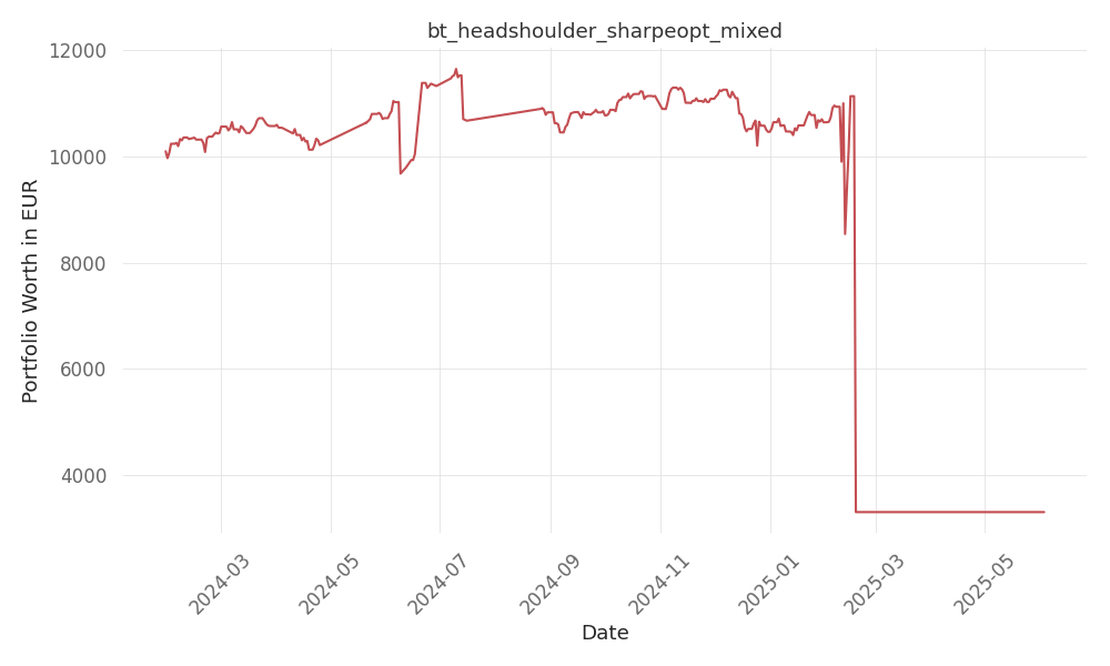

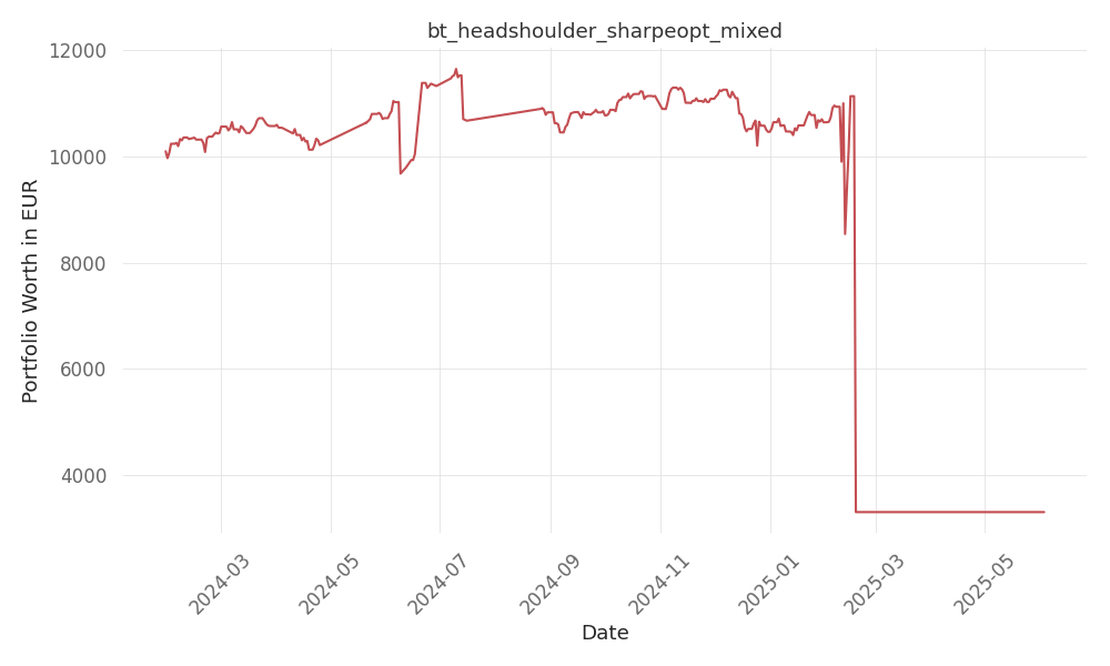

bt_headshoulder_sharpeopt_mixed

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -50 Days active 490 …

tickers: TDY

source: Benzinga

| ticker | polarity | why? |

|---|---|---|

| TDY | positively | The increase in short interest for TDY could potentially lead to a short squeeze if the stock price starts to rise, forcing short sellers to cover their positions at higher prices, which could drive the stock price up further. |

None so far…

Teledyne Technologies (TDY) has seen an increase in its short percent of float by 3.93% since its last report. The company recently disclosed that there are 843 thousand shares sold short, representing 2.38% of all regular shares available for trading. Short interest is an essential metric to monitor in the financial markets. It indicates the number of shares sold short but not yet covered. Short selling involves selling shares of a company without ownership in the hope that the stock price will decrease. Tracking short interest can provide insight into market sentiment towards a particular stock. With an average of 3.52 days needed to cover short positions based on trading volume, investors should take note of the growing short interest in Teledyne Technologies. While a rising short interest does not guarantee an imminent decline in stock price, it suggests increased bearish sentiment among traders. Understanding short interest trends and how they relate to a company’s performance relative to its peers is crucial for investors seeking to make informed decisions. Monitoring short interest can provide valuable insights into market dynamics and investor sentiment towards a specific stock.

