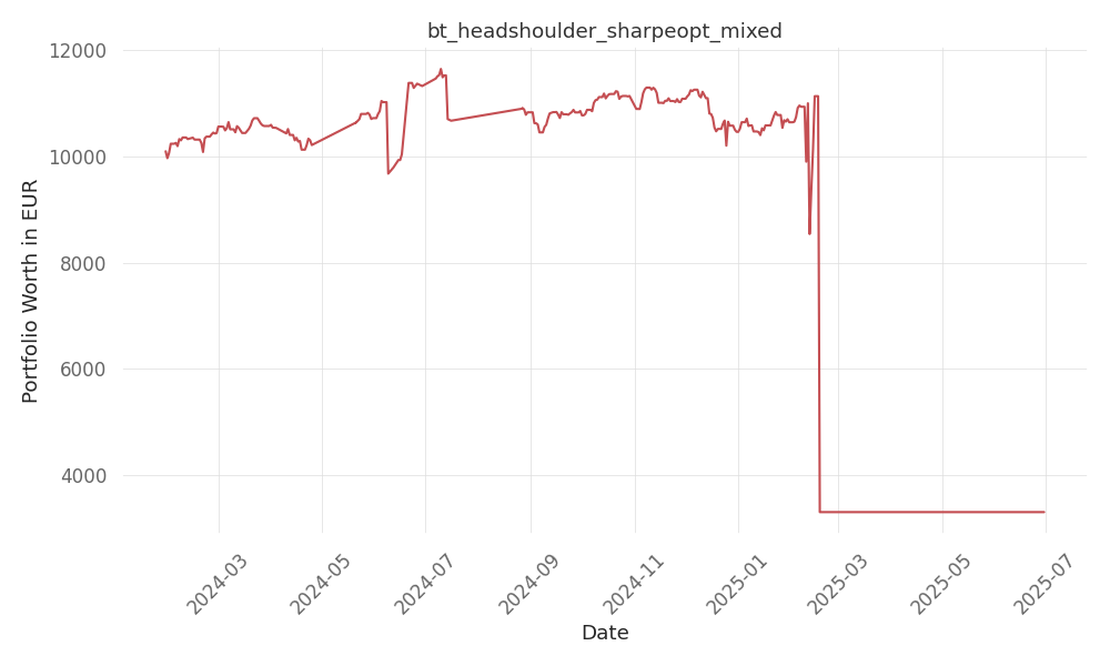

bt_headshoulder_sharpeopt_mixed

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -47 Days active 517 …

source: Motley Fool

| ticker | polarity | why? |

|---|---|---|

| NFLX | positively | With Sirius XM’s stagnant growth and diminishing cash flows, Netflix, represented by the ticker NFLX, stands to benefit as investors seek alternative investments in the digital media space, favoring companies with stronger growth prospects and adaptability in the evolving industry landscape. |

| SPOT | positively | The ticker SPOT, representing Spotify, could see a positive impact due to the company’s strategic partnerships and innovative features that continue to attract a growing user base. These developments can lead to increased subscriber numbers and revenue growth, which are key drivers of stock performance. Additionally, Spotify’s efforts in expanding its podcast and advertisement segments may contribute to a stronger market position and improved financial outcomes. |

title: “Sirius XM: A Stock on the Edge?” date: 2024-07-14

Sirius XM Holdings, known for its satellite radio services, has seen its stock price decrease by 33% year-to-date in 2024. Despite a historically low price-to-earnings ratio of 10.9, suggesting undervaluation, the company’s growth has been stagnant, and cash flows are diminishing.

Comparatively, Sirius XM’s financials seem modest. With a market capitalization of $14 billion and a dividend yield of 2.9%, it stands out in the mid-cap market. However, the lack of revenue growth and shrinking free cash flows raise concerns about its future sustainability in the competitive digital media landscape.

In contrast, Sirius XM’s subsidiary Pandora showed a 7% revenue increase in the first quarter, maintaining steady subscriber numbers and improved ad sales. This could signal a recovery in the digital advertising sector, benefiting the broader online media industry.

