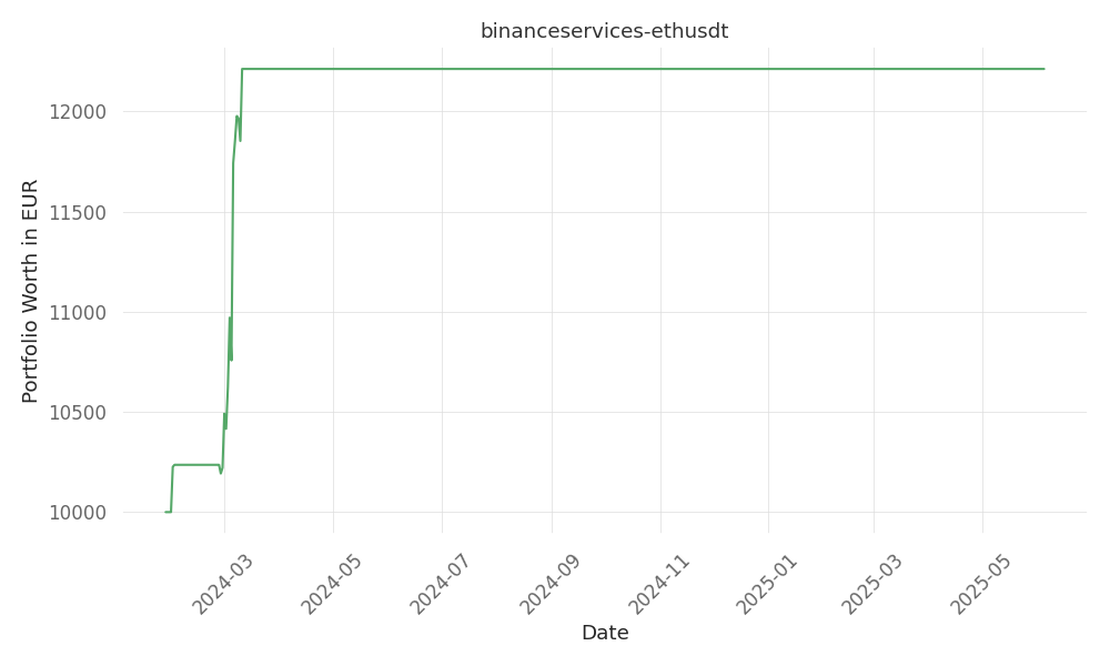

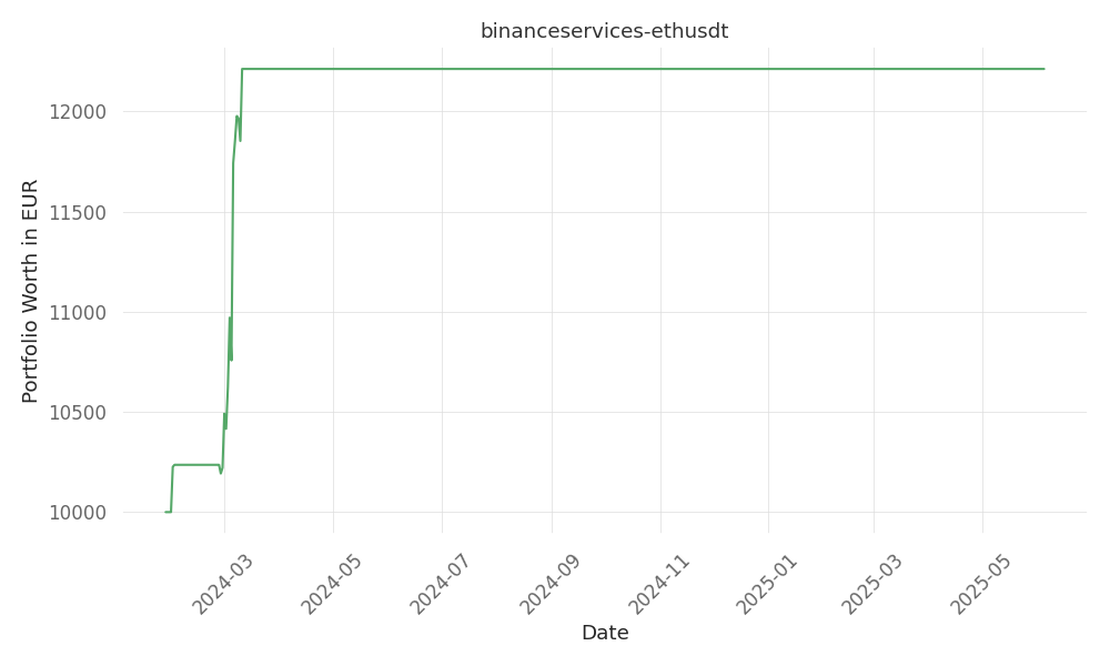

binanceservices-ethusdt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 16 Days active 494 …

tickers: UPST

source: Benzinga

| positively | negatively |

|---|---|

| UPST |

None so far…

Deep-pocketed investors have adopted a bullish approach towards Upstart Hldgs (UPST), and it’s something that market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UPST usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for Upstart Hldgs. This level of activity is out of the ordinary. The general mood among these heavyweight investors is divided, with 50% leaning bullish and 50% bearish. Among these notable options, 2 are puts, totaling $63,946, and 6 are calls, amounting to $303,280.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $19.0 to $100.0 for Upstart Hldgs during the past quarter.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Upstart Hldgs’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Upstart Hldgs’s significant trades, within a strike price range of $19.0 to $100.0, over the past month.

Symbol: UPST

PUT/CALL: CALL

Trade Type: SWEEP

Sentiment: BULLISH

Exp. Date: 12/19/25

Strike Price: $50.00

Total Trade Price: $113.8K

Open Interest: 311

Volume: 10

Symbol: UPST

PUT/CALL: CALL

Trade Type: SWEEP

Sentiment: BULLISH

Exp. Date: 01/12/24

Strike Price: $19.00

Total Trade Price: $68.1K

Open Interest: 60

Volume: 45

Symbol: UPST

PUT/CALL: CALL

