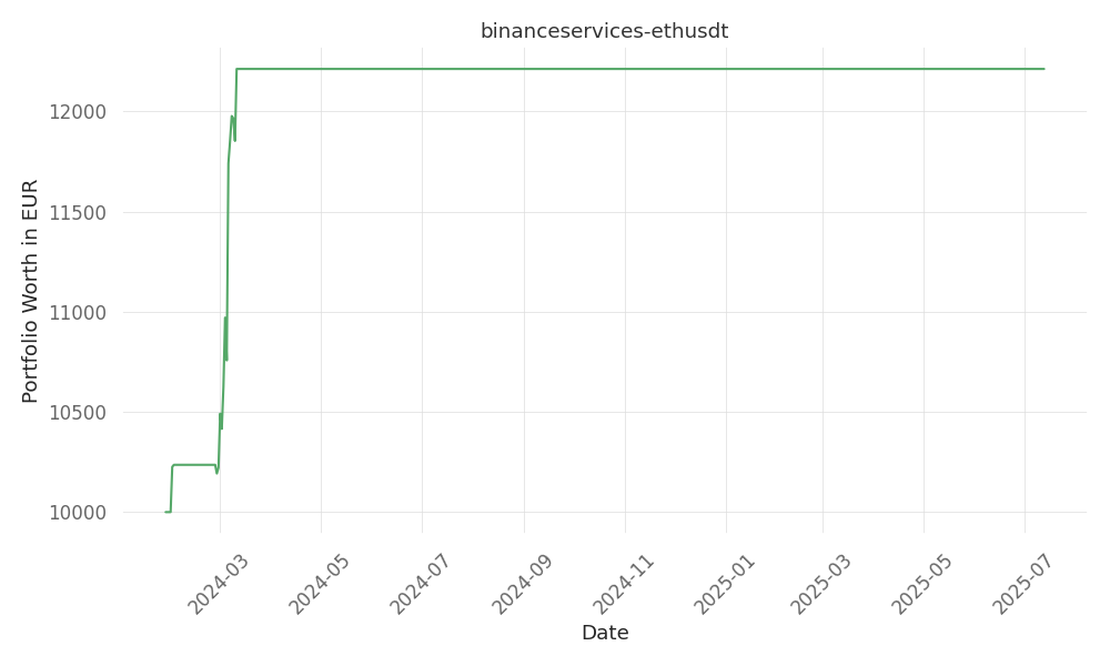

binanceservices-ethusdt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 532 …

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| MULN | positively | The sale of 70 all-electric Bollinger B4 trucks to Doering Fleet Management is a significant order for Mullen Automotive’s subsidiary, Bollinger Motors, and will positively impact the MULN stock as it brings in $11.5 million in revenue and marks the entrance of the Bollinger B4 into the market. |

| BRK-A | positively | As Mullen Automotive strengthens its position in the EV market with Bollinger Motors’ deal, it contributes to the broader advancement and consumer interest in electric vehicles. This positive momentum in the EV industry could spill over to other EV manufacturers and related companies, including those associated with BRK-A, potentially leading to increased investor confidence and positive stock performance. |

None so far…

The company announced its subsidiary, Bollinger Motors, has signed an agreement to sell 70 all-electric Class 4 Bollinger B4 commercial EV trucks. The vehicle order from Doering Fleet Management is valued at approximately $11.5 million, with the first deliveries expected in late 2024.

The Bollinger B4 will be the first Class 4 medium-duty, all-electric truck offered by Doering, marking a significant step forward for Bollinger Motors, according to Jim Connelly, chief revenue officer. Connelly also highlighted Doering’s reputation in fleet management, expressing honor in having the Bollinger B4 as an eco-friendly option for their customers.

Investors interested in trading Mullen Automotive stock can do so through brokerage platforms, many of which offer the option to buy fractional shares. For those looking to bet against the company, short-selling or utilizing put options are possible strategies, although they involve greater complexity and risk.