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -50 Days active 490 …

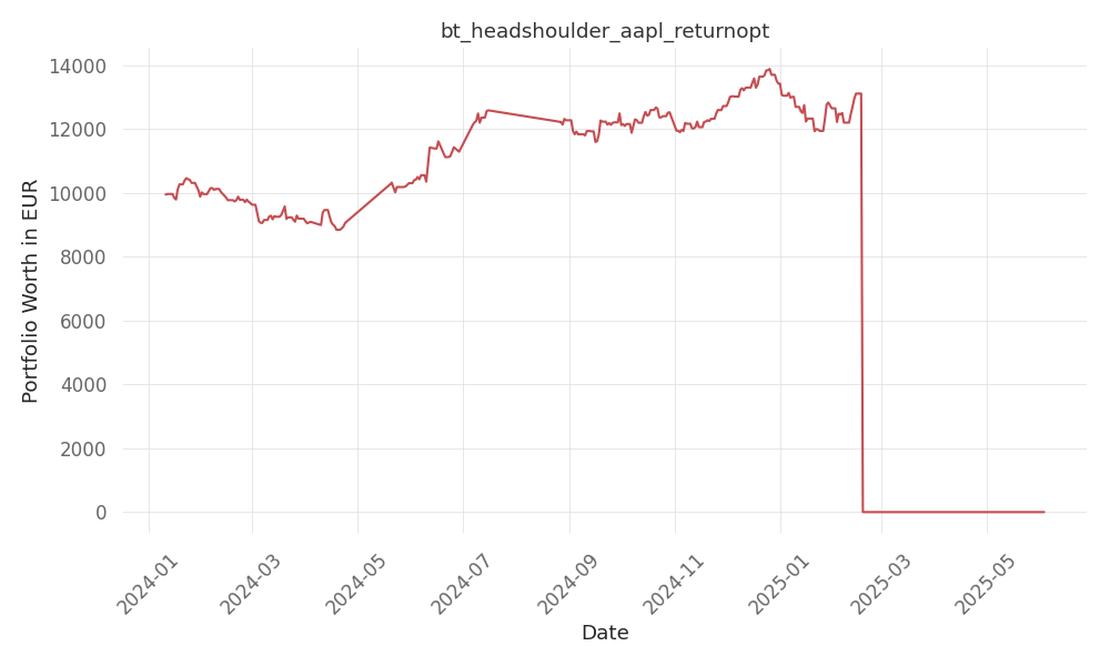

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. -71 Days active 509 …

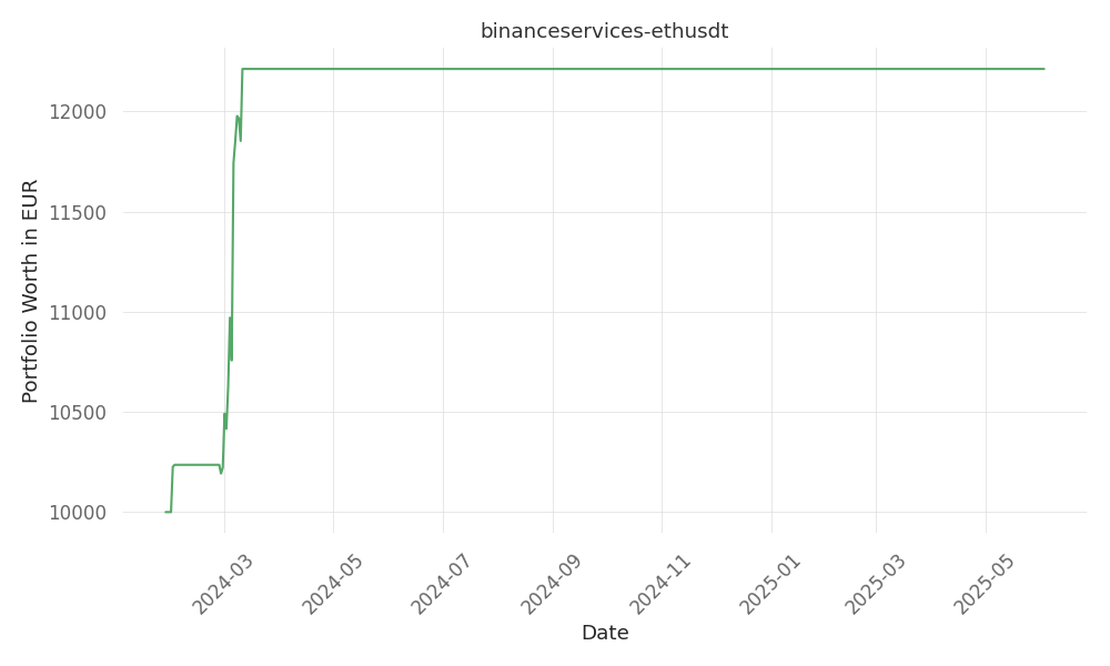

Introduction to our strategy no description yet Quick Summary Metric Value Return % p.a. 16 Days active 492 …