Trade Type: TRADE

Sentiment: BEARISH

Exp. Date: 01/12/24

Strike Price: $33.00

Total Trade Price: $39.1K

Open Interest: 130

Volume: 212

Symbol: UPST

PUT/CALL: PUT

Trade Type: TRADE

Sentiment: BEARISH

Exp. Date: 02/09/24

Strike Price: $42.00

Total Trade Price: $38.6K

Open Interest: 82

Volume: 40

Symbol: UPST

PUT/CALL: CALL

Trade Type: TRADE

Sentiment: BULLISH

Exp. Date: 12/19/25

Strike Price: $100.00

Total Trade Price: $28.2K

Open Interest: 1.7K

Volume: 40

Upstart Holdings Inc provides credit services. The company provides a proprietary, cloud-based, artificial intelligence lending platform. The platform aggregates consumer demand for loans and connects it to the network of Upstart AI-enabled bank partners. The revenue of the company is comprised of fees paid by banks.

In light of the recent options history for Upstart Hldgs, it’s now appropriate to focus on the company’s performance. We aim to explore its current performance.

With a trading volume of 3,840,165, the price of UPST is up by 2.89%, reaching $34.2. Current RSI values indicate that the stock is currently neutral between overbought and oversold. The next earnings report is scheduled for 36 days from now.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Upstart Hldgs with our pro subscription for real-time alerts.

Earnings Analyst Ratings Options Dividends IPOs Date of Trade ▲ ▼ ticker ▲ ▼ Put/Call ▲ ▼ Strike Price ▲ ▼ DTE ▲ ▼ Sentiment ▲ ▼ Click to see more Options updates