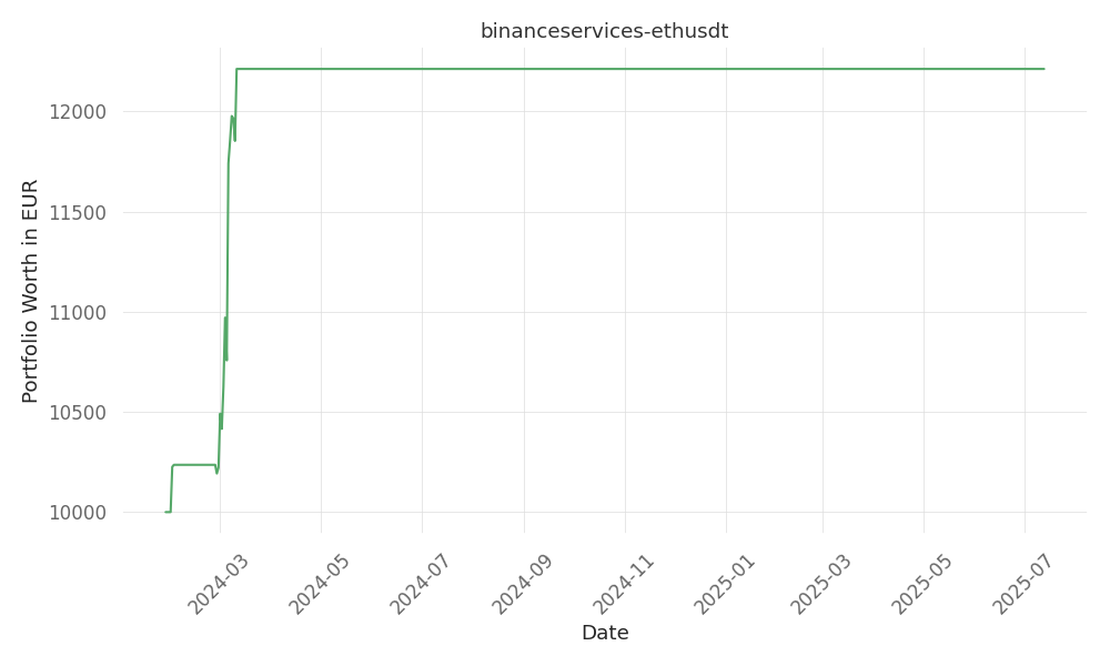

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 532 …

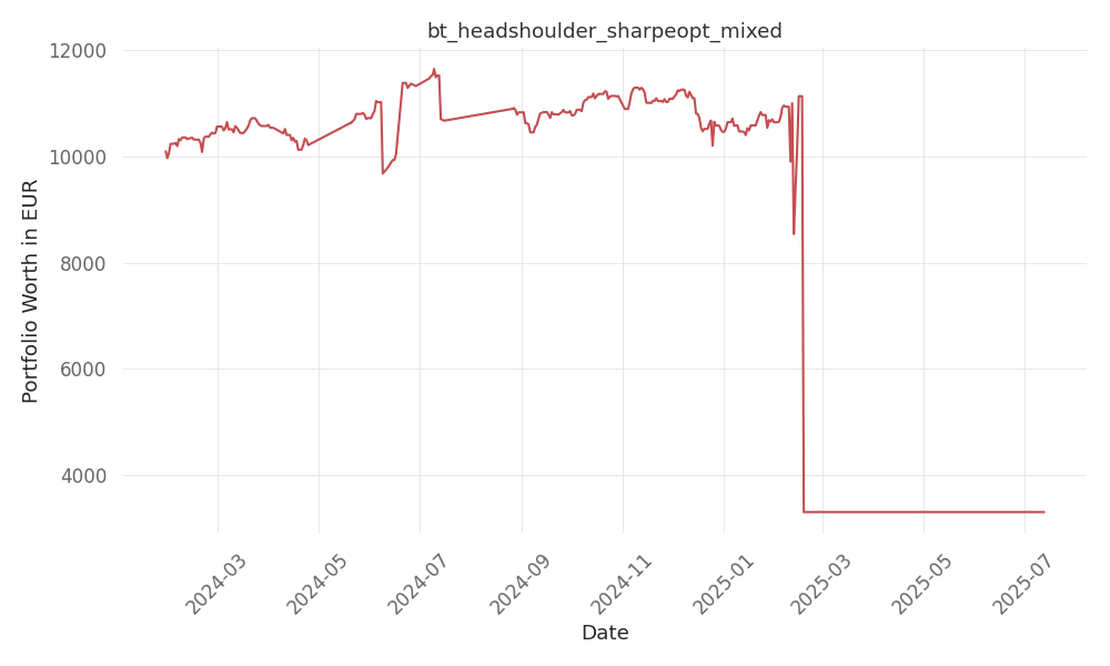

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -46 Days active 530 …

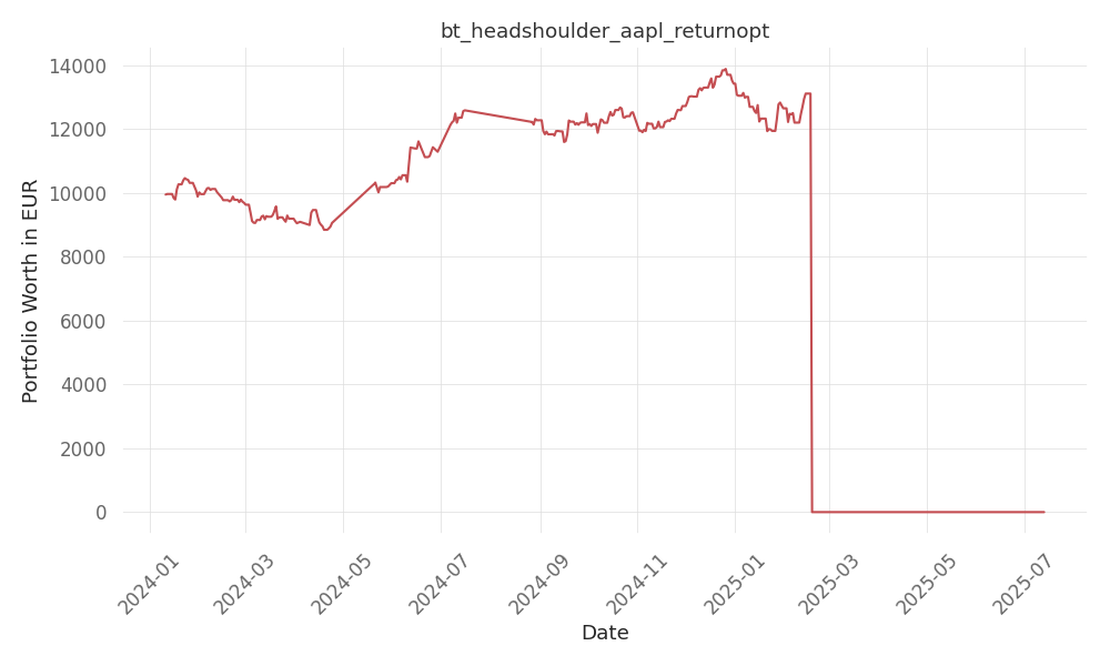

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -66 Days active 549 …