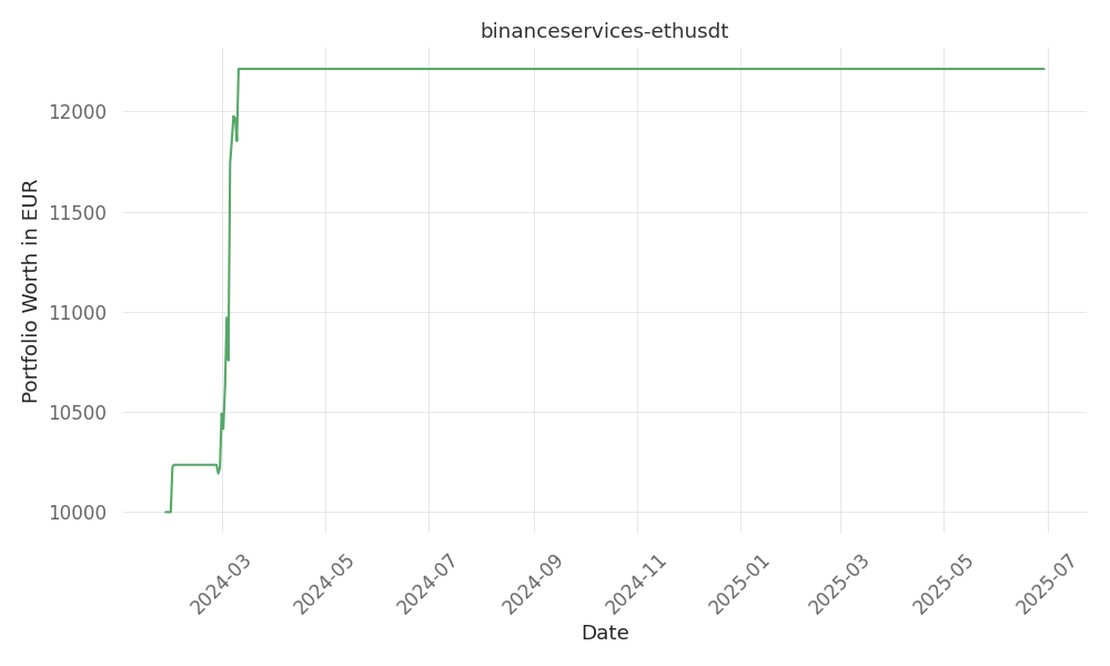

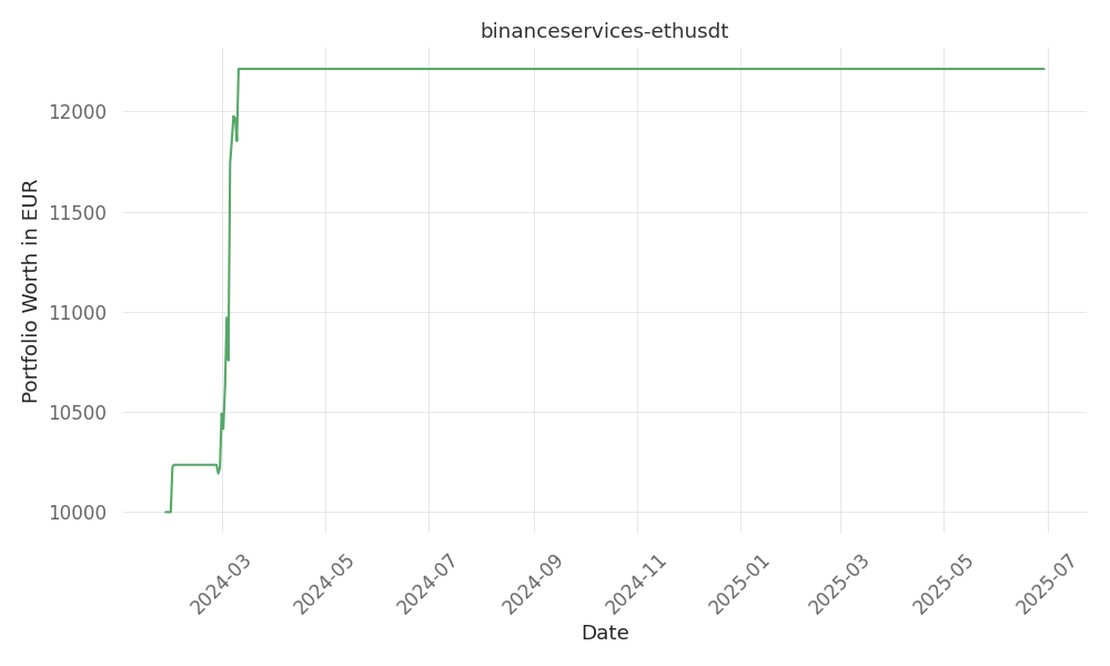

15% p.a.

binanceservices-ethusdt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 518 …

tickers: M

source: Kiplinger

| ticker | polarity | why? |

|---|---|---|

| M | positively | The ticker ‘M’ likely stands for Macy’s, and it could be positively affected by a variety of factors such as strong quarterly earnings, successful marketing campaigns, or strategic corporate decisions that resonate with investors and consumers. Positive news or developments in the retail sector, in general, can also contribute to a favorable outlook for Macy’s, as it may indicate a healthy consumer spending environment. Additionally, any advancements in e-commerce or in-store technology that improve the shopping experience could lead to increased sales and profitability for the company. |

None so far…

# Macy's Stock Tumbles After Buyout Talks End

Macy's (M) shares took a nosedive on Monday following the announcement that the company has ceased buyout discussions with Arkhouse Management and Brigade Capital Management.

