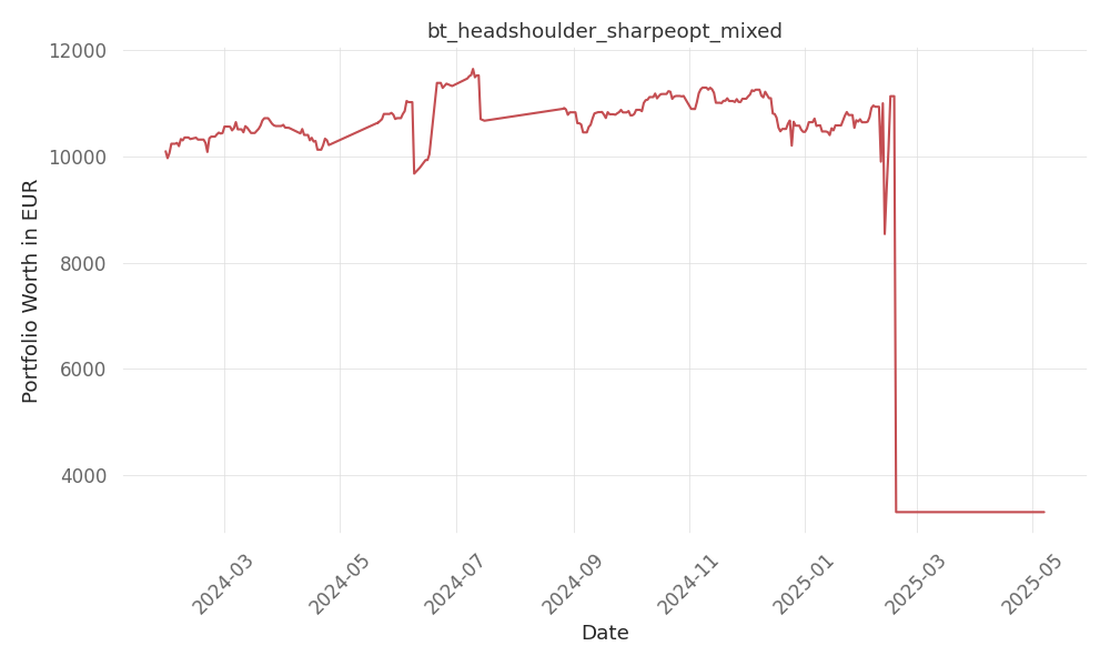

bt_headshoulder_sharpeopt_mixed

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -53 Days active 463 …

tickers: IVZ

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| IVZ | positively | The ticker IVZ, representing Invesco Ltd., is likely to be positively affected by the surge in European financials. As a major global financial services company, Invesco stands to benefit from increased investor interest and performance in the European financial sector. Additionally, the diversified investment strategy and strong performance predictions from outlook models such as the Arora Report’s ZYX Portfolio further support the potential positive impact on Invesco’s stock. |

March 20, 2025 Investors are witnessing a significant shift in market dynamics as European financial stocks have outperformed tech stocks by 33.88% in 2025. This trend, highlighted by a chart comparing the Nasdaq 100 ETF Invesco QQQ Trust Series 1 (QQQ) to the European financials ETF iShares MSCI Europe Financials ETF (EUFN), defies the prevailing wisdom from early 2025. The start of 2025 saw investors rushing to buy tech stocks while selling European financial stocks. However, the recent performance of European financials has been eye-opening. The Arora Report’s ZYX Allocation Model Portfolio includes the EUFN, underscoring the importance of diversifying beyond tech stocks. The Federal Reserve’s recent announcement has sparked a rethink among investors. While the market initially responded positively, smart money is now selling stocks due to the Fed’s mildly more hawkish stance. This aligns with The Arora Report’s analysis, which predicted this shift. Nvidia is hosting its first quantum computing day today, with companies like IONQ Inc (IONQ), D-Wave Quantum Inc (QBTS), and Rigetti Computing Inc (RGTI) participating. However, investors should be cautious as quantum computing stocks are prone to pump and dump schemes and short squeezes. The Arora Report anticipates a sell-the-news reaction in quantum stocks. Initial jobless claims came in at 223K, slightly above the 220K consensus, but continue to behave well. This leading indicator carries significant weight in The Arora Report’s adaptive ZYX Asset Allocation Model. Quadruple witching, with $4.5T notional value of derivatives expiring tomorrow, is deterring the stock market from falling and may even cause an upspike. Investors can gain an edge by knowing money flows in SPY and QQQ, and an even bigger edge by knowing when smart money is buying stocks, gold, and oil. Popular ETFs for these sectors include SPDR Gold Trust (GLD), iShares Silver Trust (SLV), and United States Oil ETF (USO). Bitcoin ran up with stocks yesterday following the Fed’s announcement. The Arora Report’s proprietary protection band helps investors navigate market complexities by providing an actionable framework. For those holding long-term positions, consider a protection band consisting of cash or Treasury bills, short-term tactical trades, and short to medium-term hedges. Adjust your protection band based on your risk preference and market conditions. Traditional 60/40 portfolios may want to focus on high-quality bonds and shorter durations, or use bond ETFs as tactical positions. The Arora Report has a proven track record of accurate market calls, including the AI rally, the 2023 bull market, and the 2022 bear market.

