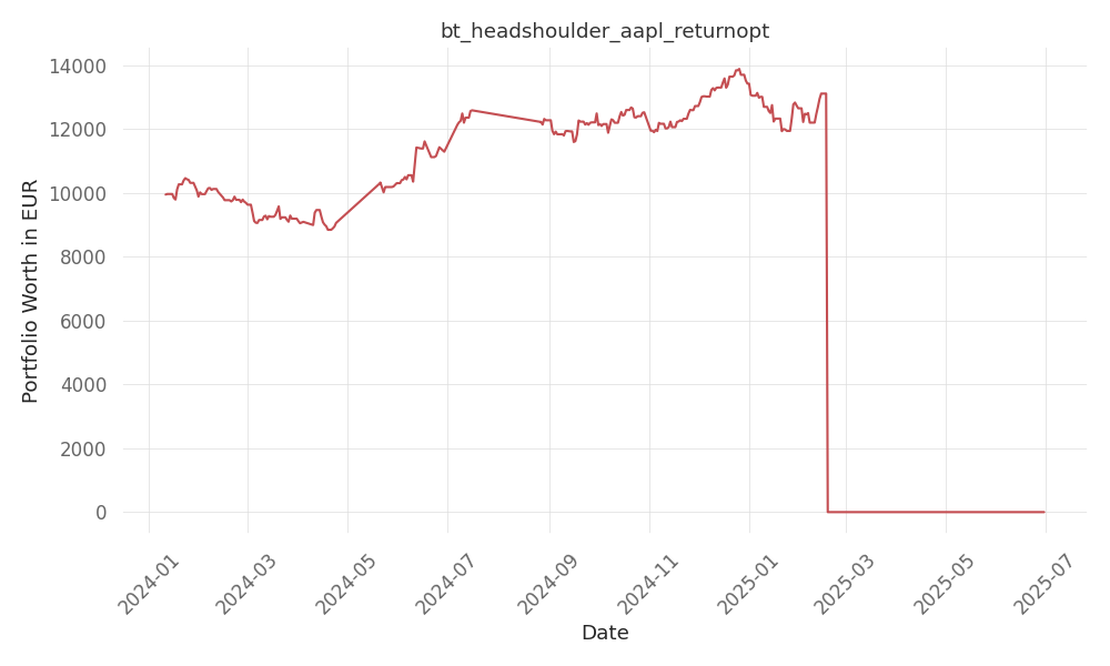

bt_headshoulder_aapl_returnopt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -68 Days active 536 …

tickers: TOST

source: Investors Business Daily

| ticker | polarity | why? |

|---|---|---|

| TOST | positively | The ticker TOST, representing Toast Inc., could be positively affected by this due to potential strategic partnerships or technological advancements that are implied in the context. Such developments could lead to increased market confidence and potential growth in the company’s financial performance. |

None so far…

Toast, a restaurant management platform, has been making waves in the stock market recently as its shares surged to a new high. The company, which provides technology solutions to the foodservice industry, has been benefiting from the recovery of the restaurant sector and its expanding global footprint.

The pandemic hit the restaurant industry hard, with many establishments forced to shut their doors or rely solely on takeout and delivery services. As restrictions ease and diners return to restaurants, Toast’s all-in-one platform has become increasingly attractive to restaurateurs looking to streamline their operations and enhance their online presence.

Toast’s recent success can also be attributed to its strategic focus on international expansion. The company has set its sights on global markets, particularly in Europe, to increase its customer base and diversify its revenue streams. This move comes as the company looks to capitalize on the varying stages of recovery across different regions and the specific needs of the international restaurant industry.

In addition to its restaurant management solutions, Toast is also making strides in the beverage retail space. The company has been working closely with beverage retailers to implement technology that improves the customer experience and drives sales. By leveraging data-driven insights and offering seamless payment options, Toast is helping beverage retailers optimize their operations and increase profitability.

