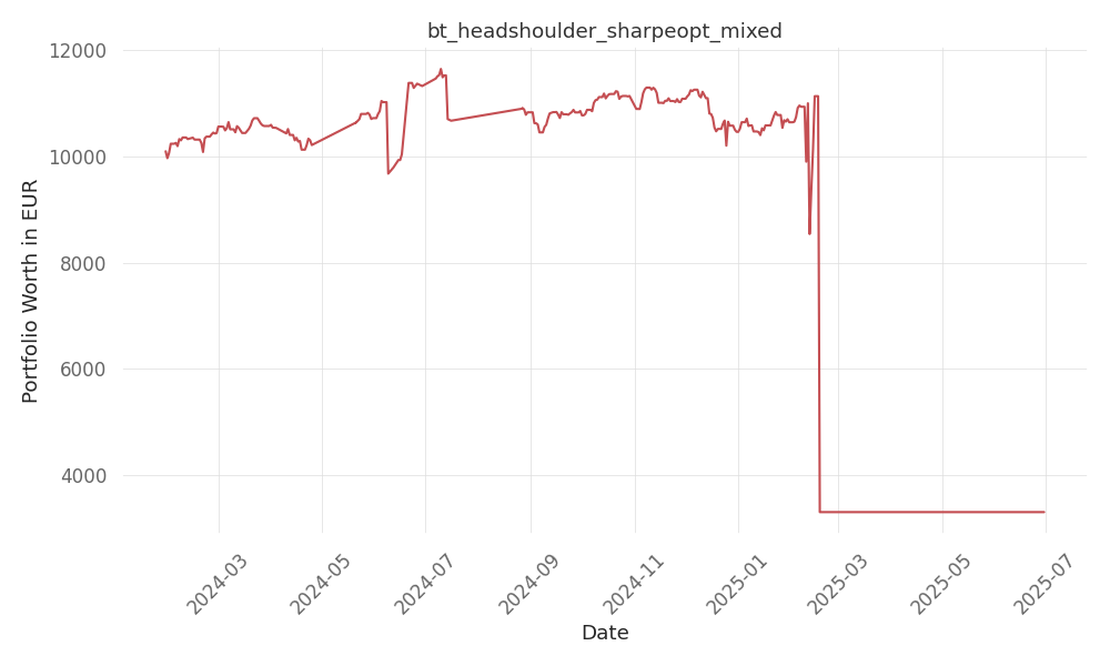

bt_headshoulder_sharpeopt_mixed

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -47 Days active 517 …

source: Motley Fool

| ticker | polarity | why? |

|---|---|---|

| MSFT | positively | As Super Micro Computer is an Nvidia partner, and Microsoft has a significant interest in Nvidia, the surge in Super Micro Computer’s stock price is likely to have a positive impact on Microsoft’s stock (MSFT). The increase in revenue and sales for Super Micro Computer due to the AI boom will also benefit Microsoft, as they have a stake in the success of Nvidia and its partners. |

| SMCI | positively | 流量异常,请尝试更换网络环境 |

| NVDA | positively | Nvidia’s partnership with Super Micro Computer has likely contributed to its share price increase, as the company benefits from its association with Super Micro’s AI advancements and IT infrastructure expertise. As a leading global chipmaker, Nvidia’s role in enabling Super Micro’s AI solutions and expansion will positively impact its market position and financial performance. |

bt_headshoulder_sharpeopt_mixed , xgb_sharpeopt_trenddet , msft-decisiontree , randombot , c-bigtech-momentum , static-skfolio-max-sortino , momentum_pvo_signal_msft , static-skfolio-risk-budgeting , static-skfolio-nested-cluster-optimization , finnhub-recommendations , newstrader , static-skfolio-denoised-cov-shrunk-expret

Shares of Super Micro Computer are up over 200% so far this year, with a 234% increase over the last year. This surge in stock price can be attributed to the enthusiasm around artificial intelligence (AI) and the company’s close association with leading chip designers such as Nvidia.

While Super Micro Computer has been closely affiliated with Nvidia, its business model is quite different. The company specializes in IT infrastructure, designing architecture solutions such as storage clusters for high-performance GPUs. This has led to soaring sales, with revenue increasing significantly over the last couple of years.