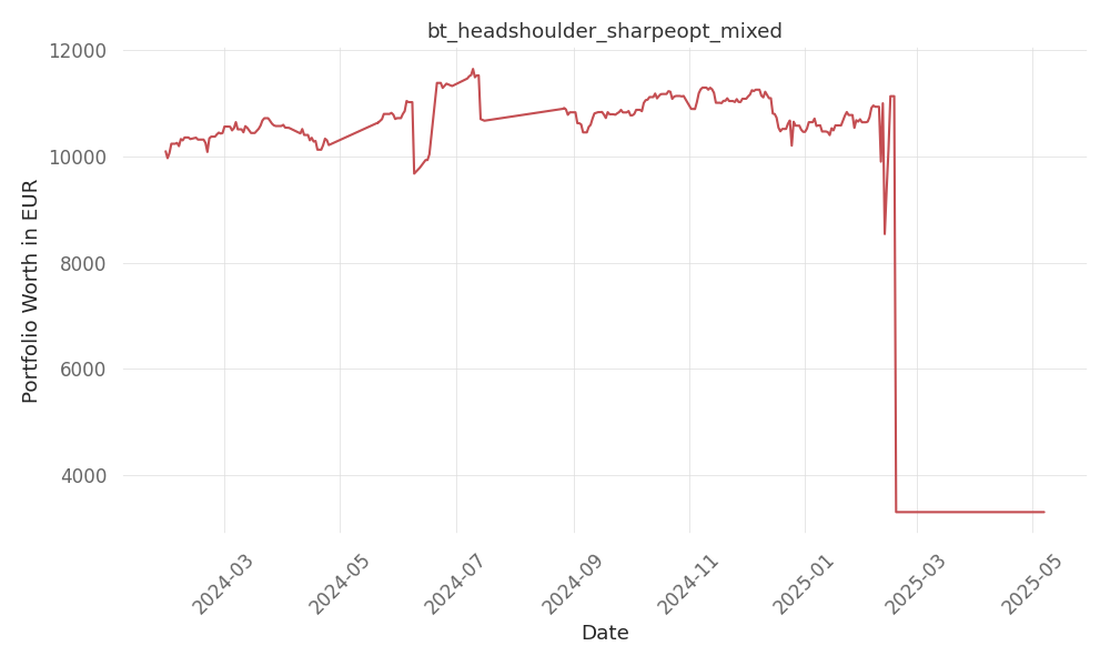

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -53 Days active 463 …

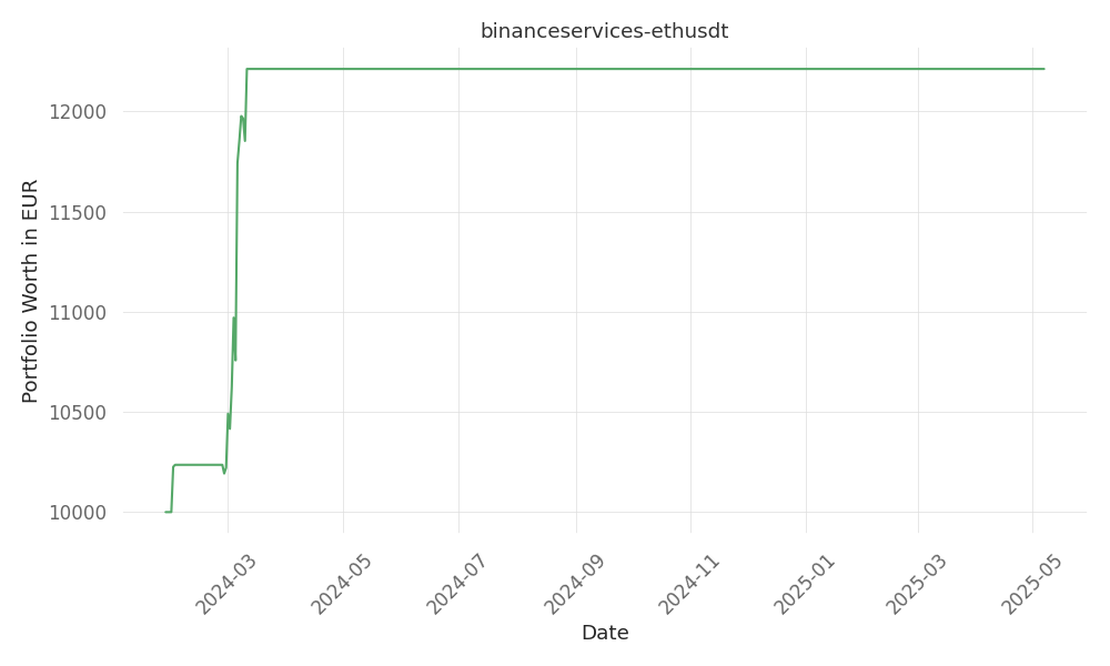

