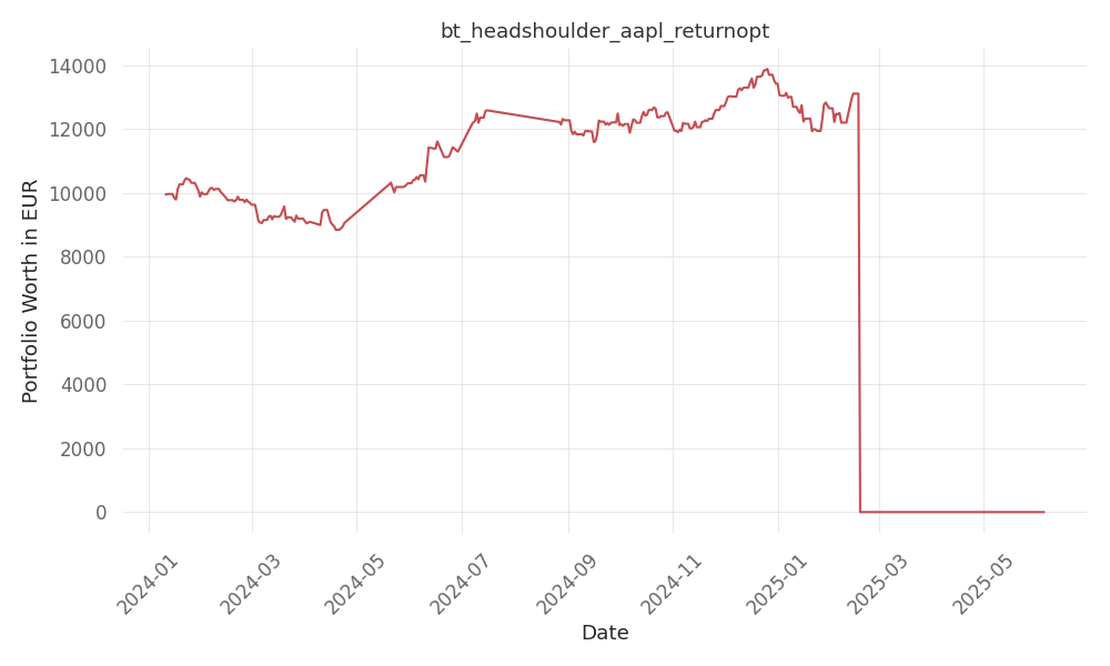

bt_headshoulder_aapl_returnopt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -71 Days active 511 …

tickers: CVS

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| CVS | positively | The bullish sentiment and significant investments from financial giants in CVS Health suggest that they anticipate positive developments and potential growth for the company, which could ultimately have a positive impact on the ticker CVS. |

Financial giants have made a noteworthy bullish move on CVS Health, according to options history analysis. The analysis revealed 10 unusual trades for CVS Health, with 80% of traders showing a bullish sentiment and 20% exhibiting bearish tendencies. Among the trades identified, 6 were puts valued at $334,981, and 4 were calls valued at $218,909. Based on the trading activity, it appears that significant investors have projected a price target range of $50.0 to $82.5 for CVS Health over the past three months.

Examining the volume and open interest provides crucial insights into stock research. For CVS Health, the trends in volume and open interest for calls and puts within a strike price range of $50.0 to $82.5 over the past month indicate liquidity and interest levels for the options.

The largest options trades observed for CVS Health were as follows:

CVS Health is a company that offers a diverse set of healthcare services, including retail pharmacy operations, pharmacy benefit management, and health insurance. Its recent acquisition of Oak Street adds primary care services to its offerings.

As of now, CVS Health is trading at $73.69 with a volume of 1,827,760. RSI readings suggest that the stock may be oversold, and its anticipated earnings release is in 5 days. Options trading presents higher risks and potential rewards, and astute traders manage these risks by continually educating themselves and monitoring multiple indicators.

Overall, the options trading activity surrounding CVS Health indicates a bullish sentiment from financial giants, but investors should conduct further research and stay informed about the latest developments in order to make well-informed decisions.

