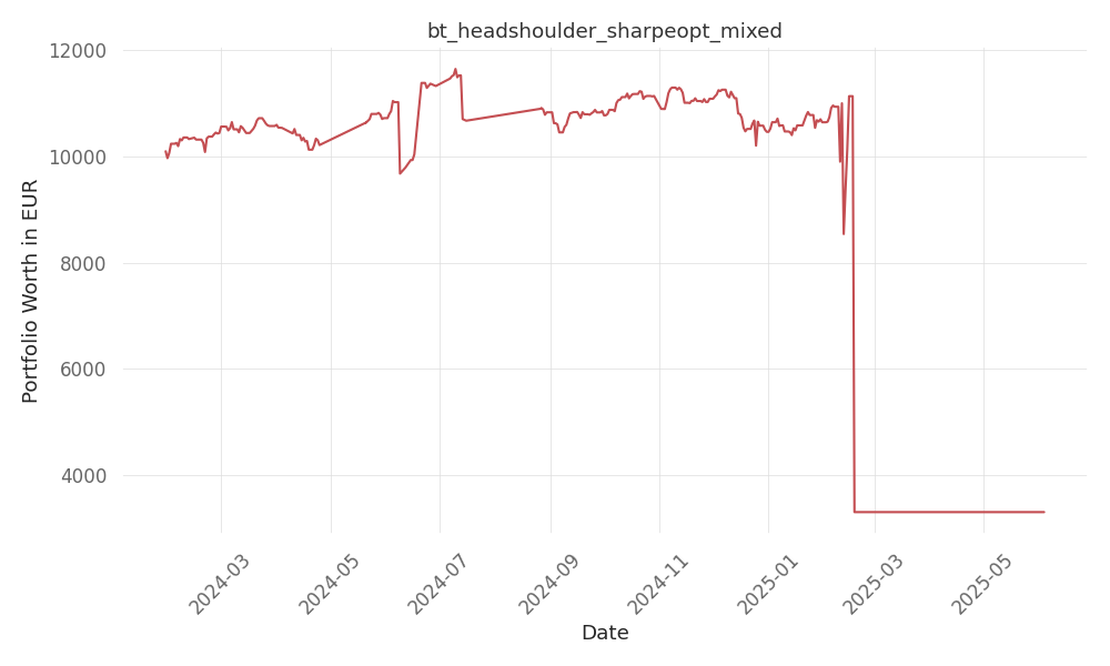

bt_headshoulder_sharpeopt_mixed

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -50 Days active 491 …

tickers: W

source: Motley Fool

| ticker | polarity | why? |

|---|---|---|

| W | positively | The positive turnaround in Wayfair’s sales and improvement in net losses, coupled with its cost-saving initiatives, suggest that the ticker W may be positively affected as investors anticipate a comeback for the company in 2024. |

None so far…

Wayfair, the online furniture giant, may be on the cusp of a turnaround after experiencing nine consecutive quarters of declining sales. Despite a challenging macroeconomic environment, Wayfair has implemented a cost-savings program and has seen its revenue finally return to growth in the third quarter. With shares down 82% from their all-time high in 2021, investors are hopeful that 2024 will be the year for Wayfair’s comeback.

Wayfair’s sales soared early in the pandemic, leading to record profitability. However, prior to the pandemic, the company struggled with a scaling problem, unable to grow without bleeding cash. As a result, it was unable to maintain profitability when sales began to decline. However, management has taken the situation seriously and has been working to become more efficient. As sales stabilize, net losses have been improving.

In 2022, Wayfair unveiled a cost restructuring plan, which included job cuts. These moves are starting to show results, with the company ending its streak of nine consecutive quarters of year-over-year sales declines. In the third quarter of 2023, sales increased by 3.7%, and the company reported positive free cash flow and adjusted EBITDA of $100 million. Repeat customers accounted for over 80% of orders, showing that previous customers are returning to the platform.

Part of the challenge for Wayfair is the current market environment. As consumers are more cautious with their spending due to inflation, Wayfair’s mass market customers are delaying purchases of furniture and home goods. Additionally, lower home sales due to interest rates impact demand for Wayfair’s offerings. However, if inflation is under control and interest rates decline, improvements in the real estate and consumer discretionary markets could support Wayfair’s turnaround.