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 17 Days active 465 …

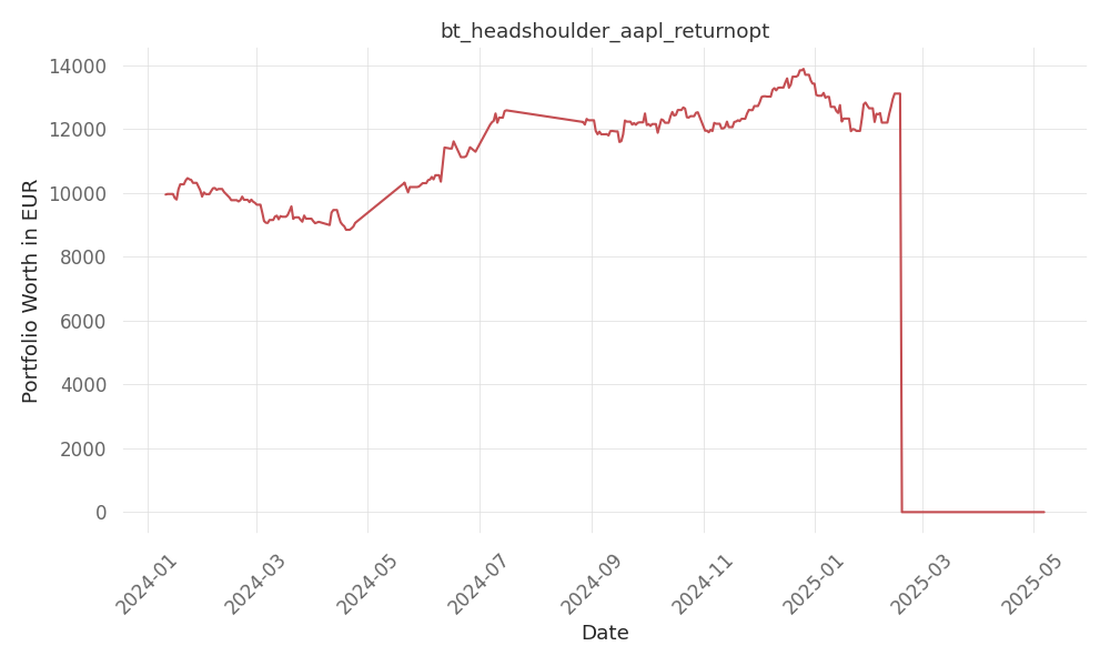

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -75 Days active 482 …