-46% p.a.

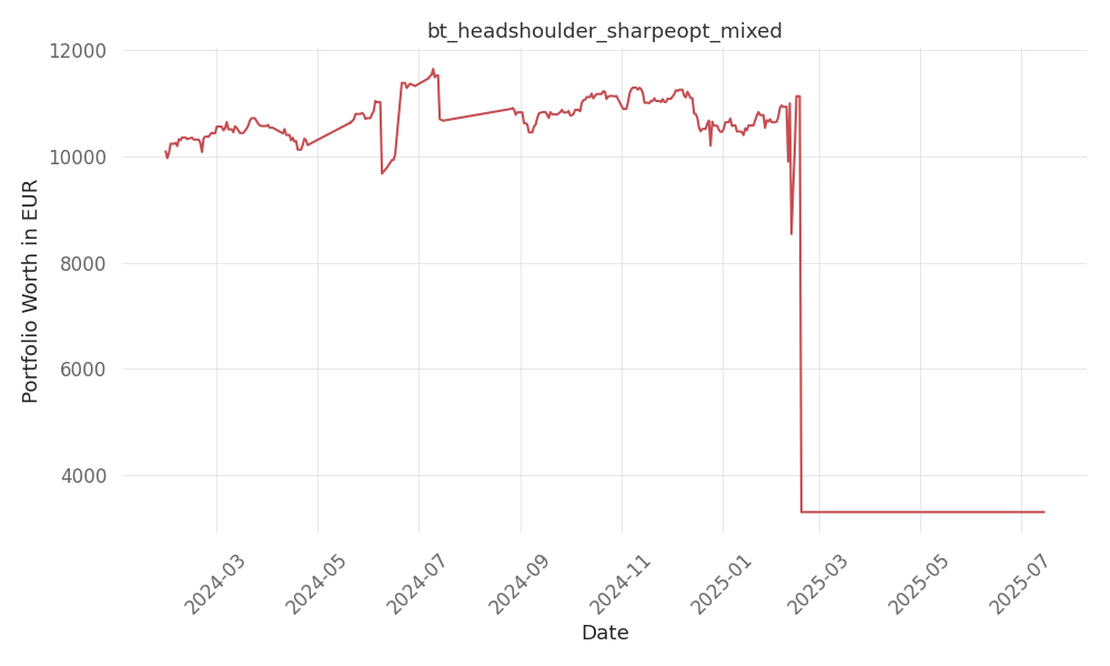

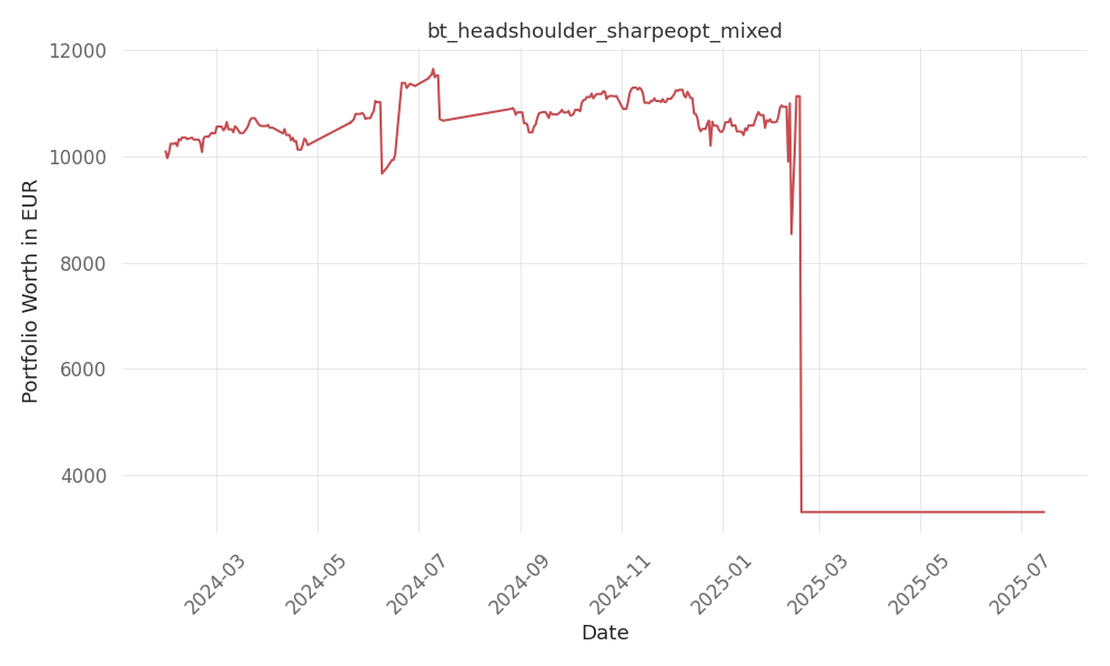

bt_headshoulder_sharpeopt_mixed

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -46 Days active 532 …

tickers: RIVN, BIDU NFLX, HUBS, DAL

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| RIVN | positively | The positive performance of mid-cap stocks, including those in the EV sector, bodes well for RIVN. The rally in EV stocks, driven by companies like Rivian, and the overall positive sentiment towards electric vehicle companies, could positively impact RIVN’s stock price and performance. Additionally, the collaboration between Volkswagen and QuantumScape Corporation highlights the growing interest in EV technology and battery innovation, which aligns with Rivian’s focus on electric vehicles. |

| BIDU | positively | With Baidu’s interest in machine learning, computer vision, and robotics, the company stands to benefit from the broader gains in the industrial sector, as seen with Sunrun Inc.’s (RUN) stock increase. Baidu’s early focus on autonomous driving technology positions it to capitalize on the advancements in this space, including the progress made by QuantumScape and Volkswagen in solid-state batteries. Additionally, Baidu’s cash-rich balance sheet enables it to invest in emerging tech industries, such as those highlighted in the article, driving further innovation and potential upside for the company’s stock performance. |

| NFLX | negatively | The ticker NFLX, representing Netflix, could potentially be affected negatively by increased competition in the streaming market, as new players may dilute the market share and impact subscriber growth. Additionally, rising content acquisition costs and the need to continuously invest in original content could strain the company’s financials. Market sentiment can also be influenced by changes in consumer behavior, such as a shift towards alternative entertainment platforms or services. |

| HUBS | negatively | With a host of mid-cap stocks witnessing substantial gains, HUBS could face negative sentiment as investors may opt to divert funds towards these top-performing stocks, potentially impacting HUBS’ trading volume and share price. The diverse sectors represented by these stocks, including healthcare, technology, and energy, may also attract investors seeking to balance their portfolios, possibly at the expense of HUBS. Additionally, the notable gains by competitors in the healthcare technology space, such as Lantheus Holdings and Kymera Therapeutics, could intensify competition and impact HUBS’ market positioning. |

| DAL | negatively | The ticker DAL, representing Delta Air Lines, could be negatively impacted by potential disruptions in global travel patterns due to geopolitical tensions or economic downturns, which typically lead to reduced demand for air travel and could adversely affect the airline’s revenue and profitability. Additionally, increases in operational costs such as fuel prices can also contribute to financial strain on the company. |

