bt_headshoulder_aapl_returnopt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -85 Days active 427 …

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| ABNB | positively | With Tesla’s market cap dropping below $1 trillion and its stock price fluctuating significantly, investors may look to diversify their holdings in the tech and travel sectors. This could lead to increased investment in Airbnb Inc. (ABNB), as travelers might opt for alternative accommodations during economic uncertainty. Additionally, ABNB could benefit from technological innovations and autonomous travel trends. |

| UBER | positively | Given Tesla’s recent struggles and the overall investor sentiment adding pressure on Elon Musk, alternatives within the marketplace might see a positive interest. Investors might choose Uber as a alternative ride share service, making it to benefit from Tesla’s stock slump. |

| WMT | positively | The recent fluctuations in Tesla’s stock could drive consumers towards more affordable or alternative vehicle options, which could benefit companies like Walmart (WMT) as consumers look to save on large expenses by shopping for necessities elsewhere. Additionally, Tesla’s focus on innovation has historically included advanced technologies like autonomous driving, so even with Tesla’s shift in CEO, it’s impact negatively may still benefit Walmart through acceptance and expectation of Tesla’s potential decline. This shift could also bring in more affordable sales in the tech category. |

static-skfolio-max-sortino , static-skfolio-nested-cluster-optimization , xgb_sharpeopt_trenddet , static-skfolio-risk-budgeting , static-skfolio-denoised-cov-shrunk-expret , newstrader

Elon Musk’s net worth has declined by approximately $52 billion this year, but he remains the world’s wealthiest individual, with an estimated fortune of $336 billion. Despite this drop, Musk maintains a significant lead over Meta CEO Mark Zuckerberg, who has a net worth of about $110 billion.

Elon Musk’s net worth is slow due to Tesla’s tumultuous year. Tesla’s TSLA shares recently dropped over 4%, marking a third of the value lost since the start of 2025. This decline has pushed the company’s market capitalization below the $1 trillion level for the first time since last November.

Over the same period, Tesla’s vehicle sales in Europe gained a lot of attention. Tesla’s major competitor comes from China’s Auto Market while the European market noted a 37% gain in January, Tesla’s sales dropped by 45%. Tesla has blamed this slump on the increasingly congested market and a sluggish U.S. economy.

Musk’s political activities have come under fire. After winning the hearts of many with his now-defunct roles, Musk has backfired with some and is now recently deeply engaged in politics. Many analysts are now thinking if it would help Tesla’s business plan which essentially revolves around innovation, cutting-edge technology, and ambitious plans in autonomous driving and robotics.

Adam Jonas recently went as far as to name Tesla his “top pick” in US autos. Jonas, an analyst from Bear Insights,stated that his prediction of Tesla’s future is bullish. He reminded people of Tesla’s competitive edge in embodied AI while maintaining a $430 price target. In his best-case scenario, this might go up to $800.

Tesla’s sales have been coasting on a thin ride as the records continue to drop. Yet Tesla and Musk still have a very high hope for the future with investors’ expectations. Musk’s net worth dropped by $5.2 billion recently, but only enough to move his position two steps down on the nation’s wealthiest.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -85 Days active 427 …

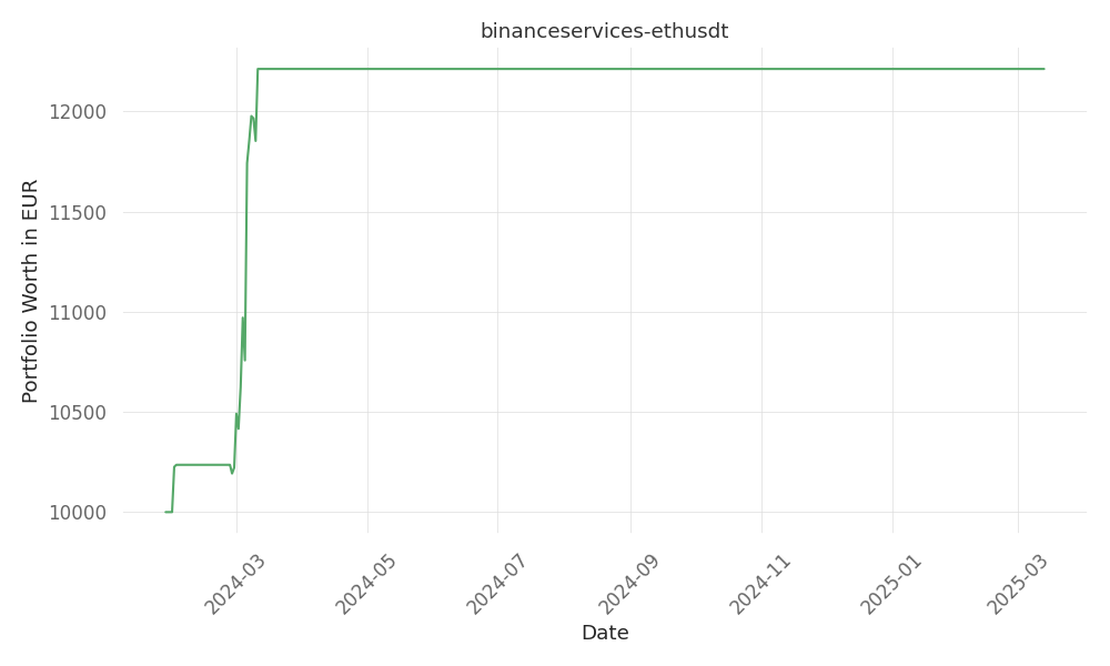

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 19 Days active 410 …

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -60 Days active 408 …