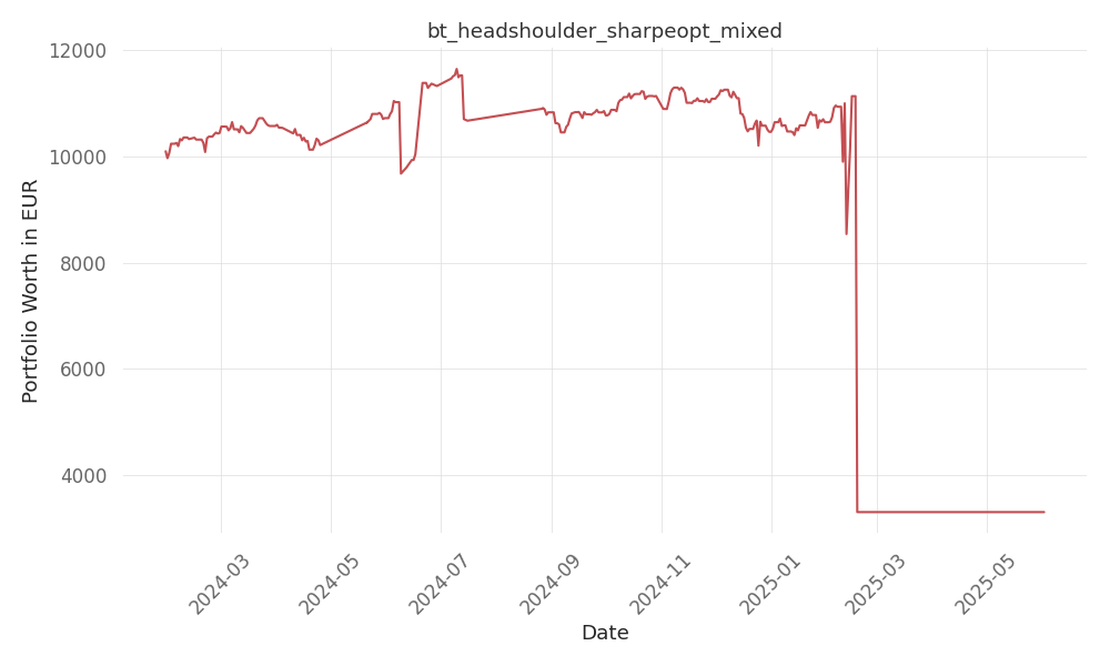

bt_headshoulder_sharpeopt_mixed

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -50 Days active 489 …

tickers: CL

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| CL | positively | The strong Q4 financial results of Colgate-Palmolive (CL) are likely to have a positive impact on the company’s stock, as it exceeded expectations and demonstrated strong sales growth. Analysts have adjusted their price targets and ratings for CL, indicating optimism about its future performance. |

None so far…

Colgate-Palmolive Company (CL) has announced its fourth-quarter financial results for FY23, exceeding analyst expectations and demonstrating strong sales growth. The company reported a year-on-year sales growth of 7% to reach $4.95 billion, surpassing the analyst consensus estimate of $4.89 billion. Furthermore, the non-GAAP earnings per share (EPS) of 87 cents beat the analyst consensus of 80 cents.

Noel Wallace, the Chairman, President, and CEO of Colgate-Palmolive, expressed the company’s satisfaction with the results. He stated, “We leveraged our strong margin performance to invest behind building our brands, with a 19% increase in advertising spending in 2023, and we expect higher levels of brand investment in 2024.”

Looking ahead to FY24, Colgate-Palmolive projects net sales growth to be in the range of 1%-4%, with a slight negative impact from foreign exchange. The company also anticipates organic sales growth to fall within its long-term target range of 3%-5%.

Following the release of the earnings report, Colgate-Palmolive’s shares rose 0.8% to trade at $83.50 on Monday.

