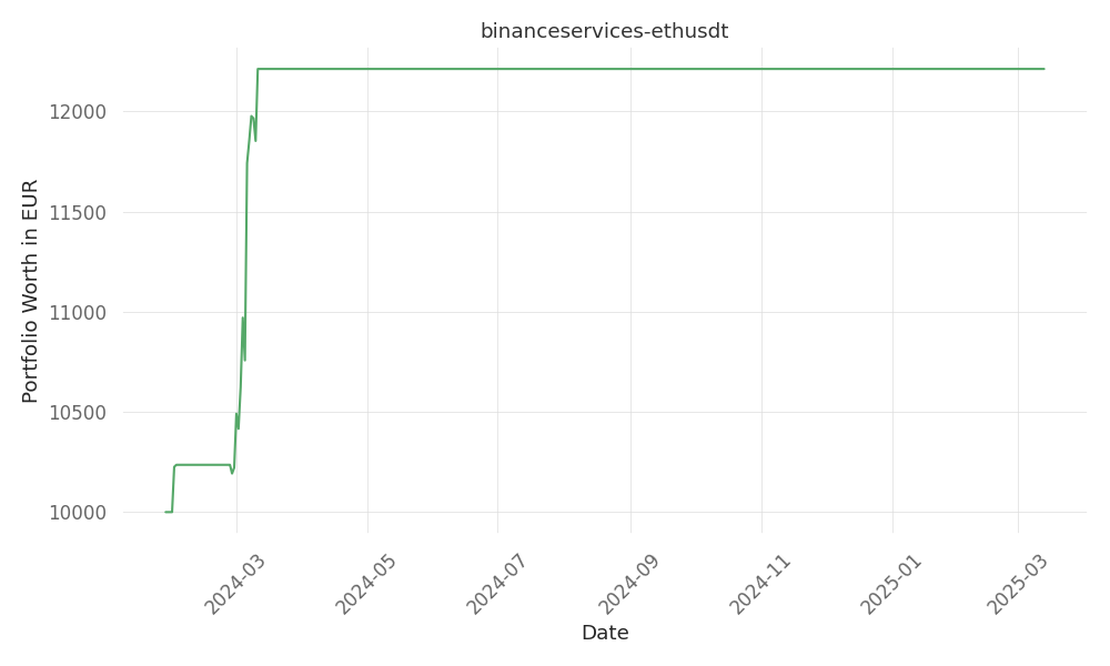

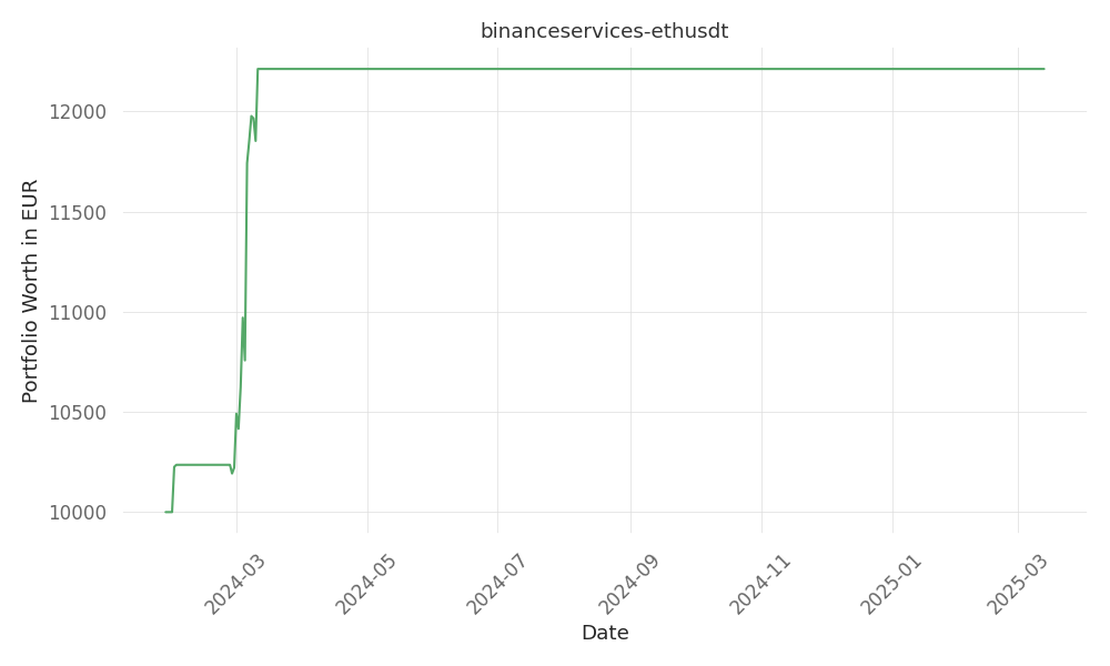

binanceservices-ethusdt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 19 Days active 410 …

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| ABNB | positively | Airbnb (ABNB) could be positively affected by the current market volatility and economic uncertainty as investors seek out defensive stocks with strong fundamentals. With consumers potentially looking to cut back on spending, the shift towards more affordable and flexible travel options, like those provided by Airbnb, could increase demand. Additionally, if the U.S. economy faces a downturn, Airbnb’s business model, which allows for local, flexible travel, could see a boost as people opt for domestic, cost-effective getaways over international travel. |

| UBER | positively | If these market conditions continue, skiitakers are likely to seek out ride-sharing services like Uber more frequently than other methods of transportation which might affect the company’s revenue. Investors might view a company like Uber and its logistics division, which is Tech-based, less sensitive to tariffs and trade uncertainties, than other retailers or even AI stocks. |

newstrader , static-skfolio-denoised-cov-shrunk-expret , static-skfolio-max-sortino

Wall Street is in turmoil again, and CNBC’s Jim Cramer is voicing what many investors are wondering: “Do we just keep selling because everyone is selling?” The stock market saw another sharp drop on Thursday, with the S&P 500 falling 1.8%, the Dow Jones Industrial Average losing 427 points, and the Nasdaq tumbling 2.6%. Cramer followed up his initial tweet with another, calling the current administration the “Every Day Lower Prices Walmart White House.” His comments reflect frustration over the volatility caused by President Trump’s tariffs and economic policies. Tariff uncertainty adds to the sell-off, as investors struggle to keep up with the back-and-forth on tariffs. Trump announced a one-month reprieve on some tariffs for Mexico and Canada, but concerns remain as new tariffs are still set to take