## Failed Negotiations

In a surprising turn of events, Macy's revealed that the proposed buyout offers, including a cash payout of $24.80 per share, were not backed by adequate financing assurances. This led to the termination of talks that could have seen the retailer go private.

## A Bold New Chapter

With the buyout off the table, Macy's is redirecting its focus to its strategic plan dubbed "A Bold New Chapter." The plan aims to revitalize the Macy's brand, boost luxury offerings through Bloomingdale's and Bluemercury, and streamline operations for better efficiency.

## Market Reactions

The market's response to the news has been lukewarm, with analysts adopting a cautious stance. The consensus recommendation is to hold, with an average target price suggesting a potential upside. However, some analysts remain skeptical, citing ongoing consumer pressures and competitive challenges that could affect Macy's market position and share price.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 518 …

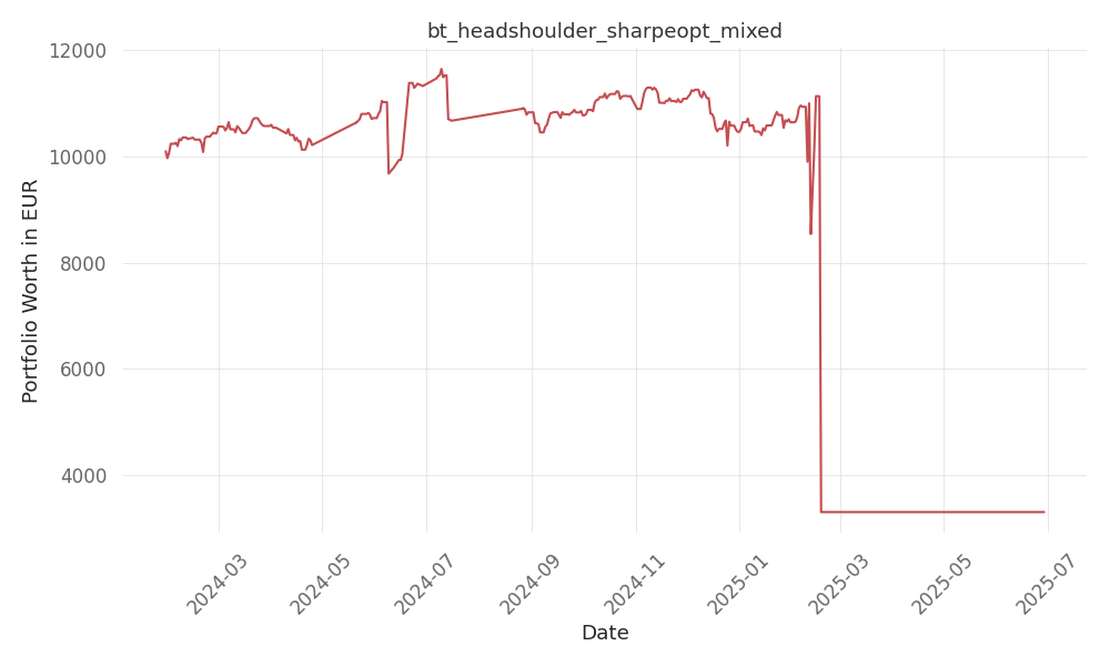

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -47 Days active 516 …

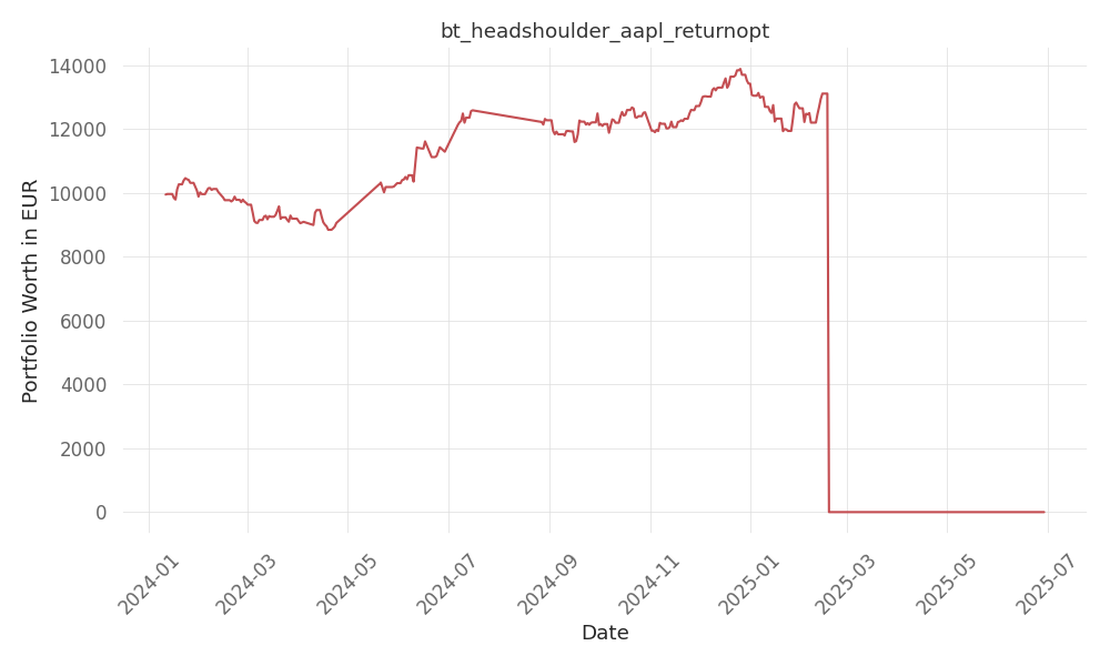

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -68 Days active 535 …