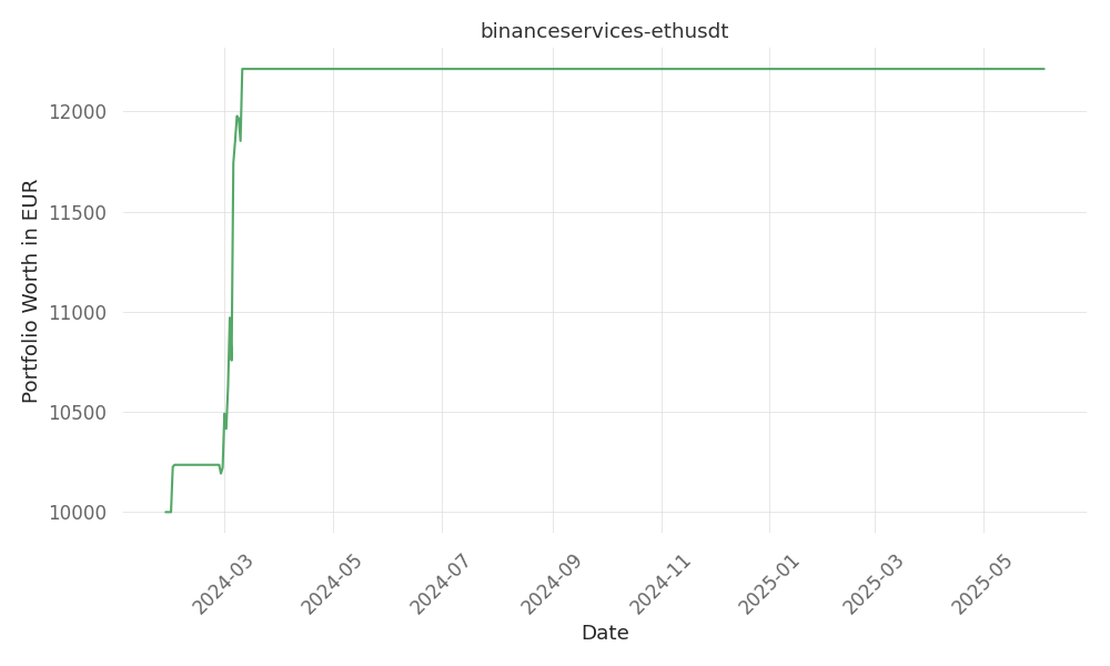

binanceservices-ethusdt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 16 Days active 493 …

tickers: CC

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| CC | positively | The Chemours Company (CC) may see a positive impact as they address issues of transparency and ethical practices within the company, potentially gaining investor trust and confidence in the long term. |

None so far…

SAN FRANCISCO, March 18, 2024 (GLOBE NEWSWIRE) – Hagens Berman has issued a call to The Chemours Company (CC) investors who have experienced significant losses to come forward and report their losses promptly. This call comes following recent developments within the company. Chemours disclosed on March 6, 2024, that senior management members, including CEO Mark Newman, CFO Jonathan Lock, and Controller Camela Wisel, had violated the Company’s Code of Ethics regarding disclosure practices. It was revealed that they had undertaken actions to delay payments to vendors and accelerate collections in order to meet free cash flow targets and incentivize executive officers, which led to a delay in the release of financial results and the suspension of the individuals pending an internal accounting probe. As a result, Chemours shares have seen a decline of nearly 20% year-to-date. Investors who have incurred substantial losses or possess information relevant to the investigation are encouraged to submit their losses for review. Additionally, whistleblowers with non-public information may consider aiding the investigation or utilizing the SEC Whistleblower program to potentially receive rewards. Investors and stakeholders are advised to stay informed and vigilant as developments unfold in this ongoing investigation. This article serves as a reminder of the importance of transparency and ethical practices within corporate governance to protect the interests of shareholders.