However, building IT infrastructure is an expensive business, and Super Micro Computer’s expense profile is rising. Capital expenditures (capex) have ballooned in recent quarters, impacting the company’s margin profile. Gross margins are currently plateauing, and there are concerns that they may begin to decrease as demand normalizes in the semiconductor space.

Super Micro Computer is valued at a significant premium to its peers, with a price-to-earnings (P/E) ratio that is more than double that of some larger and more diversified companies in the industry. Considering the competition, the cyclicality of the chip space, the high capex, and the low-margin nature of the business, there are questions about whether this valuation is warranted.

While many investors have profited from Super Micro Computer’s stock surge, the article argues that the company may be overvalued and is more of a trade than a long-term investment. There are better opportunities in the chip space and the AI arena for investors with a long-term horizon.

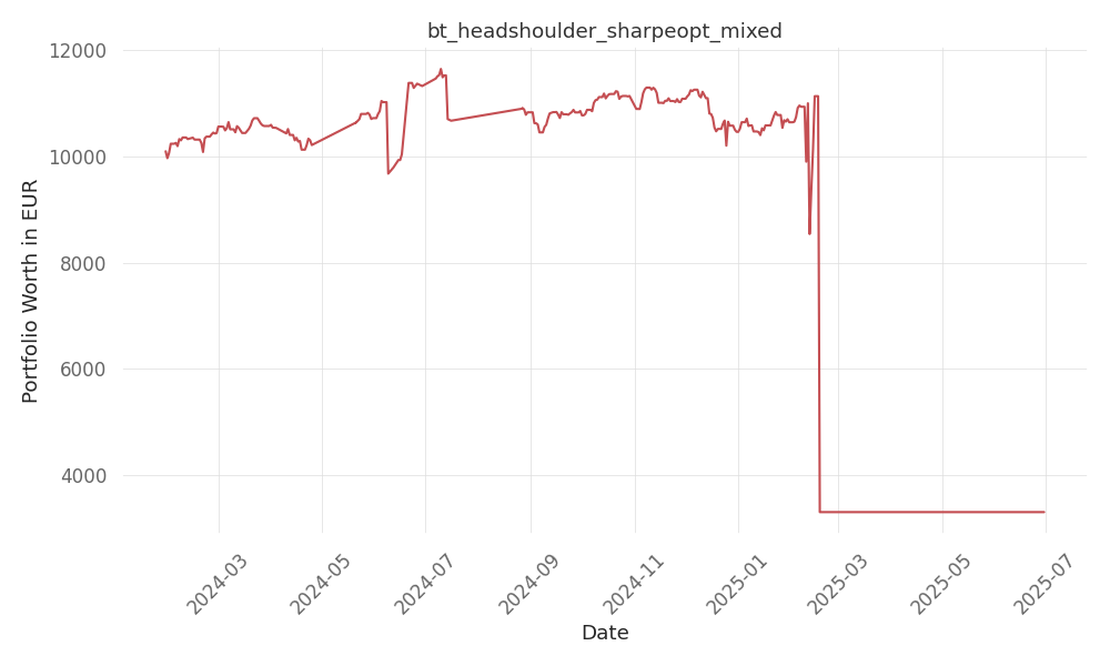

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -47 Days active 517 …

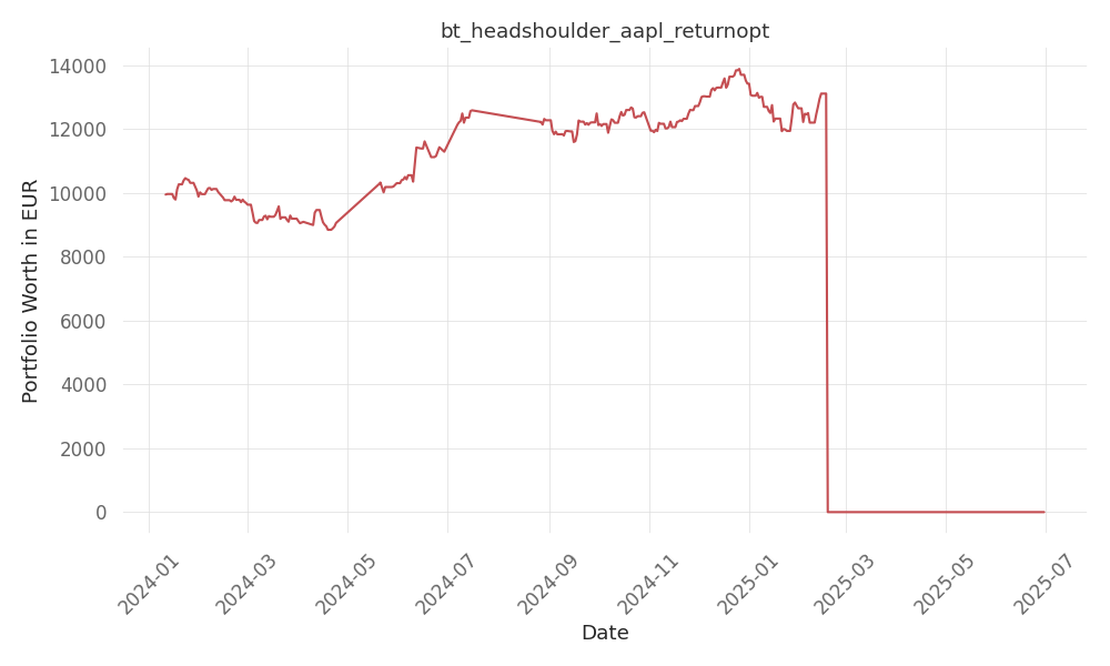

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -68 Days active 536 …

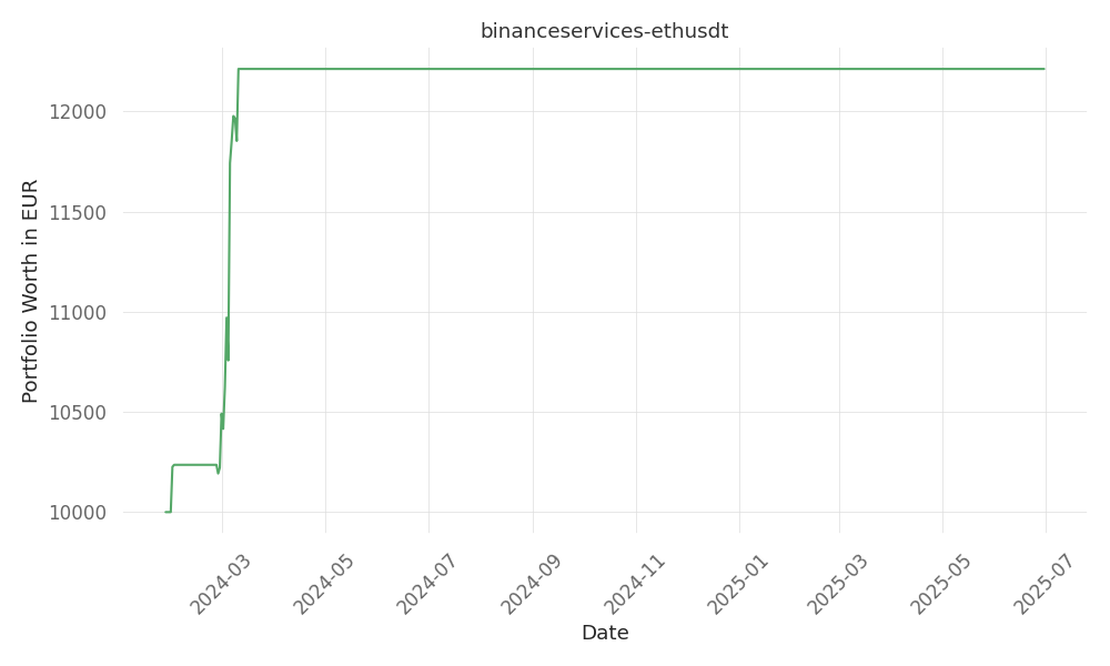

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 15 Days active 519 …