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -46 Days active 532 …

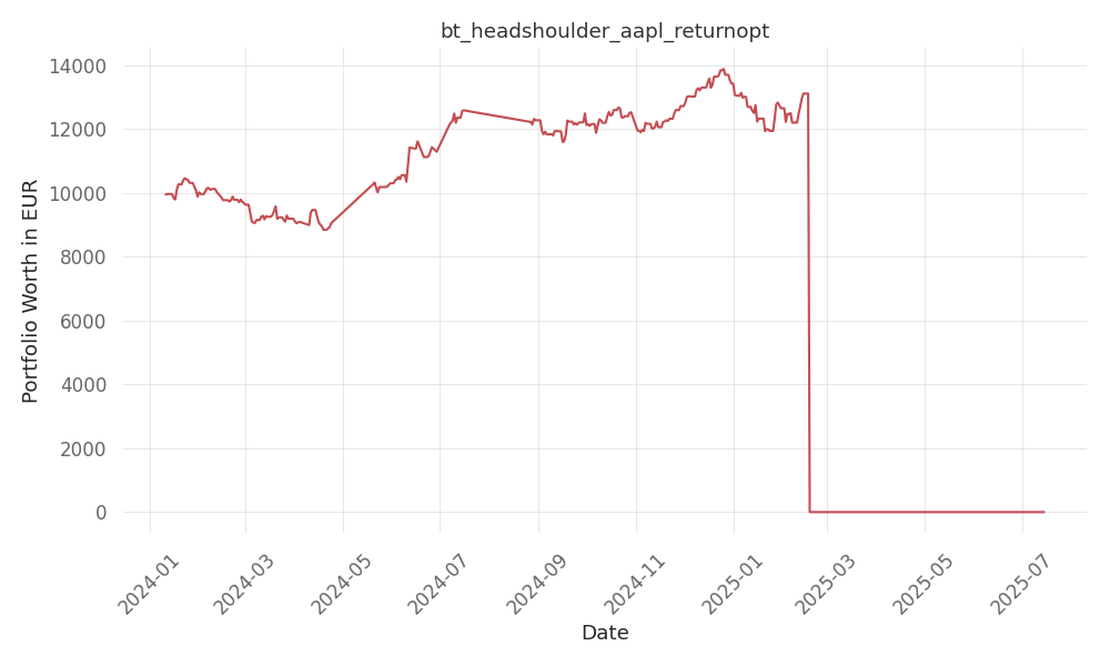

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -66 Days active 551 …

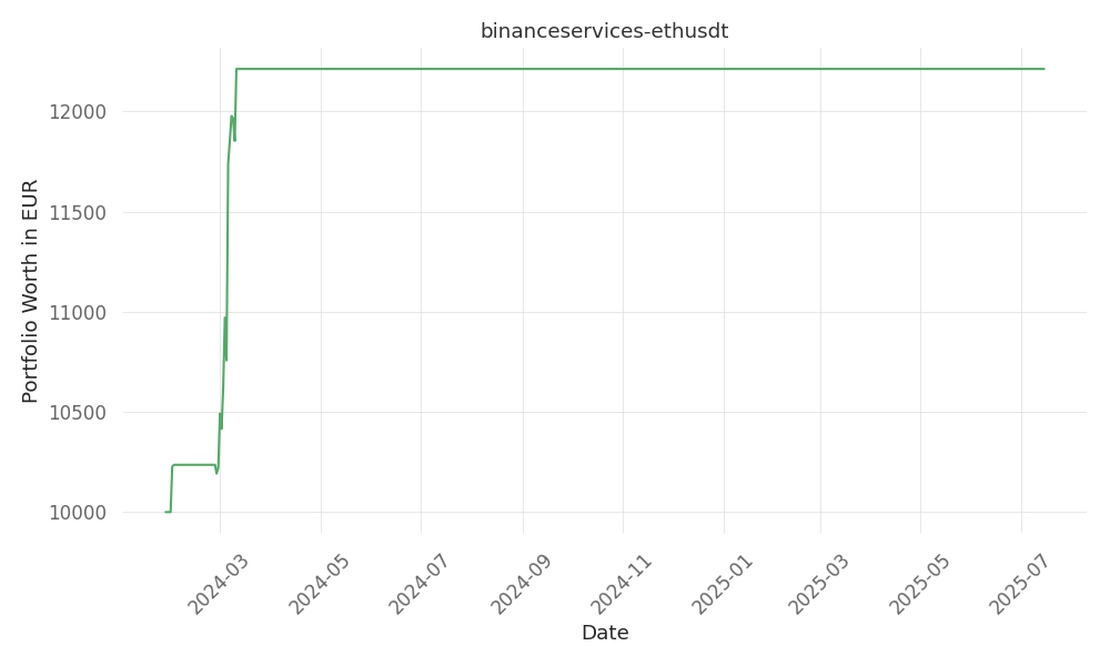

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 534 …