Investors have taken note of Toast’s promising trajectory, with the company’s stock reaching new heights. As of MarketClose on February 10, 2023, shares of Toast were trading at $24.91, up $2.29 or 10.11% with a volume of 3,866,339 shares trading hands. The stock has been on a steady upward trend, outperforming the market and gaining the attention of investors who recognize the potential for continued growth in the restaurant and hospitality sectors. Looking ahead, Toast is well-positioned to capitalize on the recovering restaurant industry and its expanding global presence. The company’s innovative technology solutions and data-driven approach are expected to drive sustained growth and improve profitability for both restaurants and beverage retailers. As Toast continues to expand its reach and enhance its platform, investors can expect further upside potential in the stock’s performance.

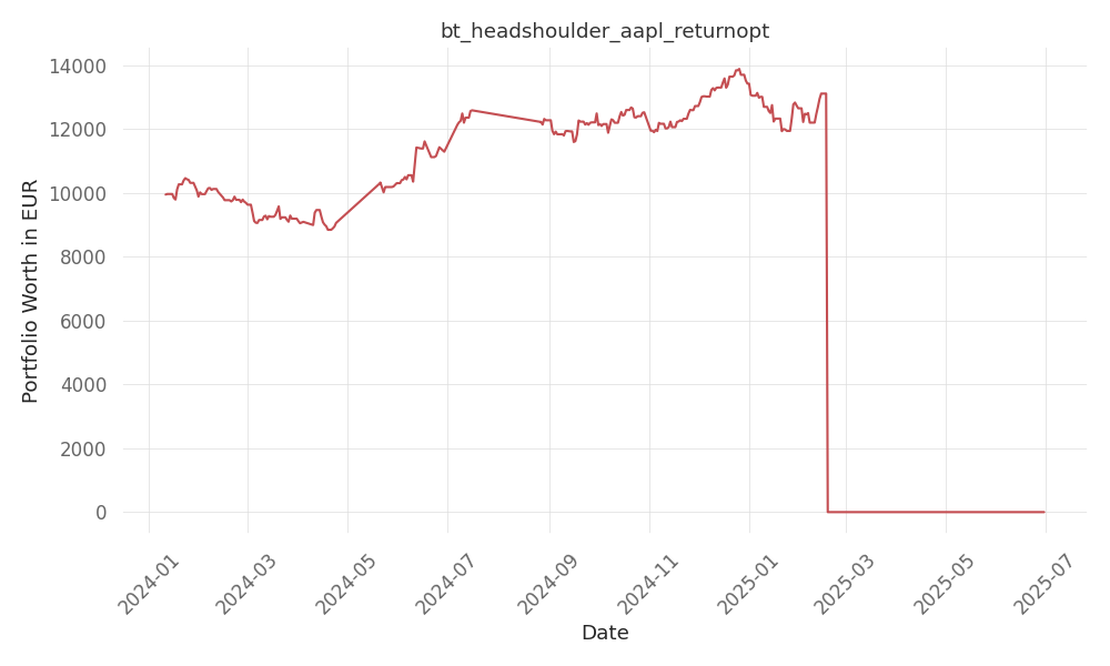

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -68 Days active 536 …

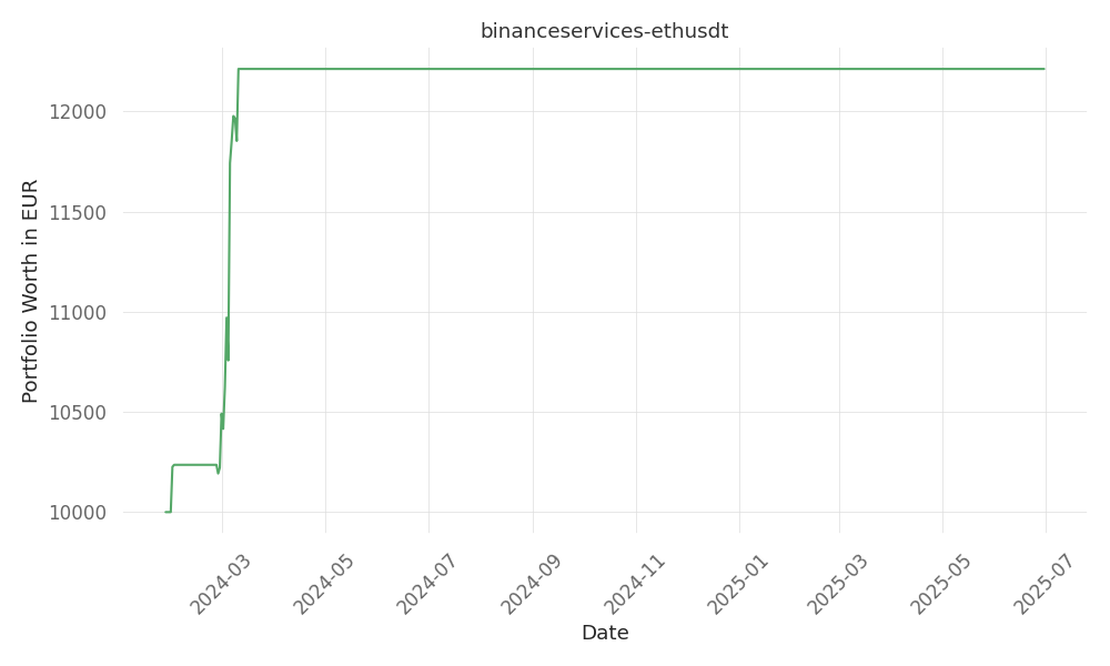

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 519 …

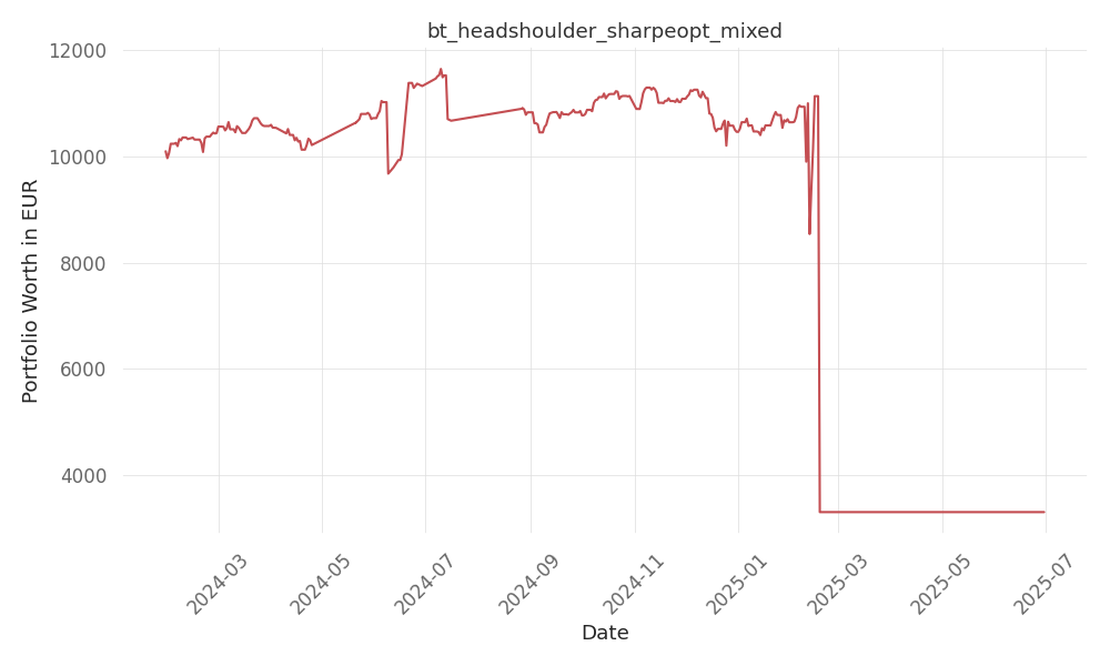

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -47 Days active 517 …