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 16 Days active 494 …

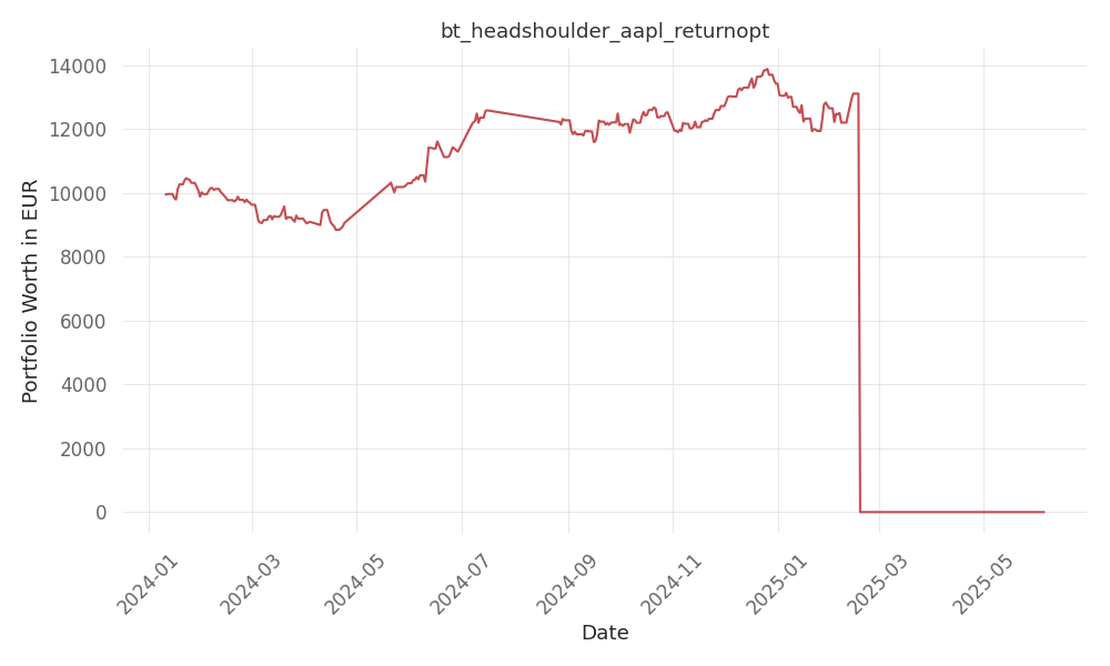

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -71 Days active 511 …

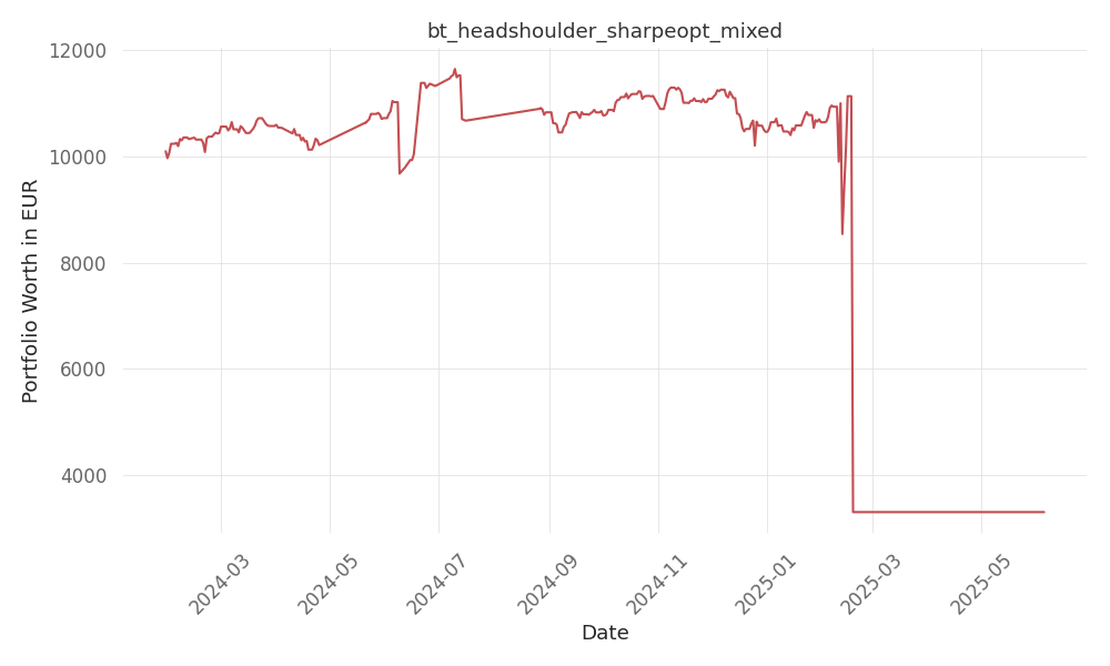

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -49 Days active 492 …