Warren Buffett’s Berkshire Hathaway had previously invested in Sirius XM but reduced its stake by 8.9% in early 2024. This move, coupled with the company’s performance, suggests that investors should be cautious. The current market conditions and competition from internet-based content providers make Sirius XM a potential “hold,” with a recommendation to sell if the stock price appreciably increases.

Sirius XM Holdings currently presents a mixed investment picture. While it offers a reasonable dividend and appears undervalued, the company’s growth challenges in a rapidly evolving industry make it a cautious hold for investors.

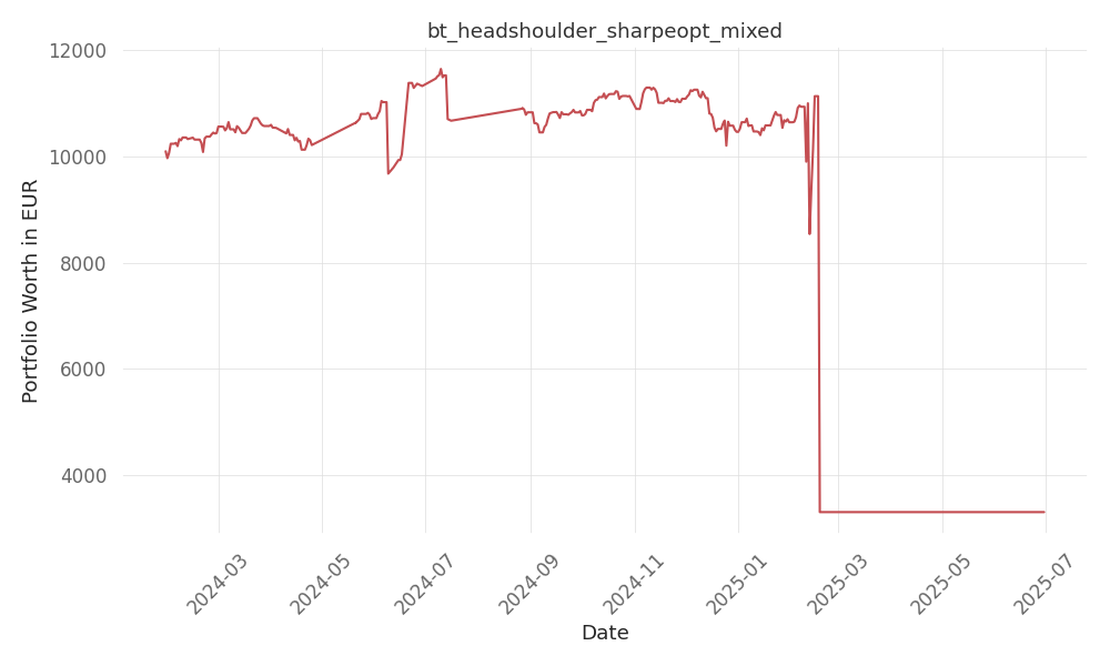

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -47 Days active 517 …

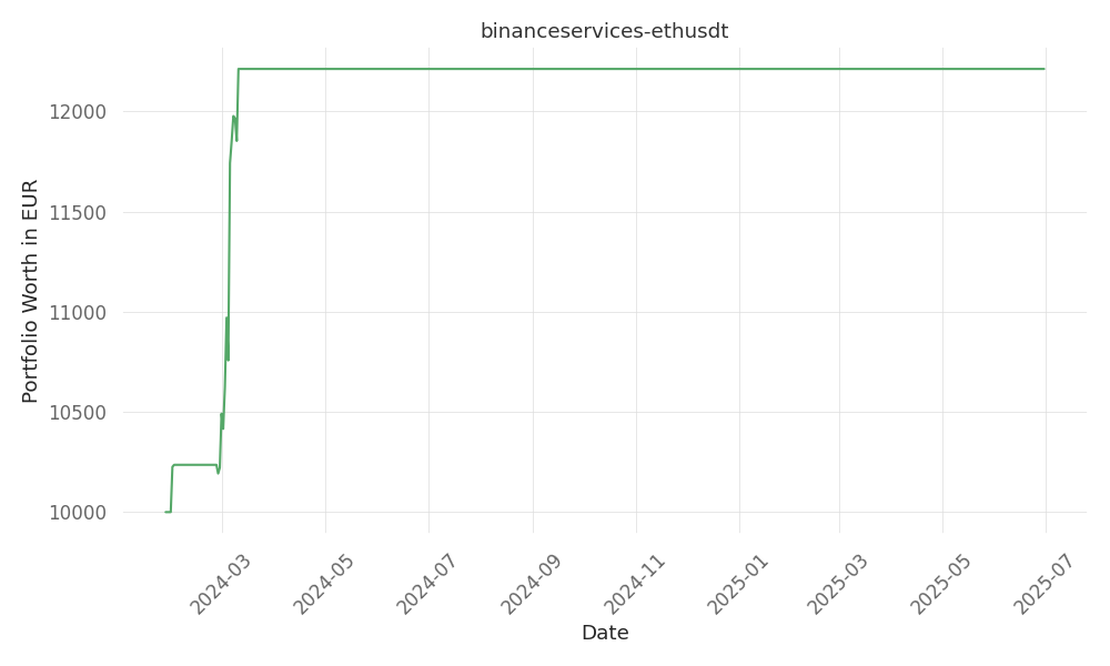

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 519 …

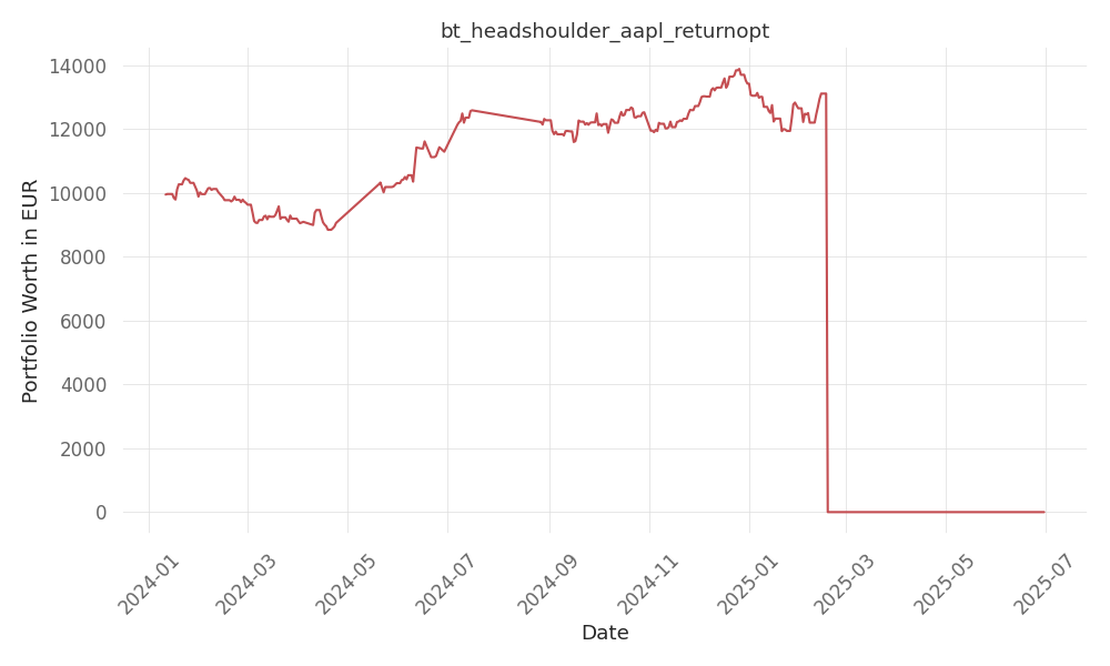

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -68 Days active 536 …