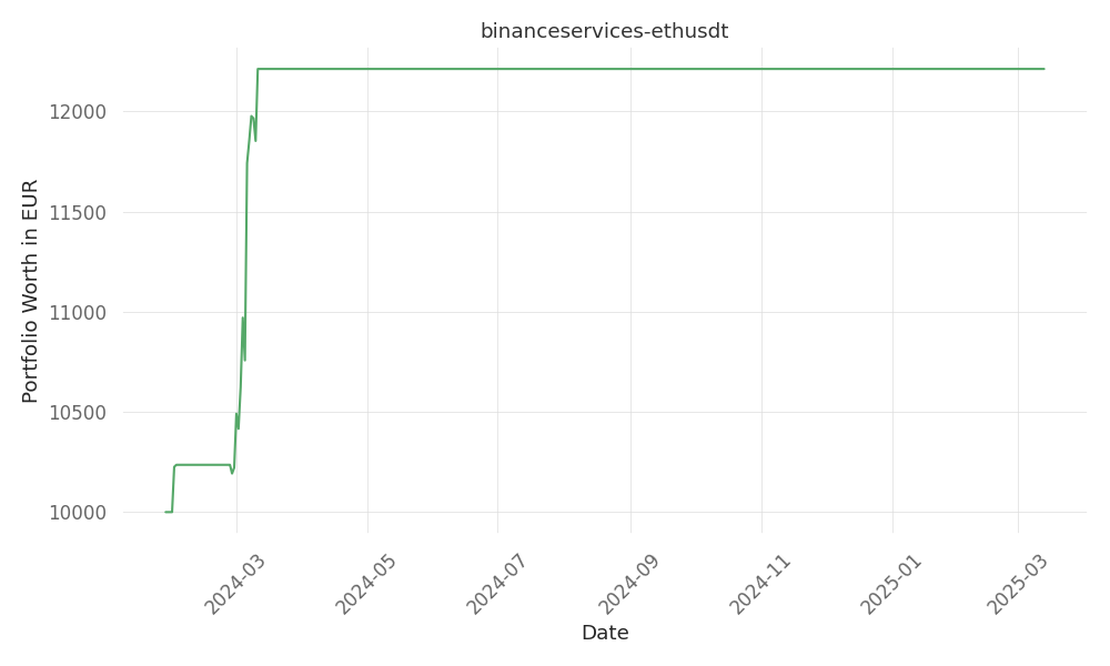

binanceservices-ethusdt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 19 Days active 410 …

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| HPE | positively | The current stock decline due to weak Q2 guidance might present a buying opportunity for long-term investors who believe in the company’s future prospects. Also, if management can follow through on their commitment to improved execution and deliver on future innovations, it could drive future growth and potentially reverse the stock decline.HPE’s historical track record of consecutive quarters of revenue growth may reassure investors that this setback is temporary, providing a foundation for a potential rebound. |

| HPQ | positively | The decline in Hewlett Packard Enterprise (HPE) shares, represented by the ticker symbol HPQ, could potentially benefit HPQ’s parent company, Hewlett-Packard, as investors may shift their focus and resources towards the more stable and diversified HPQ, leading to a potential increase in its stock value. Additionally, the separation of the enterprise and personal computer divisions could lead to increased investor interest in the more consumer-focused HPQ, as the enterprise division faces challenges. |

Hewlett Packard Enterprise (HPE) shares experienced a significant decline, dropping over 16%, following the company’s issuance of weaker-than-expected Q2 revenue and earnings per share (EPS) guidance. Despite meeting Q1 earnings estimates and surpassing revenue forecasts, the company’s gross margin decline has sparked investor concerns. In its latest financial report, Hewlett Packard Enterprise disclosed a non-GAAP gross margin of 29.4%, a sharp decrease of 680 basis points from the previous year and 150 basis points sequentially. This decline in margins has overshadowed the company’s otherwise positive performance. The company reported first-quarter earnings of 49 cents per share, aligning with analyst estimates, and generated revenue of $7.85 billion, slightly surpassing the consensus estimate of $7.82 billion. While HPE has achieved four consecutive quarters of year-over-year revenue growth, CEO Antonio Neri has acknowledged areas where the company could have executed better. CEO Antonio Neri expressed optimism about the company, highlighting recent innovations and committing to improved execution in the coming quarters. For the second quarter, Hewlett Packard Enterprise forecasts revenue to range between $7.2 billion and $7.6 billion, notably below the analyst estimate of $7.93 billion. The company also provided an EPS guidance of between 28 cents and 34 cents, which is significantly lower than the 50 cents expected by analysts. This muted outlook has contributed to the stock’s decline, with HPE shares down 16.2% at $15.06 by the time of this report.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 19 Days active 410 …

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -85 Days active 427 …

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -60 Days active 408 …