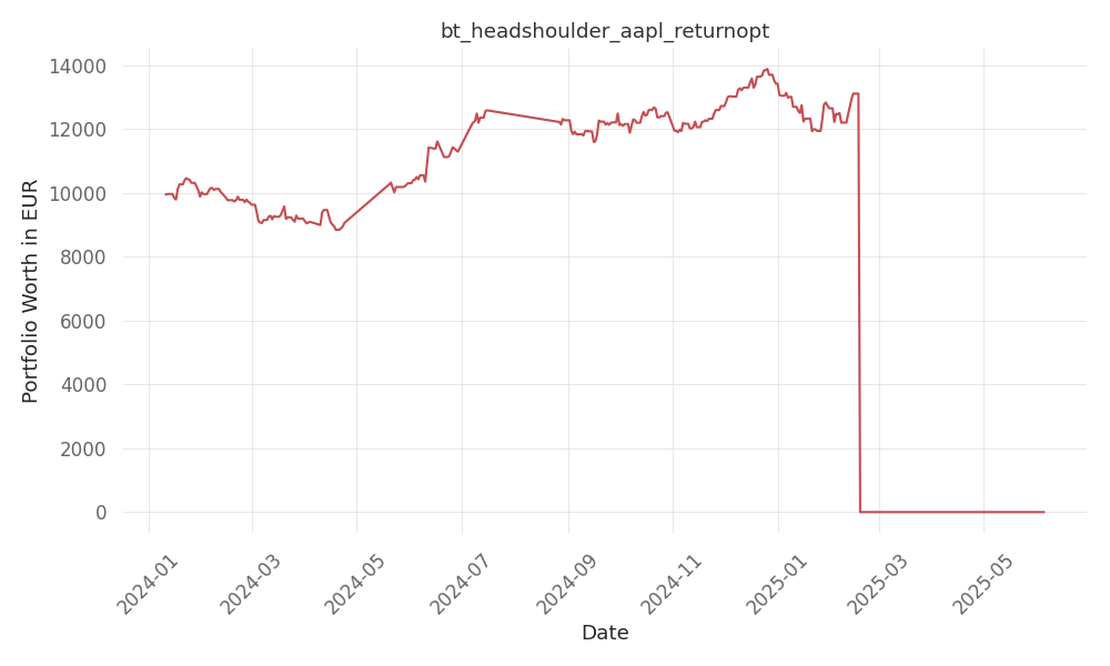

bt_headshoulder_aapl_returnopt

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -71 Days active 511 …

tickers: HSY

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| HSY | positively | The Hershey Co (HSY) is expected to be positively affected by the analyst’s upgrade, as it indicates that the company’s pricing power and innovation capabilities will continue to drive sales growth, potentially leading to an increase in market share and volume trends. |

None so far…

Shares of Hershey Co (HSY) rose in premarket trading on Monday as the candy company’s market share and volume trends have improved significantly in recent months, according to analysts at Bernstein.

Analyst Alexia Howard upgraded the rating for Hershey from Market Perform to Outperform, while raising the price target from $220 to $235. Howard believes that Hershey has the pricing power and innovation capabilities to continue to drive sales growth in the category.

Howard also stated that Hershey’s stock is currently trading meaningfully below its typical valuation over the past five years, presenting a potential buying opportunity for investors.

The upgrade is supported by several factors. First, Hershey is experiencing robust top line growth due to the increase in cocoa spot prices, which have gone up around 80% over the past year. The company is expected to use this pricing power to push through additional price hikes and strengthen its top line relative to other U.S. food peers.

Second, Hershey is expected to have good gross margins in 2024 based on pricing versus the timing of cocoa hedges. This further supports the positive outlook for the company’s financial performance.

Lastly, the analyst believes that Hershey’s pricing power and innovation capabilities will drive sales growth in the category, while other parts of the portfolio and potential acquisitions will support volume growth.

Shares of Hershey rose by 1.94% to $193.90 in the premarket session on Monday following the upgrade.

Please note that this article is for informational purposes only and does not constitute investment advice.

