bt_headshoulder_sharpeopt_mixed

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -60 Days active 408 …

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| INTC | positively | The potential $100 billion investment by TSMC in the U.S. could drive increased competition and innovation in the semiconductor industry, which may prompt Intel (ticker INTC) to further invest in its own advanced chip production capabilities, potentially boosting its stock value. Additionally, TSMC’s expansion in the U.S. could lead to a more robust semiconductor ecosystem, benefiting Intel through increased collaboration and market opportunities. |

| ASML | positively | If the company the article mentioned as ASML Holding NV is a fabrication leader in creating thin products on semiconductor wafers and cavity walls, it will positively influence ASML. TSMC’s potential $100 billion investment in the U.S. could significantly boost demand demand for ASML’s advanced lithography equipment, which is crucial for the high-capacity chipmaking TSMC is seing to implement in its new facilities. This expansion will likely propel ASML’s market who may reap in short notification. |

Taiwan Semiconductor Manufacturing Co (TSMC) is considering a monumental investment of $100 billion in the United States to expand its chip manufacturing capabilities. This move comes as the U.S. accelerates efforts to balance the scales in the global semiconductor market

The U.S. has been actively encouraging TSMC to shift more of its advanced chip production to American soil. This strategic push aligns with broader efforts to achieve dominance over AI, semiconductors and high-performance computing. TSMC is being urged to establish advanced chip packaging facilities in the U.S., further cementing its role in the globally integrated supply chain. TSMC has already invested over $65 billion to develop leading-edge chips in its Arizona facility. The company currently builds its flagship advanced chip-making facilities in Taiwan. However, the U.S. has been struggling to compete in this area since the Biden administration.

The investment plans revealed that TSMC aims to establish additional fabs with advanced chip-making capabilities. This move, if executed, holds significant potential not only to secure TSMC’s place in the U.S. semiconductor market but also to strengthen the global technology lead. Such an investment could drastically boost TSMC’s market visibility and strengthen U.S. technological autonomy.

As TSMC looks set to bolster its U.S. operations, recent developments have highlighted the intense competition in the semiconductor sector. Last week, Intel Corp launched new Intel Xeon 6 processors designed to meet the escalating demands of AI and high-performance computing, rolled out its new production. Intel’s ASML Holding NV production machines are also in production. These developments underscore the aggressive strategies being employed by key players in the semiconductor industry to gain a competitive edge.

Investors, keenly observing developments in the semiconductor sector, have responded to TSMC’s potential expansion. As of the latest check, TSMC’s stock was down 1.64% to $177.56 during Monday’s trading session. This reflects investor sentiment, particularly concerning the broader implications of expanding TSMC’s U.S. footprint during an era of geopolitical tensions.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -60 Days active 408 …

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -85 Days active 427 …

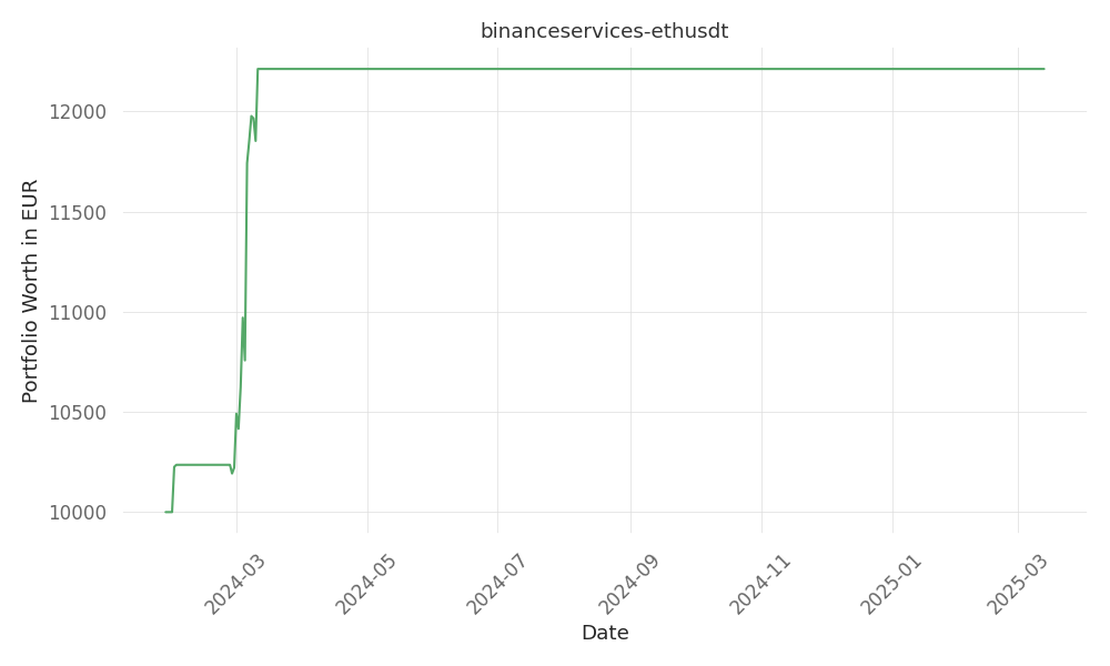

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 19 Days active 410 …