Wayfair has a large market opportunity, with management projecting a total addressable market size of $1 trillion by 2030. With low online penetration, the company is well-positioned to benefit from the growth of e-commerce. Its logistics business and investments in its digital platform provide a seamless experience for shoppers and offer tools like digital renderings.

Investors will be watching for continued revenue growth from Wayfair while keeping expenses in check. If the company can sustain its positive performance, it has the potential for another strong year in 2024. However, it’s important to note that Wayfair remains a risky investment at this stage.

This article was written by Jennifer Saibil and appeared on Fool.com. The Motley Fool recommends Carnival Corp. and Wayfair. The Motley Fool has a disclosure policy.

Source: Fool.com

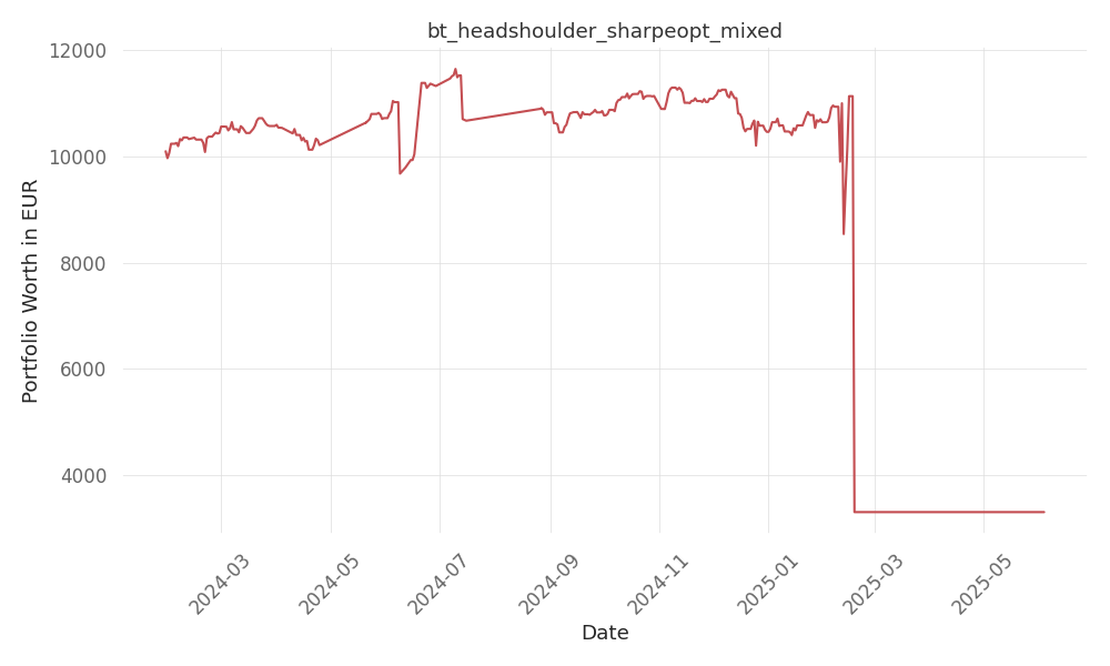

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -50 Days active 491 …

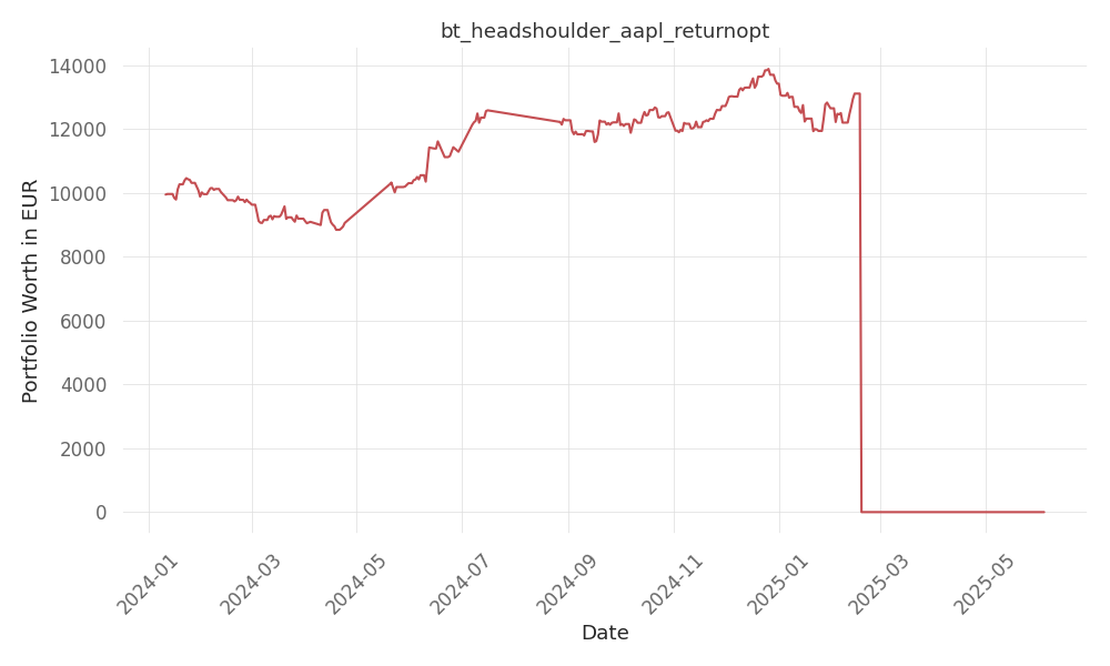

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -71 Days active 510 …

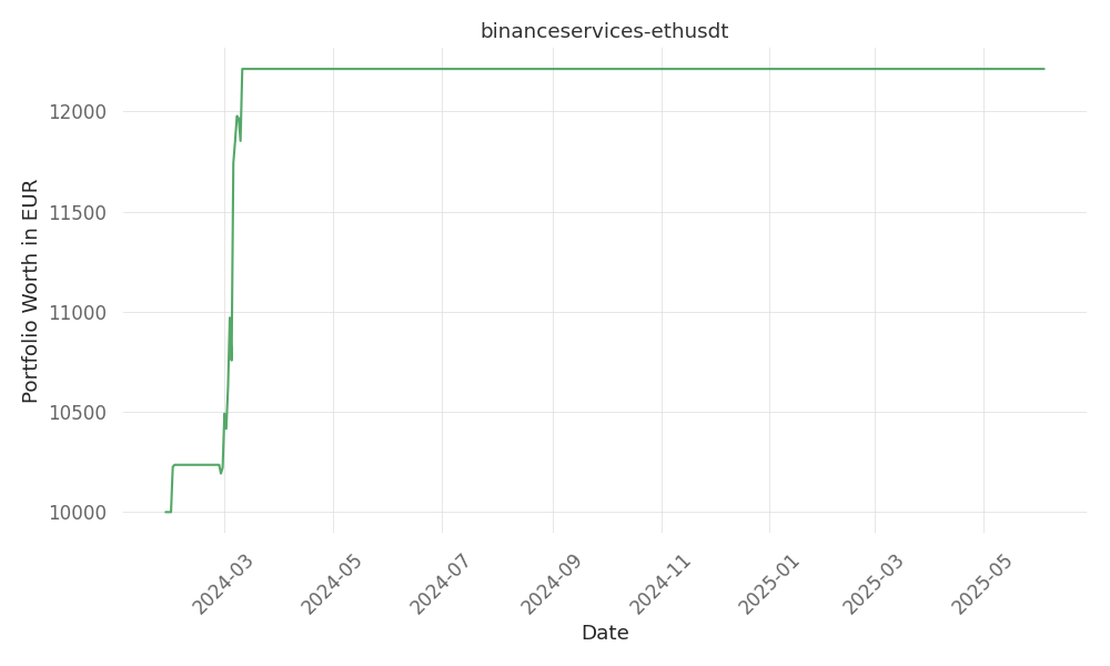

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 16 Days active 493 …