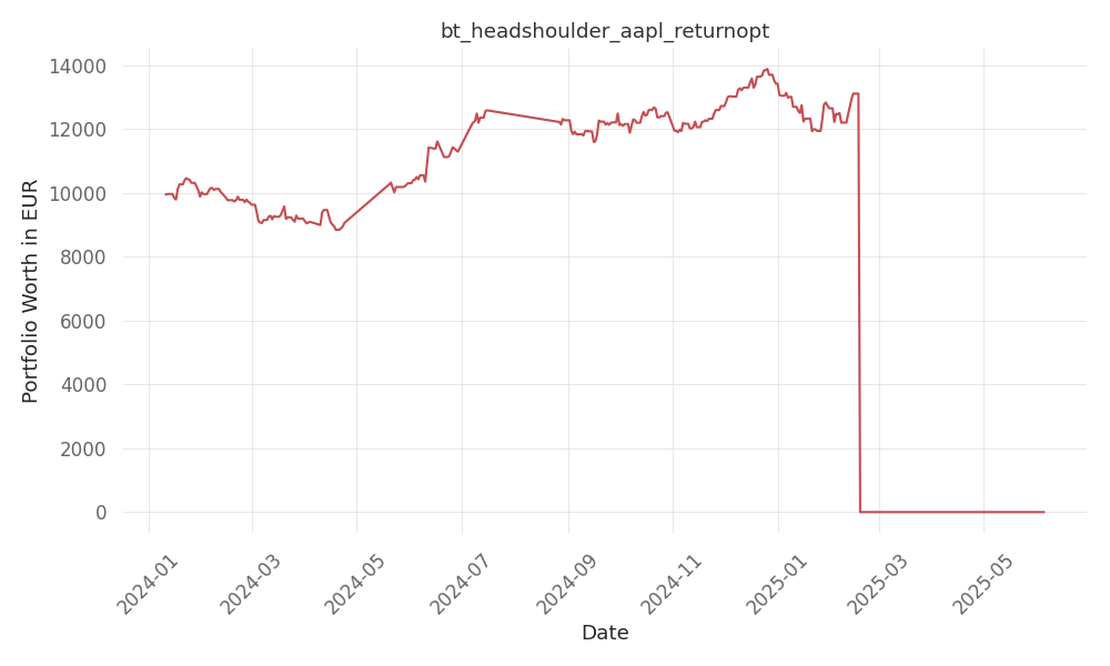

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -71 Days active 511 …

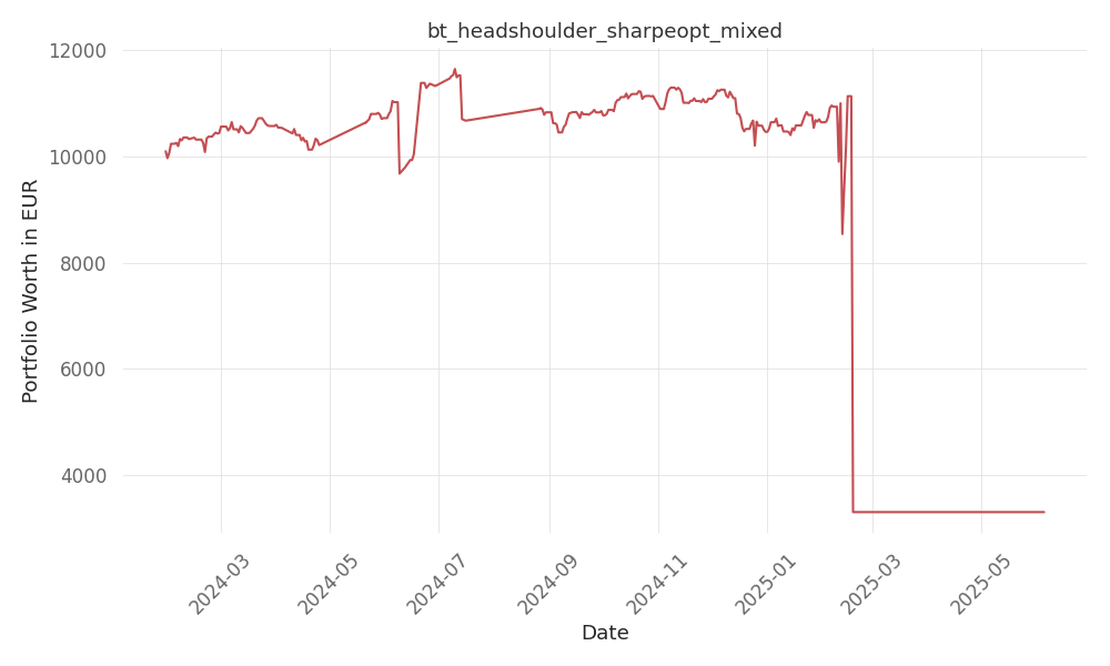

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -49 Days active 492 …

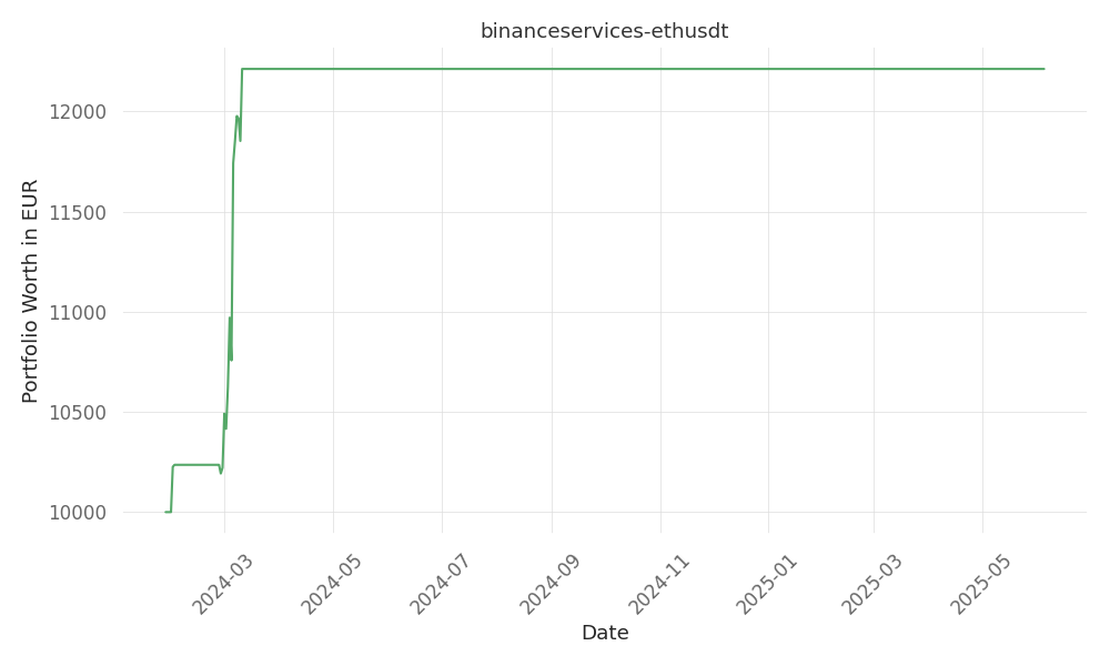

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 16 Days active 494 …