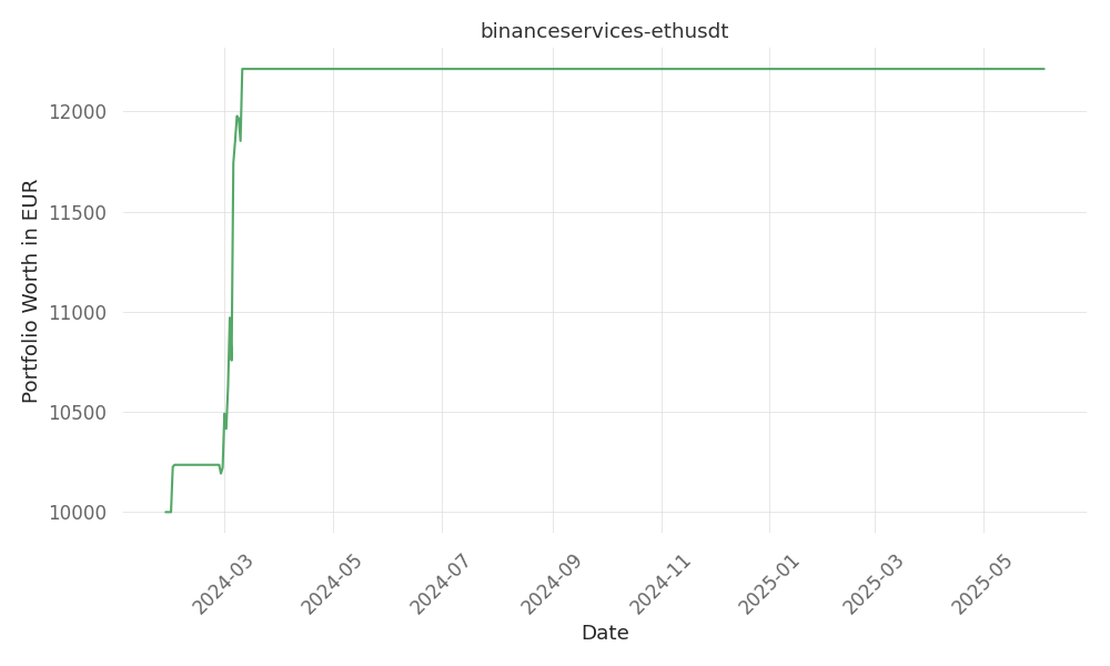

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 16 Days active 493 …

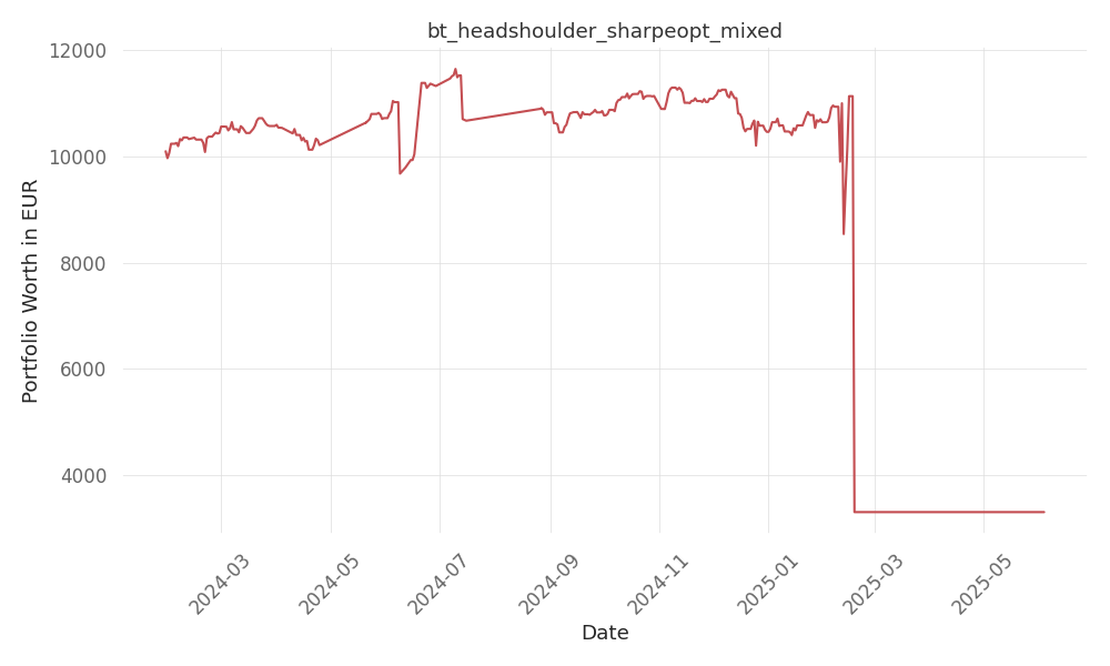

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -50 Days active 491 …

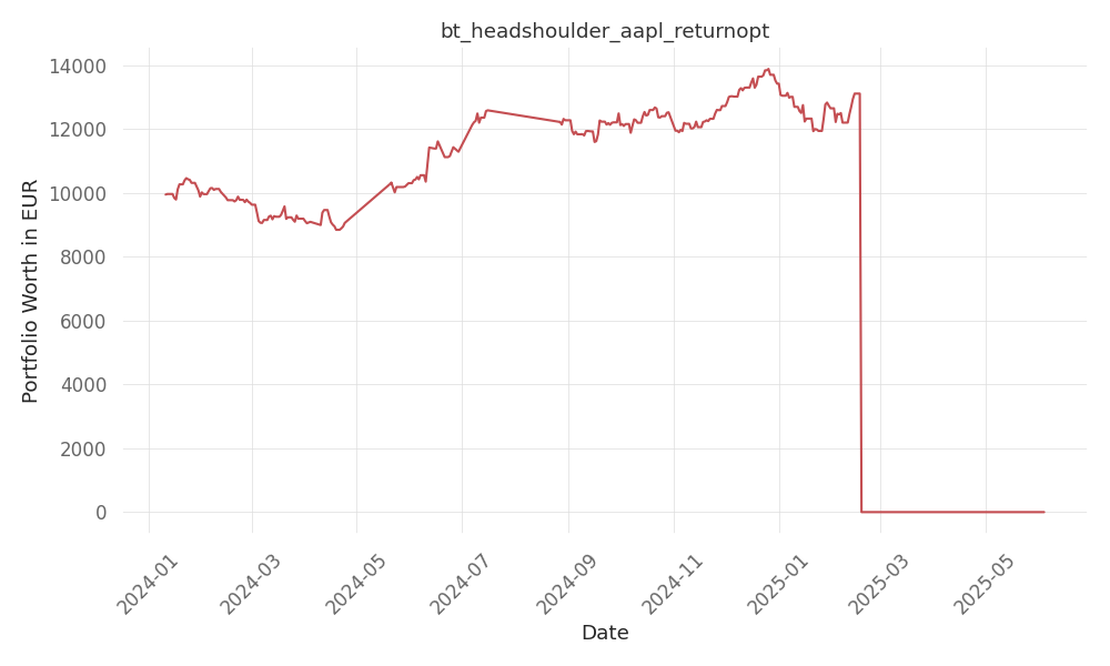

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -71 Days active 510 …