bt_headshoulder_sharpeopt_mixed

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -60 Days active 408 …

tickers: TCLRY

source: GlobeNewswire

| ticker | polarity | why? |

|---|---|---|

| TCLRY | positively | The positive financial performance and strategic divestiture mentioned in the article are likely to drive investor confidence in TCLRY, leading to a potential increase in the ticker. The forecast for stable sales and improved EBITDA along with operational efficiencies, suggests a strong outlook for the company, and is likely to boost its stock value. Additionally, the successful integration of Home Networks and the expected positive impact this will be impact operational efficiencies and added financial growth benefit, Vantiva shareholders and positively affect TCLRY. |

None so far…

Paris, France – February 27, 2025 – Vantiva, a global leader in connectivity technology, has announced its estimated operational results for the year 2024. The company reported significant improvements in key financial metrics, driven by strategic acquisitions and operational efficiencies.

Vantiva’s sales for 2024 reached €1,865 million, marking a 19.3% increase from the previous year. This growth was primarily fueled by the integration of CommScope’s Home Networks business. Adjusted EBITDA for 2024 stood at €104 million, up 6.8% from €97 million in 2023. The company also achieved a positive free cash flow of €33 million, a substantial improvement from the negative €40 million in 2023.

The integration of Home Networks has been a critical factor in Vantiva’s performance. The company has reported non-recurring synergies worth approximately €30 million, primarily from component supply optimizations. This integration has also contributed to enhanced working capital management, driving operational efficiencies. Despite the challenges posed by a difficult market environment and intense competition among Network Service Providers (NSPs), Vantiva’s renewed product portfolio and inventory adjustments have bolstered its performance. Has the video side. The video CPE segment experienced a soft demand, while sales in LATAM were impacted by the focus on commoditized entry-level products. Conversely, North America, Asia, and certain European markets witnessed robust demand for Vantiva’s Wi-Fi 7, Fiber, and FWA 5G products.

Vantiva is nearing the divestiture of its SCS business unit, which is scheduled to close by the end of March 2025. This divestiture is anticipated to trigger an impairment of about €100 million. Tim O’Loughlin, CEO of Vantiva, emphasized the company’s focus on driving strong performance in its core connectivity businesses. Looking ahead to 2025, Vantiva expects sales to remain stable, while a cost reduction plan and continuing synergies from the Home Networks integration are expected to boost financial performance. The company aims to achieve adjusted EBITDA of more than €150 million and positive free cash flow in 2025.

“With the SCS transaction now nearing closure, Vantiva is fully focused on its connectivity businesses and continuing to drive strong performance for the benefit of all stakeholders,” Tim O’Loughlin, CEO Vantiva’s said in a statement. This divestiture, coupled with ongoing operational efficiencies, sets the stage for Vantiva to achieve significant financial milestones in the coming year.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -60 Days active 408 …

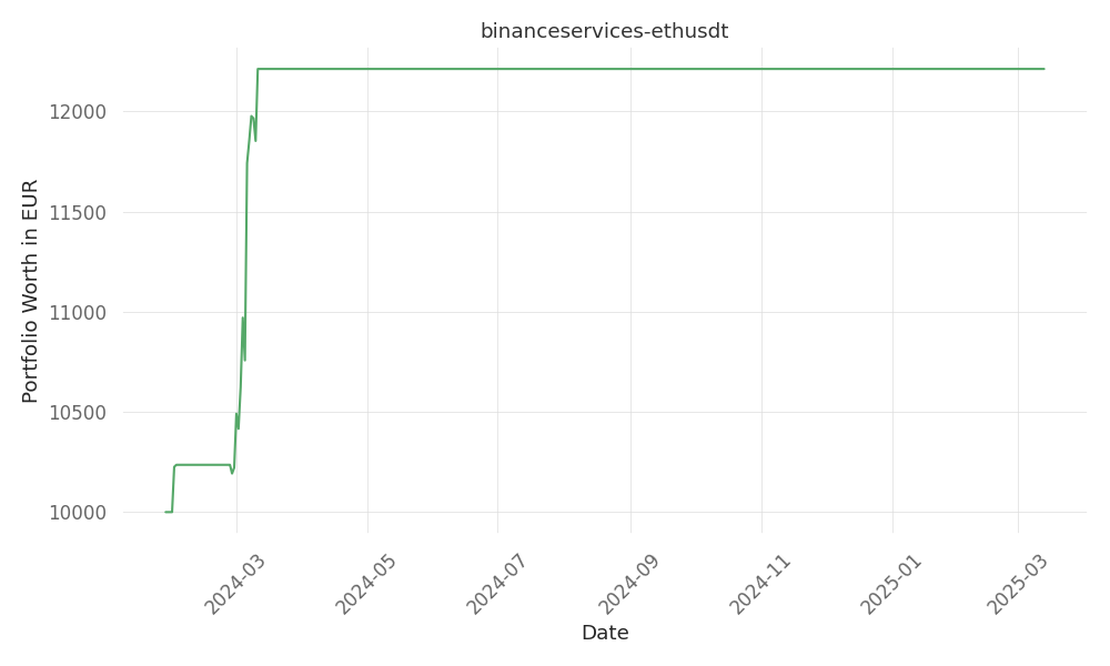

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 19 Days active 410 …

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -85 Days active 427 …