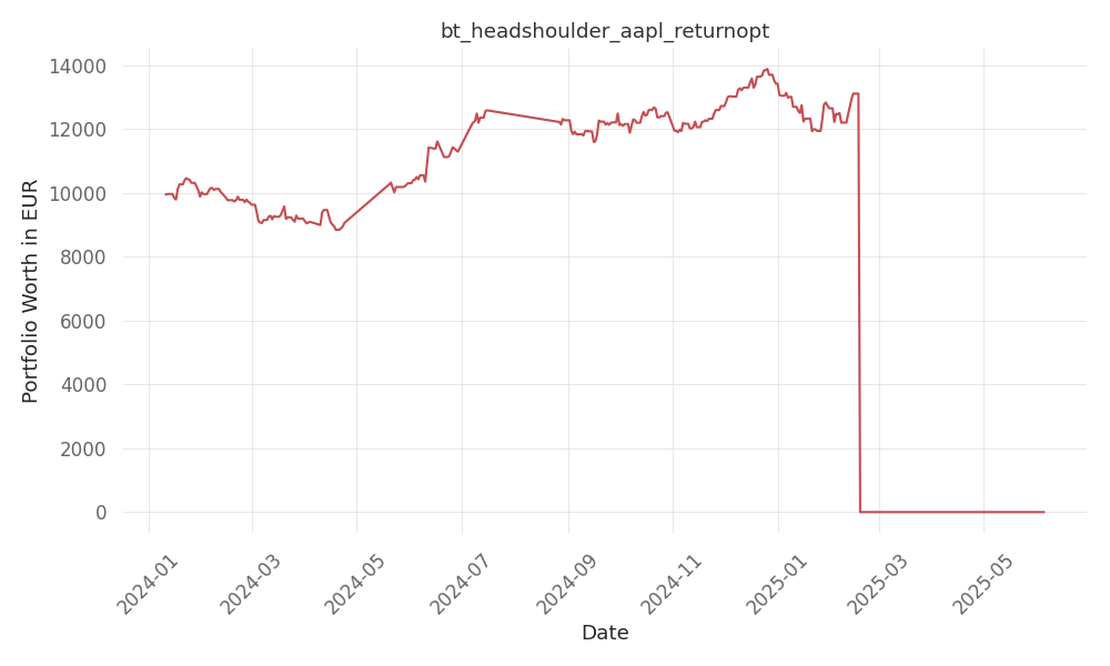

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -71 Days active 511 …

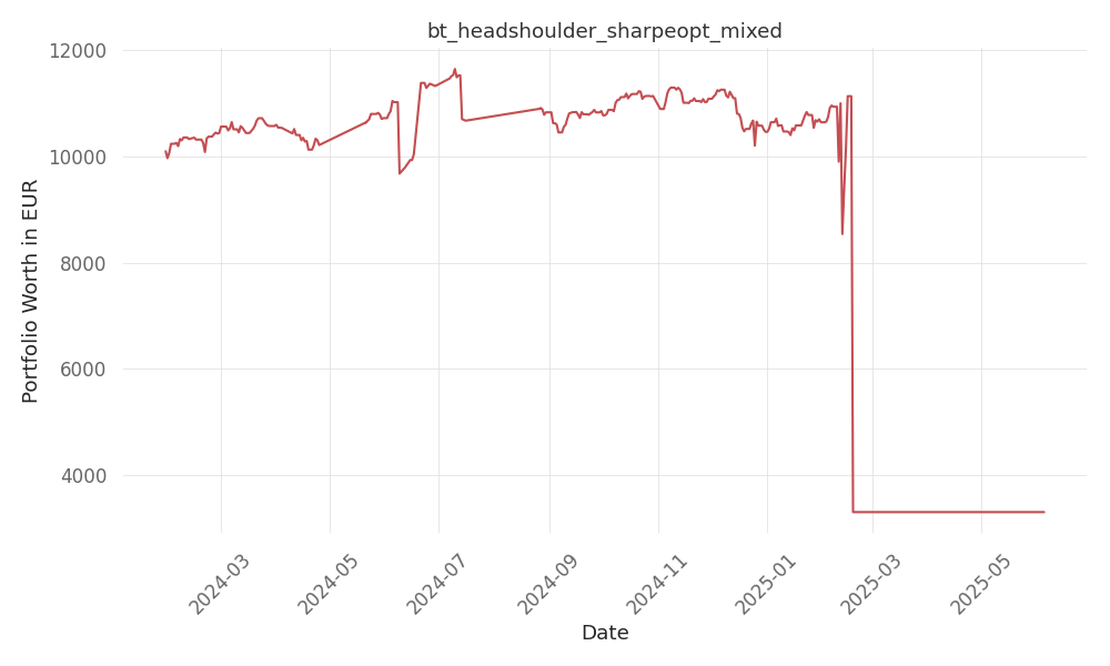

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -49 Days active 492 …

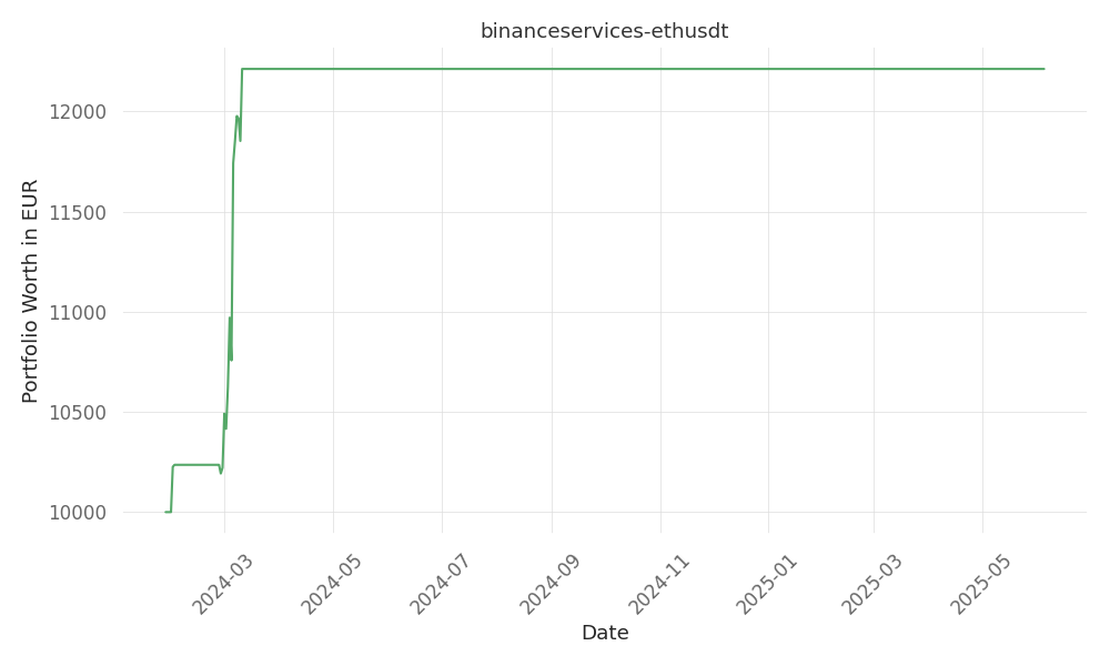

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 16 Days active 494 …