effect in April. Businesses are cautious, and consumers are bracing for inflation. Trump, however, dismissed concerns that his tariff policies are rattling markets. “I’m not even looking at the market,” he said in the Oval Office on Thursday, blaming falling stock prices on “globalist countries and companies that won’t be doing as well because we’re taking back things that have been taken from us many years ago.” Adding to the market’s pain, AI stocks—once Wall Street’s biggest winners—are seeing losses. Marvell Technology MRVL dropped nearly 20% despite reporting solid earnings. Nvidia NVDA fell 5.7%, and Broadcom AVGO slipped 6.3% ahead of its earnings report. Investors who had grown accustomed to AI stocks consistently outperforming expectations are now re-evaluating their positions. Retailers are also feeling the pressure. Macy’s M reported weaker-than-expected revenue, and Victoria’s Secret VSCO fell 8.2% after giving a disappointing forecast. These reports signal that consumer spending, a key pillar of economic stability, may be softening. While some fear more losses ahead, BlackRock BLK CEO Larry Fink sees an opportunity. Speaking at the recent RBC Capital Markets Global Financial Institutions Conference in New York, he reassured investors: “The world’s fine… The United States will get by.” He acknowledges 2025 will be volatile but believes in long-term growth. “If there’s a big dip, good. Good time to buy.” Fink highlighted AI’s potential, though he admitted its high costs are keeping it out of reach for smaller companies. He also pointed to Europe’s economic rebound, citing increased defense spending and financial reforms. With uncertainty high, Cramer’s question—“Do we just keep selling because everyone is selling?"—captures the mood on Wall Street. Whether investors follow Larry Fink’s advice to buy the dip or continue the sell-off remains to be seen.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 19 Days active 410 …

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -60 Days active 408 …

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -85 Days active 427 …