Several analysts have adjusted their price targets for Colgate-Palmolive based on the company’s strong performance in Q4. Wells Fargo raised its price target from $80 to $88 and maintained an Equal-Weight rating. UBS increased its price target from $93 to $95 and maintained a Buy rating. Raymond James analyst Olivia Tong upgraded Colgate-Palmolive from Market Perform to Outperform and set a price target of $91.

Overall, Colgate-Palmolive’s strong Q4 results have garnered positive attention from analysts, who are optimistic about the company’s future performance.

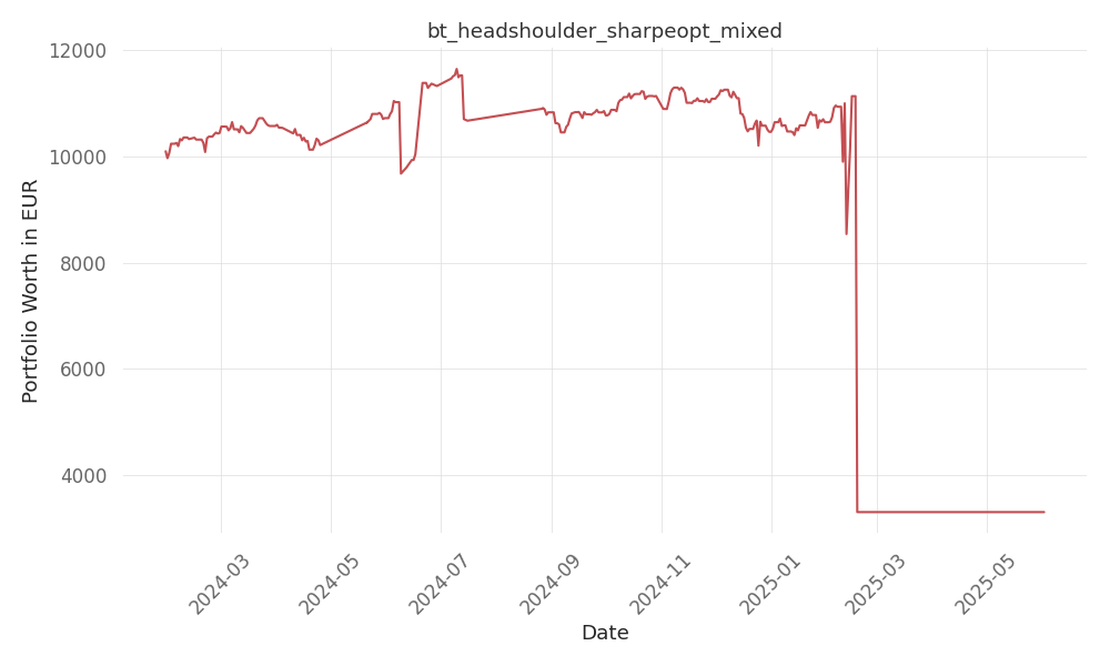

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -50 Days active 489 …

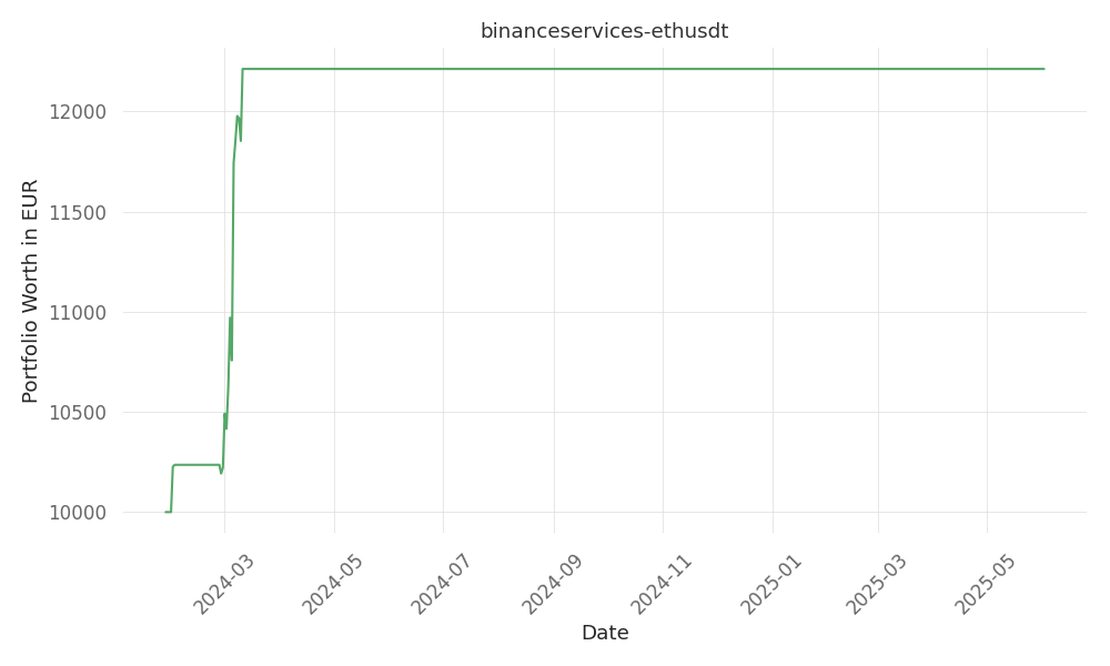

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 16 Days active 491 …

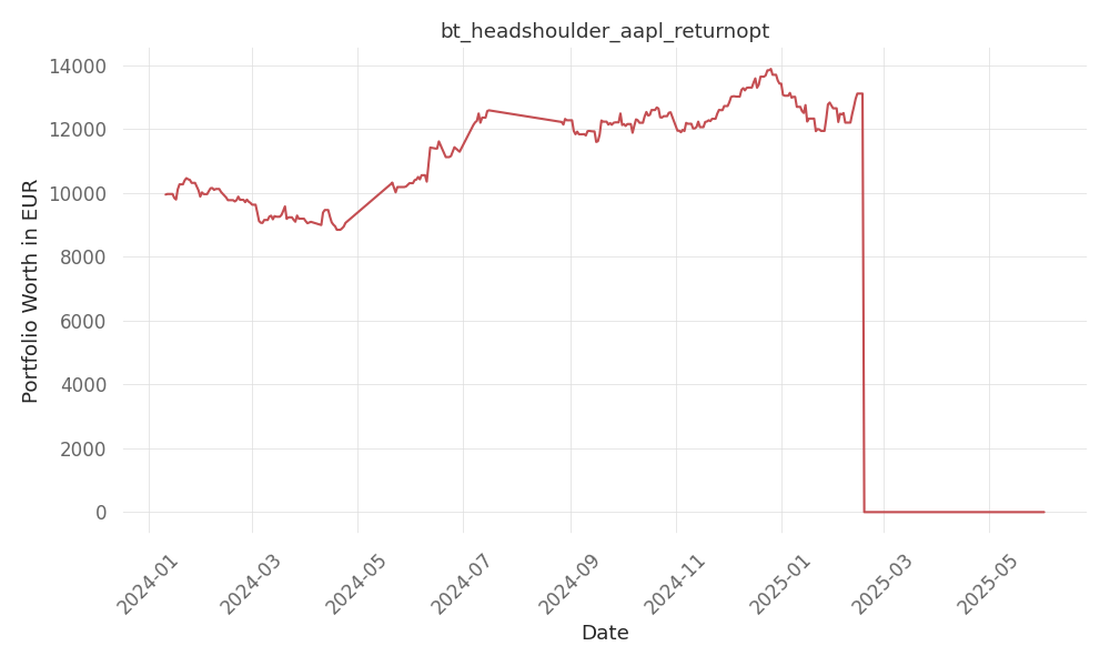

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -71 Days active 508 …