bt_headshoulder_aapl_returnopt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -85 Days active 427 …

source: GlobeNewswire

| ticker | polarity | why? |

|---|---|---|

| SPGI | positively | The strong performance and value creation reported by Wendel, including significant investments and a robust dividend policy, could positively influence SPGI, suggesting the firm is in a strong financial position and is effectively executing its strategic initiatives, which could attract more institutional and retail investors that will cause the ticker to go up. |

| BVRDF | positively | The ticker BVRDF is expected to be positively affected as Wendel, the leading European investment firm that owns the Bureau Veritas company, reported strong 2024 results with a robust performance and strategic advancements. Bureau Veritas saw a 28.3% increase in share price, contributing significantly to Wendel’s value creation. |

February 26, 2025 – Wendel, a leading European investment firm, has announced its full-year results for 2024, highlighting a year of robust performance, strategic advancements, and substantial value creation. The company reported a fully diluted Net Asset Value (NAV) per share of €185.7, marking a 16.9% year-over-year increase adjusted for the dividend paid.

Wendel’s dual model, combining principal investments with a growing asset management platform, has proven effective in driving value creation. The firm’s asset management activities, bolstered by the acquisition of IK Partners and the planned acquisition of Monroe Capital, are set to generate significant recurring cash flows and growth.

In 2024, Wendel executed a total of €2.3 billion in disposals and invested approximately €0.7 billion, including a significant €0.6 billion investment in Globeducate. The firm also announced a €1.13 billion investment to acquire 75% of Monroe Capital, expected to close in the first quarter of 2025.

Wendel’s commitment to shareholder value is evident in its dividend policy. The firm proposed an ordinary dividend of €4.70 per share for 2024, representing a 17.5% increase from 2023. Additionally, Wendel completed a €100 million share buyback program, purchasing €92.5 million worth of shares in 2024.

Wendel’s strategic moves in 2024 included the acquisition of a 51% stake in IK Partners and the planned acquisition of Monroe Capital. These acquisitions are expected to significantly enhance Wendel’s asset management platform, with third-party assets under management reaching over €33 billion.

Bureau Veritas, a key holding, saw a 28.3% increase in share price, contributing significantly to Wendel’s value creation. Other notable performances include Stahl, which completed its transformation into a pure-play specialty coatings formulator, and Crisis Prevention Institute, which reported strong revenue and EBITDA growth.

Wendel’s Supervisory Board reappointed Laurent Mignon as Chairman of the Executive Board and David Darmon as Member of the Executive Board and Group Deputy CEO for a four-year term ending April 6, 2029.

Wendel remains committed to its strategic roadmap, focusing on value creation, building its asset management platform, and maintaining a solid financial structure. The firm aims to continue delivering strong and recurring returns to shareholders in the coming years. For more detailed information, refer to Wendel’s full-year results report.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -85 Days active 427 …

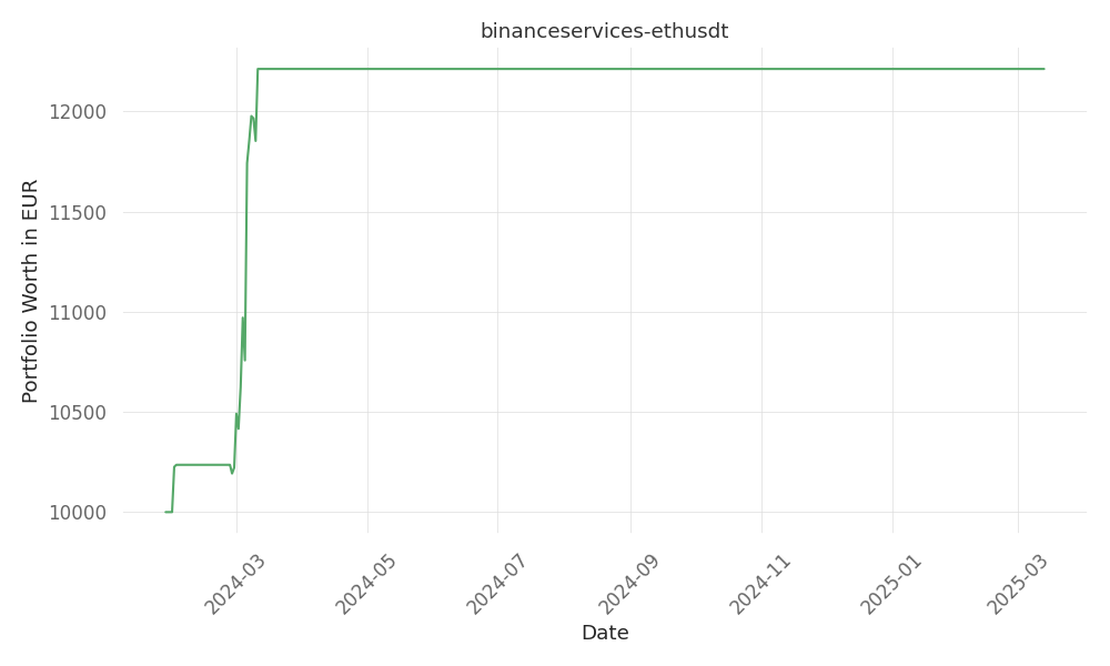

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 19 Days active 410 …

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -60 Days active 408 …